| « Back to article | Print this article |

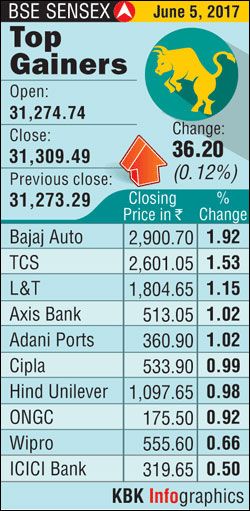

TCS, Bajaj Auto, Adani Ports and Cipla were the top gainers on BSE Sensex while Coal India, GAIL, Dr Reddy's and Infosys lost the most on the index.

Benchmark indices settled the day on record high for second consecutive session as services sector growth rising at fastest pace in 4 months in May lifted the sentiment. PMI stood at 52.2, higher than the 50.2 figure seen in April.

The gains were, however, capped as investors remained cautious ahead of the Reserve Bank of India (RBI)'s policy meeting, which begins tomorrow.

Economists don’t expect the six-member Monetary Policy Committee (MPC) to tinker with policy rates of the Reserve Bank of India (RBI) when it meets this week. Twelve economists polled by Business Standard ruled out a rate cut by the central bank even as growth numbers slowed down and inflation surprised most on the downside.

Both the Nifty and the Sensex have been on a record-breaking spree in the recent weeks. During the day, the 30-share Sensex rose as much as 48 points to reach its new peak of 31,355, while the 50-share Nifty rallied 42 points to hit its fresh high of 9,687. Both indices hit their previous highs on June 2.

Both the Nifty and the Sensex have been on a record-breaking spree in the recent weeks. During the day, the 30-share Sensex rose as much as 48 points to reach its new peak of 31,355, while the 50-share Nifty rallied 42 points to hit its fresh high of 9,687. Both indices hit their previous highs on June 2.

The S&P BSE Sensex settled at the new high of 31,309, up 36 points, while the broader Nifty50 ended at fresh peak of 9,675, up 21 points.

S&P BSE Smallcap index outperformed the frontline indices, rising 0.6% while S&P BSE Midcaps ended flat for the day.

"Geopolitical tensions in Europe & cautiousness ahead of the RBI meet have kept the market in range bound. Market is hoping that RBI may review its current stance of neutral to accomodative considering the slowdown in economic activity and consolidation in current & future outlook in inflation, if affirmative will be healthy for the market,” said Vinod Nair, Head of Research, Geojit Financial Services in a note.

Buzzing stocks

TCS, Bajaj Auto, Adani Ports and Cipla were the top gainers on BSE Sensex while Coal India, GAIL, Dr Reddy's and Infosys lost the most on the index.

Lenders continued their rally after Finance Minister Arun Jaitley stressed that reviving banking sector and investment in private sector top his priority list. Banks were among the top gainers, with Yes Bank rising 2.25% and Axis Bank up 1.2%.

Among other gainers, Reliance Communications rose as much as 4.6% after the debt-laden mobile carrier said on Friday it won a seven month reprieve from its lenders. The stock later pared gains to end flat.

Shares of jewellery retailers PC Jeweller Ltd, Gitanjali Gems Ltd and Titan Company Ltd gained after the Indian government said it will tax gold and gold jewellery, silver and processed diamonds at 3%under Goods and Services Tax.

Shares of auto and auto-related companies continued to remain in top gear for the 10th consecutive day, with both S&P BSE Auto and Nifty Auto indices hitting their respective record highs on Monday.

In the past 10 trading sessions, the S&P BSE Auto and Nifty Auto indices have rallied 6% as against 2% rise in the benchmark indices, the S&P BSE Sensex and Nifty50.

Sector-wise, the S&P BSE consumer durables index shot up by 6.5%, followed by the capital goods index up 0.90% and the oil and gas index advancing 0.96%.

Among losers, NDTV plunged nearly 7% on BSE on reports that the CBI has registered a case against NDTV founder Prannoy Roy, his wife Radhika Roy and others for causing an alleged loss to ICICI Bank to the tune of Rs 48 crore. The stock ended 3% lower.

Global markets

Sentiment across the globe was muted after US growth in May missed expectations and after attacks in London killed at least seven people. Meanwhile, oil prices jumped after Saudi Arabia, Egypt, the United Arab Emirates and Bahrain severed their ties with Qatar on Monday.

France and Germany are closed for a holiday on Monday. Germany's DAX touched an all-time high on Friday.

MSCI's broadest index of Asia-Pacific shares outside Japan reversed earlier losses to climb 0.1%.

Japan's Nikkei also added 0.1% as the yen surrendered some of its gains.

Chinese shares fell 0.5%, with news of service-sector activity rising in May at the fastest pace in four months failing to lift sentiment.

Australian shares slid 0.8% and South Korea's KOSPI was little changed.