| « Back to article | Print this article |

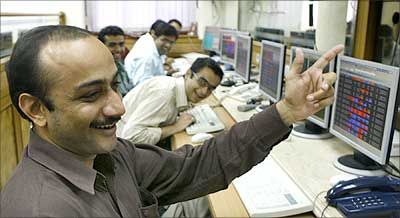

After logging 576 points in Wednesday’s trade, Sensex extended gains and surged 486 points today as participants indulged in buying valuable stocks at attractive valuations.

After logging 576 points in Wednesday’s trade, Sensex extended gains and surged 486 points today as participants indulged in buying valuable stocks at attractive valuations.

Rise in crude oil prices, expectation of above normal monsoon and better than expected corporate results this quarter pulled Nifty above the crucial 8,050 mark.

Meanwhile, stellar results posted by L&T indicated signs of improvement in the Indian economy further boosting sentiments.

Traders rolled over positions in the futures & options segment from the near-month May series to June series.

The S&P BSE Sensex rose 486 points to close at 26,367 and Nifty50 surged 135 points to end at 8,070.

Nifty reclaimed the 8,000 mark for the first time since 06 November, 2015.

“Markets have displayed a spectacular rally with Nifty touching the high of CY 2016.

"We expect Nifty to trade between 8,350-8,500 levels in the next 1-2 months owing to couple of factors namely expectation of a above normal monsoon, better than expected corporate results in this quarter, stellar performance by L&T showing signs of a pick-up in the Indian economy, win of BJP in Assam which paves way for the GST passage and a exit poll in UK indicating that hopes of Britain exit from the Euro zone has dimmed.” Said AK Prabhakar, head-research, IDBI Capital.

Some of his top bets include HDFC, HDFC Bank, Yes Bank, ICICI Bank, Shriram Transport and Tata Chemicals.

Brent oil futures climbed above $50 a barrel on Thursday for the first time in nearly seven months, boosted after US government figures showed a sharper-than-expected drawdown in crude stocks last week.

LEADERS & LAGGARDS

L&T zoomed 14% after the company’s net profit for the quarter ended March rose to Rs 2,454 crore, up 19% from the Rs 2,070 crore during the corresponding quarter a year before.

Bajaj Auto surged 1% after reporting a 29% increase in net profit for the quarter ended March 31, 2016, riding on a 12% growth in motorcycle sales and benign raw material prices.

BHEL soared 5%. It has commissioned the first 800 mw supercritical thermal unit in Raichur, Karnataka. It is due to post the quarter results tomorrow.

Meanwhile, SBI surged 5% ahead of the quarter results tomorrow.

ONGC gained 3% after its fourth quarter net profit surged over 3-fold to quote at Rs 4416 crore while GAIL ended 0.5% lower after it reported a 38.7% rise in March quarter net profit on the back of higher volumes of gas transmission and bigger trading margins.

Tata Steel received a number of serious offers for its businesses in Britain, Prime Minister David Cameron said on Wednesday as steel workers marched past Downing Street to put pressure on the government to get a deal. The stock closed with marginal gains.

The company reported a consolidated loss of Rs 3,214 crore in the March 2016 quarter against a loss of Rs 5,674 crore in the year-ago period, owing to lower net sales and exceptional items impairment charges taken on restructuring of Europe operations and employee separation compensation in India.

Tata Motors said on Wednesday that an authorised committee of the company has approved to raise upto Rs 300 crore via issue of non-convertible debentures (NCDs) to bankroll its expansion plans. The stock gained 0.6%.

Ujjivan Financial Services rose 12% after the company said it posted 134% jump in its fiscal year 2016 net profit to Rs 177 crore against Rs 76 crore a year ago.

Rattanindia Power jumped 14% after the company said it posted consolidated net profit ofRs 227 crore against net loss of Rs 2231 crore a year ago.