| « Back to article | Print this article |

A mixed global trend and weakness in rupee are likely to influence the sentiments during the day.

Benchmark indices ended lower for third straight trading sessions despite positive Asian and European cues.

Benchmark indices ended lower for third straight trading sessions despite positive Asian and European cues.

Selling among pharma and index heavyweights like Reliance Industries dampened investors’ sentiments.

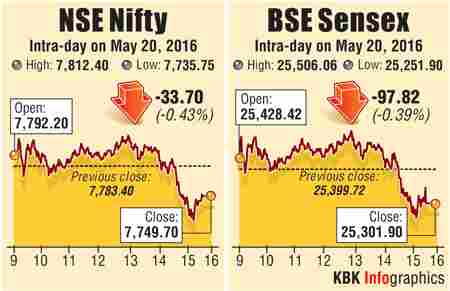

The S&P BSE Sensex slipped 98 points to ended at 25,302 and the Nifty50 dropped 34 points at 7,750.

Among broader markets, BSE Midcap and Smallcap indices slipped 0.5%-1%.

"Nearest support for the market is visible at 7,700 mark. Holding above this level is the key for the bulls and a move below this mark the intermediate term trend is likely to turn bearish," said Rohit Gadia, Founder & CEO, CapitalVia Global Research.

According to the latest data from Securities and Exchange Board of India, the capital markets had witnessed 1,444 newly registered FPIs in the entire 2014-15 fiscal.

Besides, the rupee was trading weak by 9 paise at 67.45 on sustained dollar demand from importers and on the back of dollar's strength overseas.

The Reserve Bank of India (RBI) today fixed the reference rate of the rupee at 67.40 against the US dollar and 75.54 for the euro.

According to Bank of America Merrill Lynch report, "Government's fiscal deficit target for next fiscal could be changed to a 'range' and set at 3-3.5% of the GDP, rather than 3%".

Among overseas markets, Asian shares edged up on Friday but were on track for a weekly loss, while the dollar was poised for a winning week on bets the US Federal Reserve could raise rates as early as next month.

MSCI's broadest index of Asia-Pacific shares outside Japan was up 0.7%. Japan's Nikkei stock index erased earlier losses to end the day up 0.5%, extending gains for the week to 2% as the yen recoiled against the resurgent dollar.

Oil prices rose on Friday as turmoil in Nigeria, shale bankruptcies in the United States and a crisis in Venezuela all contributed to tightening supplies.

Back home, BSE Realty and Healthcare indices slipped by 1% each. However, BSE FMCG index gained almost 1%.

Adani Ports was the top Sensex gainer, up over 4%. The stock witnessed sharp fall in trades yesterday. Moody’s Investors Service has revised its outlook on Adani Ports and Special Economic Zone (APSEZ), to “negative” from the earlier “stable”.

ITC meets street expectations with Q4 earnings; PAT up 5.6%, margins expand by 130 bps (YoY). ITC will be setting up eight new integrated food processing units by 2019, with investments in excess of Rs 4,000 crore.

ITC meets street expectations with Q4 earnings; PAT up 5.6%, margins expand by 130 bps (YoY). ITC will be setting up eight new integrated food processing units by 2019, with investments in excess of Rs 4,000 crore.

The stocks surged by over 2%.

HDFC rose 1.14% after the company said that it will raise Rs 730 crore by way of issue of secured redeemable non-convertible debentures on private placement basis.

BHEL has commissioned a 250 mw thermal unit in Maharashtra. The stock increased by nearly 1%.

Nearly 50,000 employees of five associate banks of State Bank of India have gone on a day-long nationwide strike today to protest the proposed merger with their parent bank. SBI dropped by almost 1%.

Tata Motor ended higher by 0.2%. The company plans to raise Rs 300 crore through issuance of second series of non-convertible debentures to bankroll its expansion plan.

IT stocks like Infosys and Wipro gained marginally as rupee edged lower against the dollar.

Lupin dipped almost 8% to Rs 1,525 on the BSE as analyst concerns about observations from the US drug regulator continue to remain an overhang for the near-term on the stock. The drug maker posted a record 47.5% growth in the March quarter (Q4) of FY16, driven by strong sales growth in the United States market.

Among other shares, Tata Metaliks & Raj Television Network rallied by more than 50% in past five trading sessions in an otherwise subdued market on the back of positive developments.

GHCL surged 10% after the company reported 56% year on year (YoY) growth in net profit at Rs 78 crore in March quarter (Q4FY16).

SpiceJet slipped 9.5%, extending its previous day’s 4.6% decline on the BSE, after the company reported a net profit of Rs 73 crore for the quarter ended March 31, 2016.

Pidilite Industries gained by 4% after the company reported a strong 89% year on year (YoY) jump in its consolidated net profit at Rs 153 crore for the quarter ended March 31, 2016, on back of higher volume growth and lower input cost.