| « Back to article | Print this article |

Benchmark share indices ended lower on Thursday, amid weak global cues, as investors booked profits after recent gains with index heavyweight Infosys leading the decline on concerns over volatility in revenue growth.

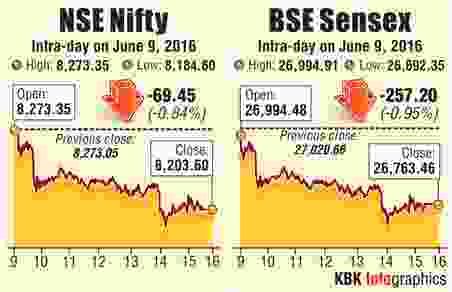

The S&P BSE Sensex ended down 257 points at 26,763 and the Nifty50 slipped 69 points to settle at 8,204.

In the broader market, the BSE Midcap fell 0.5% while Smallcap index ended flat. Market breadth ended negative with 1332 losers and 1233 gainers on the BSE.

"Markets witnessed a round of profit booking, with some weakness in global indices today.

"The key sectors which witnessed selling today included IT and FMCG and select Pharma names.

"The key support for the trade tomorrow would be 8150 and resistance at 8280 on Nifty spot levels.

"We believe, that the indices could consolidate some time further as a lot of midcaps and small caps stocks as well as underperformers would start catching up with the broader market.

"A stock specific approach should be adopted at this point, rather than index view, till the time consolidation continues," says Kunal Bothra, Head of Advisory, LKP Securities.

Foreign portfolio investors were net buyers in equities worth a net Rs 529 crore on Wednesday, as per provisional data released by the stock exchanges.

GLOBAL MARKETS

Asian shares ended lower with Japanese sharing losing the most on the back of a stronger yen.

Meanwhile, stock markets in China and Hong Kong were closed on account of a holiday. Further, commodity prices firmed up on the back of weakness in the US dollar.

Japan's benchmark Nikkei ended nearly 1% down while Singapore's Straits Times slipped 0.4%.

European stocks were trading weak weighed down by selling pressure in global telecom major Vodafone while profit warning from Essentra also dampened sentiment.

The CAC-40, DAX and FTSE-100 were down over 1% each.

STOCKS

STOCKS

Infosys ended down over 4% amid worries that compensation increase and higher visa fees could impact margins in the first quarter of the current fiscal.

Further, concerns that growth could remain volatile in the near term and cautious outlook for the retail sector among other verticals also dampened sentiment. The stock has also turned ex-dividend today for final dividend of Rs 14.25 per share for the year ended 31 March 2016 (FY 2016).

Energy shares were among the top gainers tracking firm global crude oil prices. Reliance Industries and ONGC ended up 1.7%-2% each.

FMCG majors ITC and Hindustan Unilever which had gained in the previous sessions on expectations that normal monsoon would boost rural volumes witnessed profit taking. Hindustan Unilever and ITC ended down over 2% each.

Lupin ended tad lower. Lupin is recalling over 54,000 vials of anti-bacterial injection, Ceftriaxone, due to violation of current manufacturing norms. Among others, Sun Pharma and Cipla ended up 0.6%-1.6% each.

Dr Reddy's Labs ended down 1.7% on talk that US Consumer Product Safety COmmission is seeking civil penalty stating that the company has violated provisions related to child resistant packaging in at least five prescription drugs.

Wipro ended up with marginal gains after it announced a partnership with Mountain View based Authentise Inc, a leading provider of 3D printing technologies and consulting services.

Among others, state-owned companies MMTC, State Trading Corporation of India, Hindustan Copper, ITI, Dredging Corporation of India and HMT ended up over 7% each on new norms for PSU capital restructuring.

Bharat Petroleum Corporation ended up 2.5% after the Reserve Bank of India approved increase in investment limit by foreign institutional investors/foreign portfolio investors to 49% from 24% earlier.

Image: Stock traders. Photograph: PTI