| « Back to article | Print this article |

Sectors such as Healthcare, Capital Goods, Banks, IT, Metal and Power slumped 0.3-1% each.

Markets closed the session on a lower note, weighed down by disappointing earnings reported by blue-chip companies such as Lupin and Bajaj Auto.

However, the downside was limited due to buying demand in auto and oil shares.

Market participants will continue to keenly watch the developments in Parliament, with the Modi government hopeful of the passage of the GST Bill during the ongoing monsoon session.

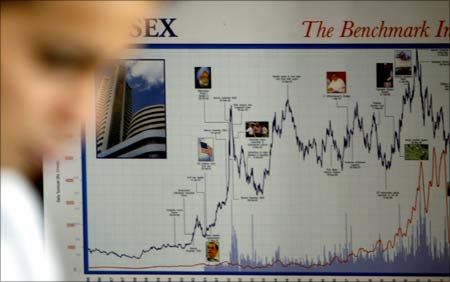

The Sensex ended lower by 134.09 points at 28,370.84 and the Nifty was down 43.70 points at 8,589.80.

In the broader markets, the small-cap stocks were in focus with the Small-cap index gaining over 0.5%; the Mid-cap index was, however, marginally down.

Market breadth remained positive with 1,522 gainers and 1,315 losers on the BSE.

On the currency front, the rupee was trading lower at 63.77 against the US dollar due to sustained dollar demand from banks and importers.

Market view

According to Ranak Merchant, Technical Analyst - Strategies, Sushil Financial Services, "The week was once again volatile as global cues continued to dominate the short term trend of the markets. Sell offs found solace just below the 8500 mark while 8667 continued to offer resistance.

The indicated 'inverse head & shoulder' pattern completed its structure with the intermediate correction and the next target in sight is 8840.

"Yet, a move above 8667 is imperative it being a Fibonacci retracenment resistance. Support continues to be in the zone of 8593-8543. The ongoing results season and the RBI policy on August 4th would determine the short term course of the markets. Traders are advised to reduce highly leveraged positions on every rise", she further added.

Sectors and stocks

Sectors like Healthcare, Capital Goods, Banks, IT, Metal and Power slumped between 0.3-1%. However, BSE Consumer Durables index has surged over 1.5% followed by sectors like Auto, Oil & Gas, Realty and FMCG, all gaining between 0.3-1%. Banking majors such as ICICI Bank, HDFC Bank and Axis Bank lost 1-1.2% each.

The Reserve Bank is likely to keep interest rates on hold in the next month's monetary policy meet, but may slash the key lending rate by a 50-75 basis points by March 2016, Morgan Stanley today said.

The investment firm believes that the RBI will leave the interest rates unchanged in its August 4 policy review meet given the acceleration in June headline CPI inflation and increase in core CPI for the third consecutive month.

Telecom Regulatory Authority of India (Trai) has received the highest number of complaints for call drops against Bharti Airtel. Shares of Bharti Airtel were down over 1.5%.Tata Steel was down nearly 4% on weak industry outlook with the global crude steel output slipping 2%.

Among its peers, Hindalco and Vedanta have lost up to 1%. Other notable losers were HUL, TCS, L&T, Infosys, Sun Pharma and Vedanta.

Shares of consumer goods companies ended higher in a weak market on hopes of passage of the Goods and Services Tax (GST) Bill during the present Monsoon session as the consumer durables sector is likely to remain as the biggest beneficiary of GST. Rajesh Exports, PC Jeweller and Titan gained between 1-10%.

Bajaj Electrical, Bajaj Electronics, Symphony, Whirlpool India and Honeywell increased between 2-6%. From the auto space, Tata Motors, M&M and Maruti Suzuki gained between 1-1.5%.

Shares of Cairn India rallied nearly 7% on the NSE, on media reports that Britain's Cairn Energy Plc is set to vote against Vedanta buyout offer for Cairn India's minority shareholders.

Result impact

Bajaj Auto shed around 5% post its quarterly results as the company’s operating profit failed to meet the street expectations.

The company reported a 37.14% increase in its standalone net profit at Rs 1,014.80 crore for the first quarter ended on June 30.

Lupin dipped over 5% at Rs 1,714 on the NSE after drug maker reported 16% year-on-year (YoY) drop in its consolidated net profit at Rs 525 crore for the quarter ended June 30, 2015 (Q1), due to lower sales. Bajaj Finserv climbed 3% after the company reported a 46% jump in net profit in the June quarter aided mainly by robust profit from life insurance business.

Container Corporation of India dipped 5.5% after the company reported a 21% decline in net profit to Rs.206.9 crore in the June quarter compared with Rs.261.88 crore a year ago.

KPIT Technologies rallied 5.6% after the company posted consolidated net profit of Rs.44.4 crore in the June quarter, down 11.7% from a quarter ago.

Global markets

A raft of forecast-beating corporate results kept European equities afloat on Thursday, shrugging off declines in Asia on the back of mixed regional data.

Top euro-zone equities were up 0.3 percent, slightly outperforming the broader pan-European FTSE 300 index.

The MSCI All-Country World index also rose. With Reuters input