| « Back to article | Print this article |

Investors would watch out for cues from the on-going winter session of the Parliament.

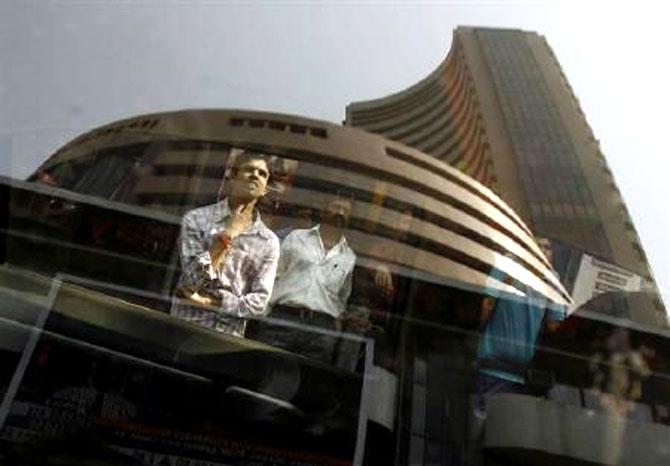

The BSE Sensex advanced for the fourth straight day on Tuesday, as it closed 24 points higher at over a three-week high of 26,169.41 after The Reserve Bank of India kept the door open for future rate cuts at its policy review and GDP quickened.

The BSE Sensex advanced for the fourth straight day on Tuesday, as it closed 24 points higher at over a three-week high of 26,169.41 after The Reserve Bank of India kept the door open for future rate cuts at its policy review and GDP quickened.

While leaving the key repo rate steady at 6.75 per cent, Governor Raghuram Rajan on Tuesday said he is open to easing rates as and when room is available, saying inflation is likely to come in better than expected.

Sensex ends marginally higher as RBI keeps rates on hold Data showed Indian economy grew faster than China at 7.4 per cent in the July-September quarter, from seven per cent in the preceding one, which gave investors much cheer.

The BSE Sensex started on a positive note and rose further before settling higher by 23.74 points, or 0.09 per cent at 26,169.41, a level last seen November 6.

Higher levels could not be sustained as participants locked in gains.

The gauge had gained 369.92 points in the previous three sessions.

The NSE Nifty also moved up 19.65 points, or 0.25 per cent, to 7,954.90 after shuttling between 7,972.15 and 7,934.15. The rupee firmed up to 66.49 against the dollar on Tuesday, helping mood brighten further. "Indices continued to be lacklustre and traded in a narrow range on an eventful day.

RBI has kept its key rates unchanged in its fifth bi-monthly monetary policy review... A weak HSBC manufacturing PMI and continued sell-off by foreign portfolio investors affected sentiment," said Gaurav Jain, Director, Hem Securities.

Stocks of metal companies led by Vedanta, Tata Steel and Hindalco were back in limelight and gained up to 4.66 per cent after global metal prices climbed.

Out of the 30-share Sensex pack, 16 ended higher.

Coal India, Dr Reddy's, Hind Unilever, Wipro and NTPC all gained. Sector-wise, the BSE metal index jumped the most surging 3.18 per cent, followed by healthcare 1.07 per cent, FMCG 1.07 per cent and PSU 0.97 per cent.

In step with the trend, the mid-cap index rose 0.78 per cent and small-cap 0.46 per cent. Meanwhile, foreign investors sold shares worth Rs 1,043.84 crore on Monday, showed provisional data. Key indices like China, Hong Kong, Japan, Singapore, South Korea and Taiwan ended higher by up to 1.75 per cent.