| « Back to article | Print this article |

Benchmark share indices shrugged off weak global cues to end higher followig the expiry of July F&O derivative contracts after the recent developments in the parliament rekindled hopes of the GST Bill getting passed in the ongoing monsoon session of Parliament.

Benchmark share indices shrugged off weak global cues to end higher followig the expiry of July F&O derivative contracts after the recent developments in the parliament rekindled hopes of the GST Bill getting passed in the ongoing monsoon session of Parliament.

Besides, the India Meteorological Department is sticking to its 2016 forecast of southwest monsoon being ‘above normal’ as of now, based on the rainfall so far, particularly in July, but a final conclusion can be drawn once it releases its second stage forecast by this month-end.

Further, the Union Cabinet on Wednesday approved raising of the foreign shareholding limit to 15% from the existing 5% in Indian stock exchanges.

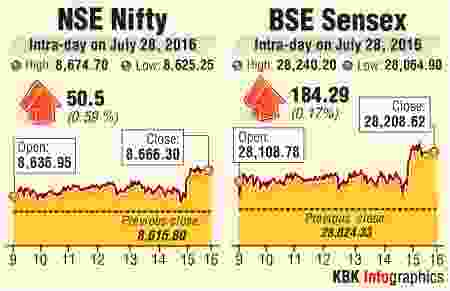

The S&P BSE Sensex surged 184 points to end at 28,209 and the Nifty50 climbed 51 points to close at 8,666.

In the broader market, both the BSE Midcap and Smallcap index closed 0.6%-0.7% higher.

In overseas stock markets, European and Asian stocks were mixed. In Japan, the Nikkei 225 Average ended 1.13% lower. Investors are hoping for further easing of monetary policy from the Bank of Japan (BOJ) after the conclusion of a two-day monetary policy meeting on 28-29 July 2016.

Strength in the yen against the dollar post last month's Brexit vote and data showing a slowdown in the Japanese economy have triggered expectations of further easing of monetary policy from the BOJ.

A stronger yen hurts the competitiveness of Japanese exporters.

Back home, the Union Cabinet on Wednesday paved the way for the goods and services tax Constitution amendment Bill to be passed in the Rajya Sabha by clearing key changes.

The Cabinet gave the green light to scrapping the one per cent addition tax on the interstate supply of goods.

Reacting to the news, logistics stocks were on limelight today and gained upto 7%.

Snowman Logistics, GATI, Allcargo Logistics, VRL Logistics, Patel Integrated, Transport Corporation of India Limited (TCIL) and Container Corporation (Concor) rallied 3% - 7%.

Among largecap stocks, Asian Paints surged over 6% to hit a fresh high on the Bombay Stock Exchange after the paints major posted robust earnings for the quarter ended June 2016.

Consolidated net profit for the June quarter was up 19% at Rs 553 crore compared with Rs 466 crore in the same quarter last year.

Maruti Suzuki India rose around 5% after the company said that it plans to expand the number of NEXA outlets to 250 by March 2017.

Shares of Sun Pharma were up nearly 2% after the company today announced a licensing agreement with Almirall on the development and commercialisaiton of Tildrakizumab for treating psoriasis in Europe.

Bajaj Auto rose 1% after posting a 2% rise in net profit for the June quarter, beating Street estimates. It was helped by higher domestic volumes and lower taxes.

Bajaj Auto rose 1% after posting a 2% rise in net profit for the June quarter, beating Street estimates. It was helped by higher domestic volumes and lower taxes.

Punjab National Bank has earned net profit during the quarter ended June 30,2016 against net loss in the previous sequential quarter, even as it declined more than half compared to the corresponding period of 2015. The stock dipped over 2%.

YES Bank gained around 2% as buying interest in the stock continued a day after the private sector bank reported strong Q1 June 2016 results and said its assets quality remains strong.

On losing side, Tata Steel, L&T, Axis Bank, Tata Motors and Bharti Airtel dipped between 1%-3%.

he net profit of the country’s top mobile operator, Bharti Airtel, for the June quarter dipped 31% to Rs 1,462 crore against Rs 2,113 crore in the corresponding quarter of the previous year, mainly on account of higher spectrum costs and adverse foreign-exchange loss due to devaluation of the Nigerian currency, Naira.

Image: A bronze replica of a bull is seen at the gates of the Bombay Stock Exchange. Photograph: Arko Datta/Reuters