| « Back to article | Print this article |

Markets ended lower for third consecutive trading session this Friday on back of political instability back home amid caution ahead of key jobs data in US scheduled later in the day that will decide the pace of growth recovery in world’s biggest economy.

Markets ended lower for third consecutive trading session this Friday on back of political instability back home amid caution ahead of key jobs data in US scheduled later in the day that will decide the pace of growth recovery in world’s biggest economy.

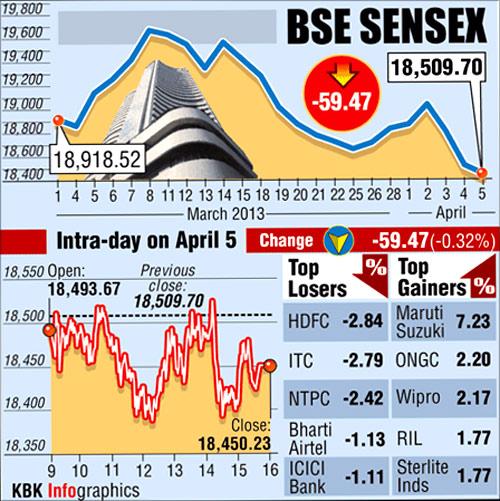

The Bombay Stock Exchange's 30-share index Sensex dropped 59.47 points to end at 18,450.23 while the National Stock Exchange's 50-share Nifty shed 21.50 points at 5,553.25.

Foreign funds sold shares worth Rs 3.26 billion in the domestic markets onThursday, following Rs 3.68 billion selling on Wednesday, provisional exchange data shows.

Market participants are increasingly jittery over political instability at Asia’s third-biggest economy after Bhartiya Janta Party (BJP) veteran LK Advani hinted at an early election on Wednesday.

Global risk appetite slightly improved after the Bank of Japan’s new governor announced unprecedented monetary easing to end two decades of economic stagnation, however, caution prevailed ahead of US non-farm payrolls data may show US employers hired a net 190,000 workers last month and the unemployment rate held at a four-year low of 7.7 percent.

Japan’s Nikkei gained 1.5% to 12,833, re-treating from day’s high of 13,225.62

Meanwhile,