| « Back to article | Print this article |

State owned banks SBI and PNB were the top Nifty gainers along with ICICI Bank and auto shares.

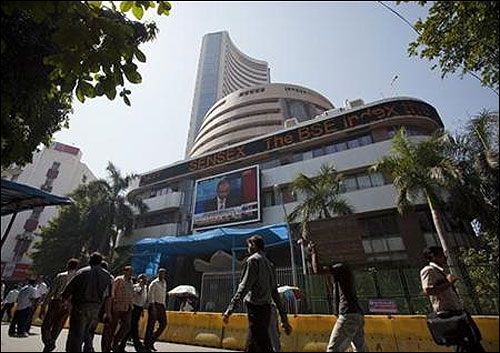

Markets ended marginally higher on Friday, amid a rangebound trading session, led by select state-owned banks and auto shares while energy shares reversed early losses.

The S&P BSE Sensex ended up 60 points at 23,709 and the Nifty50 ended up 19 points at 7,211.

In the broader market, the BSE Midcap and Smallcap index ended mixed.

Market breadth was slightly higher with 1295 gainers and 1213 losers on the BSE.

"There was shortcovering and selective buying in select stocks and traders were unwilling to extend positions. Market are likely to be volatile next week ahead of the Budget," says Mayuresh Joshi, Fund Manager, Angel Broking.

Foreign institutional investors were net buyers in equities to the tune of Rs 419 crore on Thursday, as per provisional stock exchange data.

SECTORS & STOCKS

BSE Auto, Bankex and IT indices were the top gainers while Capital Goods, Oil & Gas indices were the top losers.

State-owned oil exploration major ONGC recouped early losses to end nearly 1% higher.

Maruti Suzuki ended 2% lower after media reports suggested that the company may fail to meet its volume growth target for the year ending 31 March 2017 (FY 2017) because of capacity constraints.

L&T ended flat. The company said its construction arm won orders worth Rs 1,404 crore across various business verticals.

State Bank of India ended up 3.1% after the bank said it has raised Rs 3,000 crore through issue of bonds on private placement basis to fund business growth.

Punjab National Bank gained over 5% after reports suggested that Punjab National Bank (PNB) is weighing options of diluting stake in some of its subsidiaries and selling off real estate assets.

HDFC Bank ended flat. The bank said in a release on the BSE that it will modify all the issuance done from Bahrain branch after Standard and Poor’s lowered long and short term rating on Kingdom of Bahrain.

Axis Bank eased 1.2% while mortgage lender HDFC ended down 1%.

BHEL ended down 1.9%. Foreign brokerage UBS has maintained its 'sell' call on BHEL and has reduced target price to Rs 70 from Rs 115 per share.

UBS says EBITDA break-even unlikely by FY'20 and BHEL is likely to report losses till FY'18.

Among others, airline shares ended higher after most of them reported higher passenger load in January.

SpiceJet was the leader with 92.1% followed by GoAir and IndiGo, at 84.9% and 84.7%, respectively. SpiceJet gained 4% and Jet Airways surged 2.8%.

Meanwhile, reports suggest that Etihad Airways plans to raise its stake to 49% from 24% in Jet Airways.

Shares of railway related stocks like Texmaco Rail & Engineering, Titagarh Wagons, Kalindee Rail Nirman (Engineers), BEML and Stone India ended up to 9% on the BSE ahead of Rail Budget next week.

Shriram EPC rallied 16% on the BSE after the company said it has bagged contracts worth over Rs 438 crore from the Ministry of Road & Highways and Government of Jharkhand.

Gayatri Projects ended up 5.8%, extending its previous day’s 4.5% gain on the BSE, after the company said its wholly-owned subsidiary Gayatri Energy Ventures signed an eight-year power purchase agreement with Telangana Power Distribution companies (TPDC).

TeamLease Services reversed intra-day losses to end 1.3% higher while Quick Heal Technologies ended up 1.6%.