While its deposits from Iran accounts have come down from a peak of around Rs 25,000 crore to Rs 2,200 crore, it’s been offset by the bank receiving almost Rs 24,000 crore in deposits post note ban.

While its deposits from Iran accounts have come down from a peak of around Rs 25,000 crore to Rs 2,200 crore, it’s been offset by the bank receiving almost Rs 24,000 crore in deposits post note ban.

A few quarters ago, UCO Bank posted a huge loss, turning out to be one of the worst-performing public sector banks. While non-performing assets weighed heavy on the balance sheet, its weaning Iran deposits added to the cost of funds.

Deposits from the Iran accounts have come down from a peak of around Rs 25,000 crore to Rs 2,200 crore at present. But, after demonetisation, the bank has received close to Rs 24,000 crore as deposits, which would help the lender to offset the impact of falling deposits from the Iran accounts.

While deposits from Iran were zero cost, that from demonetisation will bear a minimum cost of four per cent; still, the bank sees a marginal improvement in net interest margin on account of lower cost of funds.

“Without exchange, the total deposits were close to Rs 24,000 crore from demonetisation. It has to some extent helped offset the impact of outflow from Iran deposits, but it is also a temporary phenomenon. Of this, only 50 per cent has come to savings or current account, which will also be there for a temporary period of two to three months. There would definitely be some improvement in net interest margin, but not to a great extent,” the lender’s managing director and Chief Executive Officer R K Takkar told Business Standard.

Since 2012, UCO Bank has been enjoying interest-free deposits on account of the rupee-trade mechanism with Iran. UCO Bank was the only conduit for payment among banks to settle trade with Iran. Under the mechanism, 45 per cent of oil imports of Indian oil companies are settled in rupee denomination at UCO Bank. With sanctions on Iran being lifted, the bank’s corpus of funds from the scheme has been shrinking.

Between the first and second quarter of the current financial year, the bank had seen losses come down, while margins are improving. The bank’s net loss came down from about Rs 1,715 crore at the end of Q1 to about Rs 385 crore at the end of Q2 of FY17. The bank’s NIM stood at 2.33 per cent at the end of September 2016, against 1.63 per cent at the end of Q1 of FY17.

The bank, which has seen almost no growth in credit offtake so far in this financial year, is expecting three-four per cent credit growth this year on account of falling cost of funds. The bank on Tuesday reduced the MCLR (marginal cost of fund-based lending rate) across various tenures by 70-80 basis points. After the reduction, the MCLR of the bank for one-year tenure is 8.60 per cent.

“We have already reduced MCLR by 70-80 basis points. Now for one year, MCLR is at 8.60 per cent. Due to flow of funds due to demonetisation, the cost implications we have reduced,” said Takkar.

Notably, with Bank of Baroda offering lowest interest rate of around 8.35 per cent on home loans, the bank would face intense competition in the home loan market. The bank is looking to have tie-ups with institutions and builders to push home loan products.

“There is a market for everybody; other than rates, what matters is turnaround rate. If we can tie up with builders, institutions and their employees, we can increase our home loan portfolio,” Takkar said.

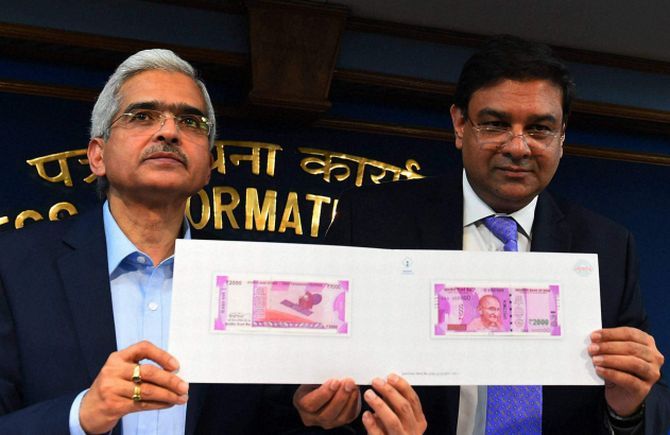

IMAGE: Economic Affairs Secretary Shaktikanta Das, left, with Reserve Bank of India Governor Dr Urjit Patel. Photograph: PTI Photo.