| « Back to article | Print this article |

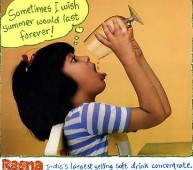

Amid rising competition from a host of multinational players in the packaged beverage space, Rasna is working on a strategy to maintain its market leadership.

Amid rising competition from a host of multinational players in the packaged beverage space, Rasna is working on a strategy to maintain its market leadership.

The largest and the oldest player in the powdered ready-to-drink market in India is facing stiff competition from players like Kraft Foods India, which has evolved an aggressive marketing strategy for its powdered beverage brand Tang with a new campaign and by sprucing up its distribution network.

Part of Rasna's strategy involves addressing consumer needs before competition can identify the same.

"We have a whole range of products that span the price spectrum -- from Rs 1 satchets to packs that cost over Rs 70.

"Our strategy is clear: To innovate and take leadership on the product platform," says Ahmedabad-based Rasna Pvt Ltd's Chairman & Managing Director Piruz Khambatta.

One such initiative to woo its target group with a 'total powder offering', the company has launched stick packs for its existing Fruitplus drink.

It had also stepped into the energy drink space offering three flavours of Rasna Glucose-D in West Bengal.

"I am happy to have competition because that will grow the market. The challenge for me is not a new entrant.

"We have seen many of them over the last two-and-a-half decades we've been around. My concern is how do I get more people to consume powdered beverages."

While the prepared beverages market in India, including squashes, syrups, and powdered beverages is a Rs 1,000-crore market, the powdered beverages alone being a Rs 400-450 crore (Rs 4-5 billion) segment.

Khambatta says while the market is growing at 20 per cent every year, there is scope for further growth.

"India's per-capita consumption of powdered beverages is just about three to four glasses. Compare this with Philippines, where the per-capita consumption is three times that of India, and you'd realise that India can do with some more of the latter."

But is the market conducive for new product launches? Khambatta believes it is: "We reinvented the powdered beverage market by making the big shift from being a synthetic product maker to one that is packed with nutrients.

"All our products today are pitched on the health platform. In this day and age when health consciousness is growing, I think it's