The Indian rupee weakened for a third consecutive session on Wednesday, falling below the 61 to the dollar mark for the first time in more than a month, hurt by good demand for the greenback from importers and by continued weakness in Asian currencies.

The Indian rupee weakened for a third consecutive session on Wednesday, falling below the 61 to the dollar mark for the first time in more than a month, hurt by good demand for the greenback from importers and by continued weakness in Asian currencies.

Most emerging Asian currencies fell as the Chinese yuan extended its recent decline to a 16-month low, while the Indonesian rupiah touched its weakest level in more than seven weeks due to increasing month-end dollar demand.

Traders said the direction of foreign fund flows in the near term will remain crucial to determine the rupee's fortunes, as India continues with its five-week-long elections for which the outcome will not be unveiled until mid-May.

For now, foreign investors have remained buyers with net purchases of a modest $30.80 million

on Tuesday, marking a third consecutive day of inflows.

"The rupee is fragile currently and the same is expected to continue till the election result. It is likely revolve around the 60.50 to 61.50 band until May 16," said Shakti Satapathy, a senior strategist with AK Capital.

"Though a stable political regime would give some short-term respite, the fiscal strategies of the new government would remain crucial in determining the future trend for it".

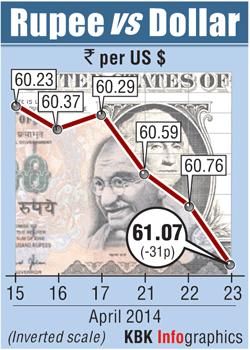

The partially convertible rupee closed at 61.07/08 per dollar compared with its close of 60.76/77 on Tuesday. The unit fell as low as 61.19 intraday, its weakest since March 21.

Continued importer demand for dollars this week has helped offset the impact from rising domestic shares, which hit a record high for a third session in a row on Wednesday.

In the offshore non-deliverable forwards, the one-month contract was at 61.48 while the three-month was at 62.30.

The Indian rupee weakened for a third consecutive session on Wednesday, falling below the 61 to the dollar mark for the first time in more than a month, hurt by good demand for the greenback from importers and by continued weakness in Asian currencies.