The rupee snapped a two-day winning streak on Monday, weighed down by weakness in domestic shares and hurt by broad-based dollar buying from importers and banks.

The rupee snapped a two-day winning streak on Monday, weighed down by weakness in domestic shares and hurt by broad-based dollar buying from importers and banks.

Traders say the rupee and other global currencies will likely track the continued uncertainty in the US budget stalemate and government shutdown.

The dollar traded near an eight-month low against a basket of currencies.

Asian currencies mostly eased taking a breather from their recent rally, as a lack of progress toward resolving the US budget standoff kept investors' appetite for risky assets in check.

"There are not many domestic factors to watch this week, so the US will be watched closely," said Hari Chandramgethen, head of foreign exchange trading at South Indian Bank.

"I expect the dollar/rupee to trade in a lower range of 60.80 to 62.20

this week."

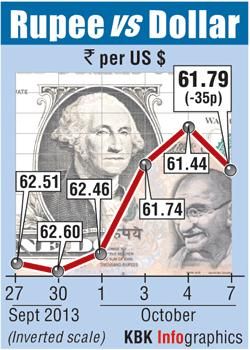

The partially convertible rupee closed at 61.79/80 per dollar compared with Friday's close of 61.43/44.

The unit moved in a range of 61.50 to 61.96 during the day.

Traders said despite the good all-round buying seen from importers and banks, there was good dollar selling by exporters seen around 61.90-95 levels, helping limit a sharper fall.

The BSE Sensex ended flat after dropping more than 1 per cent earlier in the day, as sentiment overall was broadly cautious ahead of corporate earnings results that are expected to be hit by weakening growth and a volatile rupee.

In the offshore non-deliverable forwards, the one-month contract was at 62.38, while the three-month was at 63.39.

In the currency futures market, the most-traded near-month dollar/rupee contracts on the National Stock Exchange, the MCX-SX and the United Stock Exchange all closed at around 62.18 with a total traded volume of $1.99 billion.

The rupee snapped a two-day winning streak on Monday, weighed down by weakness in domestic shares and hurt by broad-based dollar buying from importers and banks.