Sensex and Nifty finished the session at 2016 closing high on sustained buying interest amid rise in crude oil prices and appreciating rupee.

Meanwhile, investors are keenly awaiting policy decision from the US Federal Reserve later today and the expiry of April derivative contracts on Thursday.

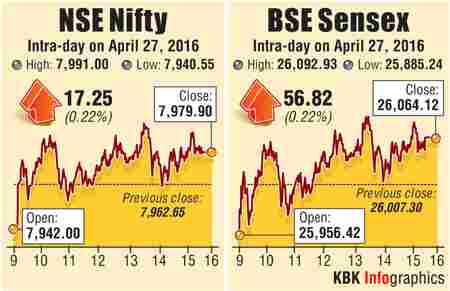

The S&P BSE Sensex gained 57 points to end at 26,064 and the Nifty50 climbed 17 points to close at 7,980.

Chandan Taparia, Derivative Analyst at Anand Rathi says “Nifty levels is concern, we have seen fresh put writing at 8,000, 7,950 and 7,900 strike which will keep the downside limited to 7,920 zones while maximum Call open interest at 8,000 and 8,050 strike would keep the upside limited to 8,020 then 8,080 levels. 7,950-7,980 is a crucial zone which we are keeping in radar for expiry closing point of view.”

Foreign portfolio investors bought shares worth a net Rs 512.22 crore yesterday, as per provisional data released by the stock exchanges.

GLOBAL STOCKS & OIL MOVEMENT

Asian stocks ended lower ahead of the outcome of the US Fed meet later today.

Meanwhile, the Bank of Japan monetary policy meet is scheduled for Thursday, 28 April 2016.

Market participants are becoming more confident in their expectations of further easing from the Bank of Japan.

Japan’s Nikkei, Hong Kong’s Hang Seng and China’s Shanghai Composite lost between 0.4%-0.7%.

Crude oil prices rallied to hit their highest level in 2016 highs after a report by American Petroleum Institute showed decline in US crude oil inventories last week.

Oil exploration majors ONGC, Oil India and Cairn India gained between 1%-3.5%.

RESULT IMPACT

Axis Bank slipped 3.5% after it put loans worth Rs 22,600 crore under watch in Q4FY16.

The private lender expects that 60% of these may become non-performing assets in the next eight quarters.

Following the tandem, ICICI Bank and SBI lost between 2%-3.5%.

Bharti Airtel surged 3.5% ahead of its fourth quarter earnings later today. Among others, Idea Cellular and Reliance Communications were up 1.5%-2.5% each.

Private lender Yes Bank on Wednesday reported a 27.4% rise in its stand-alone net profit at Rs 702.1 crore for the fourth quarter ended March. The stock closed flat.

IDFC Bank slipped nearly 6% after the bank reported weak earnings for the fourth quarter ended March 2016 and increase in non-performing assets.

Shares of Raymond surged over 6% after the company reported 161% growth in consolidated net profit at Rs 56.2 crore for the quarter ended March 31, 2016 compared with Rs 21.5 crore in the same quarter last fiscal.

Swaraj Engines was up 3% after the company reported a strong 41% jump in net profit at Rs 11.65 crore for the quarter ended March 2016 (Q4).

Biocon, India's largest biopharma firm reported 250% jump in fourth quarter profits to Rs 361 crore, and 17% increase in revenue to Rs 1,004 crore. The stock gained 1%.

STOCK TRENDS

STOCK TRENDS

Reliance Industries Ltd (RIL), one of the largest manufacturers of synthetic fibre in the world, has partnered with the Bhilwara-based Star Cotspin Limited, a leading manufacturer and exporter of sewing thread in India. The stock inched up.

Cigarette maker ITC and HUL closed higher between 0.5%-1.5% on good monsoon prospects.

Hero MotoCorp surged 0.7% after the company decided to invest Rs 3,000 crore to set up a new manufacturing facility in Andhra Pradesh. The plant will have a capacity of 1.8 million units.

NHPC dipped nearly 7% after the government decided to divest 11.36% stake in the power producer company through an offer-for-sale issue on Wednesday.

Among other notable gainers include Adani Ports, GAIL, M&M, Coal India up between 1%-5%. On the flip side, Hindalo, Tata Steel, BHEL, Tata Motors and HDFC down 0.5%-2%.