| « Back to article | Print this article |

Markets end lower this Friday with 30-share sensitive index, Sensex touching its lowest level in nearly four months on back of significant selling witnessed in Information Technology index after Infosys guided for a weak revenue outlook for fiscal 2014.

Markets end lower this Friday with 30-share sensitive index, Sensex touching its lowest level in nearly four months on back of significant selling witnessed in Information Technology index after Infosys guided for a weak revenue outlook for fiscal 2014.

BSE-IT index slumped over 10 percent after Infosys, the company with second-highest weightage on the index, guided for a revenue growth of 6-10%, much below the Nasscom estimate of 12-14% for the fiscal 2014.

“The numbers were very disappointing as the company failed to meet their margin expectations and moreover the revenue guidance given today at 6-10% was way below the general and industry expectation,” said Daljeet Kohli, head of Research at India Nivesh.

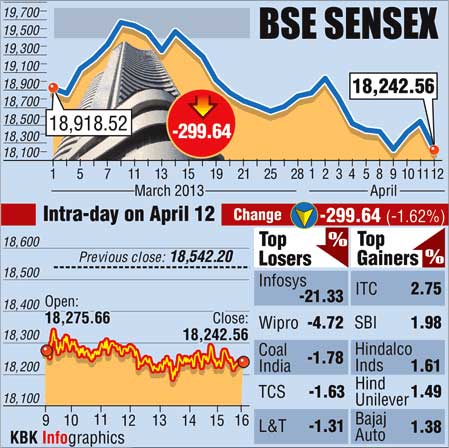

Mirroring the concerns, the Bombay Stock Exchange's 30-share index Sensex slumped 299.64 points to end at 18,242.56 while the National Stock Exchange's 50-share Nifty declined 65.45 points and closed at 5,528.55.

Risk appetite was also frail after country’s industrial production barely grew and was at 0.6% in February from a year earlier, government data showed on Friday.

In the April-February period, industrial production expanded an annual 0.9%.

Global shares declined as investors booked profits after the recent gains.

Asian markets ended lower with China’s Shanghai Composite Index falling 0.6% to 2,207, Hong Kong’s Hang Seng declined 0.06% to 22,089, Singapore’s Straits Times fell 0.44% to 3,294 while Japan’s Nikkei was down 0.47% to 13,485.

Back home, the key sectoral indices such as IT, technology, consumer durables and capital goods sectors declined while FMCG, power, bankex