| « Back to article | Print this article |

Markets slipped in late trades, amid weak European cues, as investors booked profits after recent gains while the uncertainty over the passage of the GST Bill continued to weigh on investor sentiment.

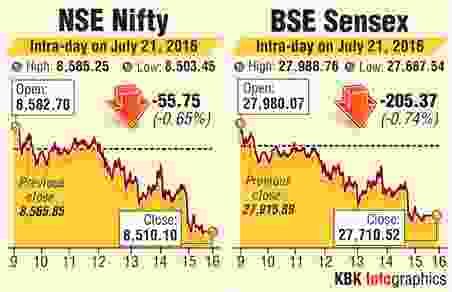

The S&P BSE Sensex ended down 205 points at 27,710 and the Nifty settled 56 points lower at 8,510.

In the broader market, BSE Midcap and Smallcap indices ended down over 0.1% each.

Market breadth was negative with 1584 losers and 1100 gainers on the BSE.

"The Nifty is likely to remain rangebound between 8,400-8.600 till the GST Bill gets passed.

"Markets are witnessing profit taking at higher levels as there are no positive surprises from the first quarter earnings," said A K Prabhakar, Head of Research at IDBI Capital.

Foreign institutional investors were net buyers in equities worth Rs 215 crore on Wednesday, as per provisional stock exchange data.

Wipro ended up 0.7% after the company won an contract from Greater Toronto Airports Authority for Futuristic IT and Business Transformation.

L&T closed 1% lower after the listing of its IT subsidiary evoked a poor reponse. L&T Infotech which had listed at Rs 667 ended at Rs 698 on the BSE.

Axis Bank ended nearly 4% lower after it reduced its base rate by 10 basis points to 9.35 per cent.

The third-largest private sector lender is scheduled to announce its first quarter earnings on Friday.

ICICI Bank ended down over 2% amid profit booking after sharp gains in the previous sessions.

HDFC Bank ended marginally lower. The private lender reported a 20.15% increase in net profit to Rs 3,238.91 crore for the quarter ended June 30.

HDFC Bank ended marginally lower. The private lender reported a 20.15% increase in net profit to Rs 3,238.91 crore for the quarter ended June 30.

Shares of ACC and Ambuja Cements hit fresh highs in intra-day trade. ACC rallied nearly 4% after the company announced the commencement of commercial production from the new 2.79 million tonne per annum clinker facility at Jamul, located at Chhattisgarh.

Ambuja Cements ended nearly 2% higher after the Cabinet Committee on Economic Affairs (CCEA) on Wednesday approved the company’s proposal to buy 24% stake in its holding company Holcim India for Rs 3,500 crore.

VRL Logistics ended up 10% after the company in a release sais that the promoters have stated their intention to withdraw their Regional Airline plans.

State-owned refiner HPCL closed nearly 4% higher after the company said that the board has approved issue of fully paid bonus shares in the ratio of 2 bonus equity shares of Rs 10 each for every 1 existing equity share of Rs. 10 each held.

IIFL Holdings gained nearly 6% after the company said in a release CDC Group Plc, UK [CDC] proposes to invest Rs 1,000 crore in the wholly owned subsidiary of the Company namely India Infoline Finance Limited.

Wockhardt ended down over 5% after the company said that three units i.e. L-1 Chikalthana, H-14/2 Waluj and B-15/2 Waluj in Maharashtra have received Establishment Inspection Report (EIR) with observations.