| « Back to article | Print this article |

The 30-share Sensex ended lower by 18.37 points at 27,957.49 and the 50-share Nifty slipped 1.30 points at 8,491.

The 30-share Sensex ended lower by 18.37 points at 27,957.49 and the 50-share Nifty slipped 1.30 points at 8,491.

On the last day of the financial year 2014-15, markets ended marginally higher after paring early gains on losses in select index heavyweights and bank shares despite the strong showing by select oil and pharmaceutical stocks.

The 30-share Sensex ended lower by 18.37 points at 27,957.49 and the 50-share Nifty slipped 1.30 points at 8,491.

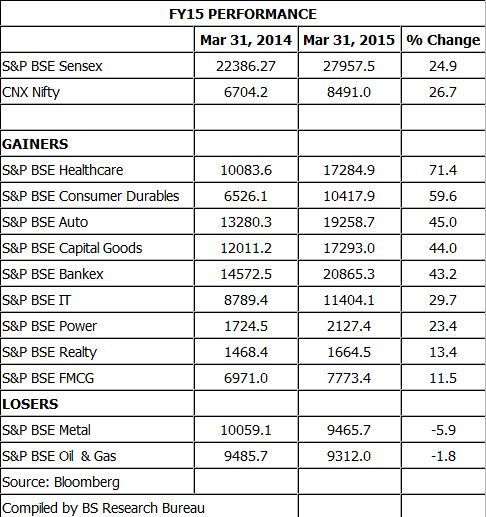

However, for the financial year 2014-15, indices gained around 26% with 12 out of 25 top pharmaceutical stocks gaining over 100%.

On Tuesday, the broader markets outperformed the benchmark indices with the BSE Midcap and Smallcap indices gaining 0.3-1%.

Market breadth on the BSE was positive with 1,587 advances against 1,135 declines.

"Amid volatility, equity markets closed almost unchanged on last trading session of the financial year.

In the first half, we saw benchmarks extending yesterday’s rebound but sudden dip in the last hours eliminated all the intra-day gains. We expect index to trade range bound on Wednesday as well; however, volatility would continue on stock specific front ahead of long weekend.

Hence, we advise short term traders to hedge their leveraged trades, if they wish to carry them for the next week," said Jayant Manglik, President-retail distribution, Religare Securities in a post market note.

On the currency front, the rupee recovered by 10 paise at 62.57 against the US dollar at Interbank Foreign Exchange on fresh selling of the American currency by exporters.

Analysts remain bullish on the road ahead for the markets and suggest that investors should accumulate stocks on a decline.

Says Mudit Goyal, technical analyst, SMC Global Securities: “We have seen decent buying from lower levels.

Overall, the Nifty has breached its 100-EMA on daily charts while also managing to trade above the same, which gives the positive outlook for the coming days.

One should buy on dips. Investors can initiate long positions around 8,450-8,470 (Nifty) levels for the upside target of 8,640 levels in the near term."

SECTORS & BUZZING STOCKS

Among sectors, S&P BSE Bankex slumped by almost 1% on Tuesday.

Sectors like Capital Goods, FMCG and IT ended marginally in negative zone. However, BSE Oil & Gas and Healthcare indices gained over 1% each. Reliance Industries gained nearly 2%.

Morgan Stanley has upgraded Reliance Industries to "overweight" from "underweight", citing confidence about the conglomerate's downstream projects and improving outlook for telecoms business. Tata Power was the top Sensex gainer, up over 3%.

Tata Power has gained as Supreme Court ruled that companies can use argument of change in international law to charge higher tariff. Tata Motors extended gains from yesterday and ended higher by nearly 3.5%.

Maruti Suzuki rose 1%. Other notable gainers were GAIL, HUL, Dr Reddy’s Labs, Sun Pharma, Cipla and Wipro.

ONGC was the top Sensex loser, down over 2.5%.

The company has driven a hard bargain to renew its insurance and re-insurance covers, at $20 million -- a discount of 35% -- for its offshore assets valued at $34 billion from state-run United India Insurance and two global re-insurers.

From the banking space, HDFC Bank, Axis Bank, ICICI Bank and SBI slipped between 0.4-1.3%. ICICI Bank and HDFC Bank have cut rates by up to 0.25% on high value fixed deposit on select maturities, a move that could be a precursor to lower lending rates.

Further, ICICI Bank announced yesterday that it has repatriated excess funds from its two overseas subsidiaries as part of capital optimisation and return on equity plans.

State Bank of India (SBI) today said that they have received board approval to divest up to 10% of its stake in SBI Life Insurance.

Capital goods major L&T gained almost 1%.

The construction arm of L&T has won orders worth Rs 2,101 crore across various business segments in March, 2015.

Other notable losers were Tata Steel, Hindalco, M&M, ITC and Infosys. SMART MOVERS Financial Technologies (India) zoomed 15% to Rs 194 on heavy volumes.

Shares of ECE Industries were locked in upper circuit 20% at Rs 125 on the NSE after the company’s promoter acquired an over four percentage points stake in the company via open market.

Mastek moved higher by over 8% after the company’s US subsidiary, Majesco, received the clearance for listing its shares on the NYSE.

Petron Engineering Construction soared 20% on the BSE after the company said it has received order worth of Rs 85 crore for integrated refinery expansion project of the state-owned firm Bharat Petroleum Corporation Limited (BPCL).

Shares of GVK Power and Infrastructure zoomed around 16% on the BSE on reports that the company is likely to file a draft prospectus for an up to $250 million (approx Rs 1,565 crore) initial public offer (IPO) of its airport unit soon.

Public sector oil marketing companies (OMCs) such as Indian Oil Corporation (IOC), Bharat Petroleum Corporation (BPCL) and Hindustan Petroleum Corporation (HPCL) rallied by up to 6% on the Bombay Stock Exchange (BSE).