The rupee fell to its weakest in two months against the dollar on fears the US Federal Reserve would start winding down its stimulus, although central bank intervention and soothing trade deficit data pulled the currency off its lows.

The rupee fell to its weakest in two months against the dollar on fears the US Federal Reserve would start winding down its stimulus, although central bank intervention and soothing trade deficit data pulled the currency off its lows.

Bonds also recovered -- after benchmark 10-year bond yields had at one point risen above 9 percent to their lowest in three months -- after the data showed the trade deficit in October rose in line with expectations.

Still, the outlook for markets is likely to remain uncertain after a stronger-than-expected U.S. jobs report on Friday raised concerns the Federal Reserve could start winding down its monetary stimulus this year.

The previous bout of Fed withdrawal fears had threatened to spark a crisis of confidence in India -- sending the rupee to a record low of 68.85 in late August and leading to steep falls in bonds and stocks.

Investors are also on edge before consumer price inflation and industrial output data due on Tuesday, and wholesale prices on Friday.

"The uptick in bonds yields was exaggerated. There was value buying seen above 9 percent levels after the trade data was released," said Harish Agarwal, a fixed income dealer with First Rand Bank.

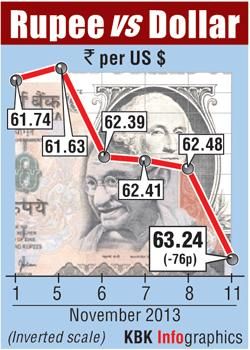

The partially convertible rupee closed at 63.24/25 per dollar after falling to as low as 63.44, its weakest since September 18. It had closed at 62.475/485 on Friday.

The benchmark 10-year bond yield closed down 4 basis points at 8.95 percent. It had risen as much as 15 basis points to 9.14 percent, its highest since August 20.

Sentiment improved as the Reserve Bank of India (RBI)

was spotted selling dollars late in the session, while the underlying trade data was seen as positive, with exports rising for a fourth consecutive month.

Comfort about the trade balance could further ease concern about the current account deficit, which is expected to narrow on the back of measures to curb gold imports as well as the RBI incentives that allowed banks in India to raise $15.1 billion from loans and citizens abroad.

Finance Minister P. Chidambaram said this month the current account gap would be at $60 billion or lower, well below the previous estimate of $70 billion.

Improving confidence about the rupee had spurred the RBI to curtail a special window to provide dollars directly to state-run oil companies, which traders had credited for contributing to the rebound in the rupee.

Still, concerns remain. Data on Friday showed US employers added 204,000 jobs, well above what economists had expected, spurring concern about US tapering.

Any hints of a withdrawal of Fed stimulus could cut short a rally that has lead the rupee to gain 8.8 percent since its record low and sent the BSE Sensex to a record high this month on the back of strong foreign buying.

At home, economic growth has slowed to a decade-low but inflation remains high, leading the RBI to the difficult choice of raising India's key lending rate by 50 bps since September.

Analysts are now bracing for one more increase should consumer price inflation or wholesale price inflation data this week accelerate.

"Definitely WPI/CPI can be the next trigger for a further upmove (in bond yields) if the data is bad," said Bekxy Kuriakose, head of fixed income at Principal PNB Asset Management.

The rupee fell to its weakest in two months against the dollar on fears the US Federal Reserve would start winding down its stimulus, although central bank intervention and soothing trade deficit data pulled the currency off its lows.