| « Back to article | Print this article |

After witnessing lacklustre trades in the past two sessions, markets shot up in today’s trade after Britons commenced voting on a referendum on whether Britain should remain a part of the 28-nation European Union.

Meanwhile, strength in the European cues and gain in the Indian rupee aided the rally.

Participants will watch out for the Brexit poll outcome in the early morning trades tomorrow.

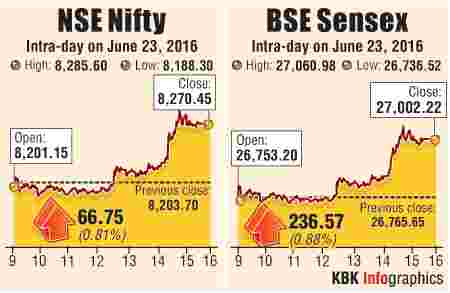

The S&P BSE Sensex gained 237 points to close at 27,002 and the Nifty50 surged 67 points to finish at 8,270.

“Markets witnessed rangebound trades in the past two days, however it shot up in the late trades today on the back of decrease in the selling pressure amid uncertainty regarding the mega Brexit referendum.

Meanwhile, lower volumes are exchanged across the exchanges.

If Britain decides to stay in the EU then Nifty can see 8,250 levels otherwise it may drop up to 7,700 levels.

Post the event, markets will keenly wait for the announcement of the beginning of the Monsoon session of Parliament as passage of the crucial GST bill remains pending,” says A K Prabhakar, head of research, IDBI Capital.

European shares soared on as firmer copper prices boosted mining stocks, while hopes among investors that Britain would vote to stay in the European Union also supported markets.

FTSE 100, DAX and CAC 40 gained between 1.5%-2% each.

Asian equities closed mixed as investors remain edgy ahead of the UK vote outcome on whether to leave the European Union (EU). Japan’s Nikkei ended up 1%, China’s Shanghai Composite closed 0.5% lower while Straits Times and Hang Seng gained 0.3% each.

Among some of the notable gainers are Tata Motors, SBI, ITC, Axis Bank and HDFC Bank gaining between 1.5%-3.5%.

Lupin surged 1.7% after it received final approval from the USFDA for Amabelz tablets (Estradiol and Norethindrone Acetate Tablets USP, 0.5mg/0.1mg and 1mg/0.5mg) to market a generic version of Amneal Pharmaceuticals' Activella tablets.

Sun Pharma gained 2% after the company said its board will hold a meeting on later today for evaluating a proposal of Buy Back of Equity Shares of the Company. Among others, Dr Reddy's Labs was up 1.5%.

GAIL India ended with marginal gains after it was awarded Rs 550 crore worth of contracts for laying part of 'Urga Ganga' gas pipeline from Phulpur in Uttar Pradesh (UP) to Haldia in West Bengal (WB).

Metal companies like Tata Steel and Hindalco, auto majors such as Tata Motors, Motherson Sumi, IT companies like TCS, Tech Mahindra, HCL Tech and Pharma companies like Lupin, Dr Reddy’s Laboratories are likely to get impacted in case Britain decides to leave European Union (EU).

Metal companies like Tata Steel and Hindalco, auto majors such as Tata Motors, Motherson Sumi, IT companies like TCS, Tech Mahindra, HCL Tech and Pharma companies like Lupin, Dr Reddy’s Laboratories are likely to get impacted in case Britain decides to leave European Union (EU).

Tata Motors was up 3.5%, Tata Steel was up nearly 1%, Hindalco gained 1.5%, Motherson Sumi lost 0.7%, Lupin and Dr Reddy’s Lab gained 1.7% and 2% respectively.

The government will sell 2.06 crore shares in NTPC to eligible employees at a price of Rs 115.90, a 5% discount to the price of Rs 122 at which the government sold 5 per cent stake in the power generator in February.

The stock lost over 2%.

Drug Controller General of India (DCGI) has given nod to Biocon and its partner Quark Pharmaceuticals to proceed with clinical trials on human subjects for a new drug candidate, ‘QPI-1007’ aimed for ocular neuroprotection.

Biocon jumped 0.4%.

MTNL surged 5% after the state-run telecom firm said it will submit its revival plan to the Department of Telecommunications (DoT) by August this year which aims to bring the loss making public sector undertaking (PSU) out of the red.

Reliance Power received a show-cause notice from Union ministry of coal (MoC) for the delay in developing coal blocks associated with its 4,000-Mw Ultra Mega Power Project (UMPP) at Tilaiya in Jharkhand. Reliance Power lost 0.4%.

Auto stocks continue the run-up on the back of progress in monsoon rains. Hero Motocorp, Bajaj Auto and Maruti Suzuki gained between 0.3%-1.5%.

Image: The Bombay Stock Exchange. Photograph: Hitesh Harisinghani/Rediff.com