| « Back to article | Print this article |

Markets ended higher led by banks, amid firm global cues, after the RBI kept key policy rates unchanged amid inflation concerns but maintained an 'accomodative' monetary policy stance going forward.

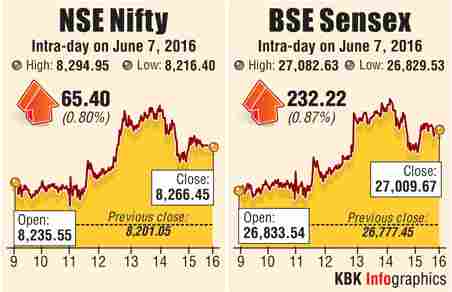

The S&P BSE Sensex ended up 232 points to settle above 27,000 at 27,010 for the first time since October 28, 2015 and the Nifty50 settled 65 points higher at 8,266.

In the broader markets, the BSE Midcap and Smallcap indices ended up 0.3%-1% each. Market breadth was positive with 1481 gainers and 1132 losers on the BSE.

"Despite the neutral stance by the RBI markets are likely to remain rangebound with an upward bias aided by global cues with the delay in interest rate hike by the US Fed and the stability in global crude oil prices.

"On the domestic front forecast of normal monsoon and better-than-expected earnings have aided sentiment," says Kunj Bansal, ED & CIO, Centrum Wealth Management.

The Reserve Bank of India at its bi-monthly policy review earlier today kept the repo or the repurchase rate unchanged at 6.50% on the back of higher food inflation and amid expectations of a rate action by the US Federal Reserve.

The central bank has also kept the Cash Reserve Ratio unchanged at 4%.

"RBI stance of the monetary policy continues to be accommodative; RBI will be on pause for a few months unless the next couple of months’ data sharply reverses the inflation trajectory.

"While we continue to believe that there is some more scope for monetary easing, but clarity on this will emerge only with incremental food inflation data, effect of monsoon on the disinflationary path of inflation, and degree of volatility from global factors.

"We believe in near future, focus will be on transmission of rate cut in the system," says Motilal Oswal ,Chairman & MD, Motilal Oswal Financial Services.

GLOBAL MARKETS

Global shares firmed up after Federal Reserve Chair Janet Yellen did not signal any timing of a possible hike in US interest rate.

Asian shares ended higher with Hong Kong’s Hang Seng gaining the most to settle over 1% higher. Among others in the region, Japan’s Nikkei, China's Shanghi Composite and Singapore’s Straits Times ended up 0.1%-0.6% each.

European shares also edged higher as the US Federal Reserve is unlikely to raise rates soon. The CAC-40, DAX and FTSE 100 were trading 0.6%-1.5% each.

STOCKS

STOCKS

Financials were among the top gainers with ICICI Bank up over 4% after the private banking major decided to raise Rs 25,000 crore in tranches via private placement of bonds, debentures and securities, including bonds and non-convertible debentures (NCDs).

Among other banks, SBI was also ended up 4%, HDFC Bank gained 0.5% while Axis Bank ended flat after gains in the previous session.

FMCG major ITC and Hindustan Unilever ended up 2% each on hopes that above normal monsoon would boost rural volumes.

Sun Pharma has gained over 1% after Dilip Shanghvi, the promoter of Sun Pharmaceutical Industries, is set to expand his oil & natural gas business.

Larsen & Toubro ended up over 1% after the engineering major said that its construction division has won orders valued at Rs. 2161 crore includes a major railway electrification order.

Other gainers include, L&T, TCS, Sun Pharma and Lupin among others.

Among others, Bodal Chemicals has moved up by 5% to its record high of Rs 99.30 on the BSE after the company announced that it has received sanction from both the bankers i.e. Union Bank of India (UBI) and Bank of India (BOI), for release of promoters and promoter group shares holding which were pledged with UBI and BOI as collateral security.

Mining and metal stocks have climbed across the bourses amid a global rally in base metal prices after the US dollar fell to a three-week low against a basket of global currencies. JSW Steel, NMDC, Hindalco, Vedanta, Tata Steel, Coal India and Hindustan Zinc have advanced between 0.5%-1%.