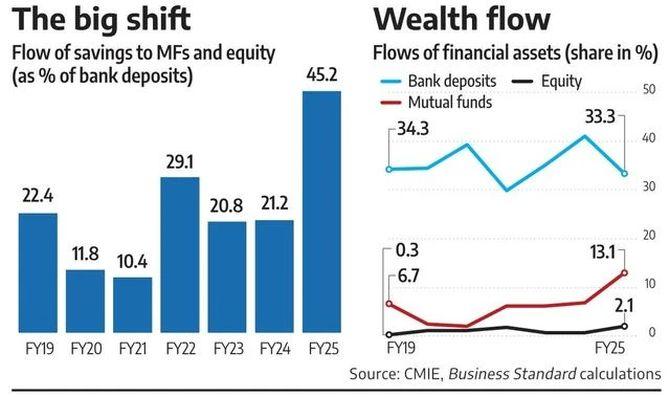

For every 100 rupees, households invested Rs 45.2 in mutual funds and equities in 2024-2025.

Incremental flows of household savings into stock markets and mutual funds relative to bank deposits have more than doubled over the past year.

For every Rs 100 worth of savings invested in bank deposits, households invested Rs 45.2 in MFs and equities in 2024-2025, shows a Business Standard analysis of data from the November Reserve Bank of India Bulletin.

The corresponding figure was Rs 21.2 in 2023-2024.

The total money that MFs manage was Rs 79.9 trillion as of October 2025. This is 33 per cent of the aggregate banking deposits of Rs 241.7 trillion.

MFs accounted for around 29 per cent of bank deposits in March 2025.

A combination of low deposit rates, increased financial literacy, and ease of investment through financial technology platforms has caused more money to flow into MFs and the stock market.

Flows from domestic investors into the equity market are likely to continue despite markets being flat over the past year, according to Amnish Aggarwal, director of research (institutional equities) at PL Capital.

Retail investors no longer retreat from the markets at the first sign of volatility, as borne out by continued flows into MFs despite market gyrations due to a military engagement with Pakistan earlier this year and tariff uncertainty.

"Over a period of time, domestic investors have matured considerably," Aggarwal said.

The improvement in the ratio towards MFs and equity investments was also driven by a year-on-year decline in flows to bank deposits.

Bank deposit flows dropped to Rs 11.86 trillion in FY25 compared to Rs 14.23 trillion in FY24.

MFs received Rs 4.66 trillion in FY25 compared to Rs 2.39 trillion in FY24. Stock market investments (equity) accounted for Rs 74,000 crore in FY25 compared to Rs 29,000 crore in FY24.

The value of MFs and equities doubled over the previous financial year.

This has largely been driven by MFs, which nearly doubled over a large base in FY24.

Direct stock market (equity) investments are up 153 per cent over the same period on a smaller base.

MFs and equities account for 15.1 per cent of financial asset flows in FY25 compared to 8.7 per cent in FY24.

'A persistently low fixed deposit rate for an extended period might eventually lead people to search for other asset classes that offer higher returns, thereby increasing equity MF flows,' according to a study, Equity MFs: Transforming India's Savings Landscape, from authors including Mayank Gupta, Satyam Kumar, Abhinandan Borad, Subrat Kumar Seet and Pratibha Kedia, which appeared in the August 2025 RBI Bulletin.

The weighted average domestic term deposit rates of scheduled commercial banks on outstanding rupee term deposits hit a 23-month low (6.82 per cent) in September 2025. It was 5.6 per cent on fresh term deposits.

'MFs in India have experienced considerable popularity, attributable to the rise in income levels, increasing levels of financial literacy, young demographic composition, the widespread growth of the digital ecosystem and internet connectivity, and the success of the marketing initiatives led by the Association of Mutual Funds in India, leading to a buildup of trust,' added the RBI Bulletin study.

Tax rates on fixed deposits can exceed 30 per cent for those in the highest tax bracket, pointed out Raunak Roongta, founder and managing partner of Raunak Roongta Financial Services, a registered MF distributor.

There are hybrid MF offerings that are subject to a 12.5 per cent tax, he said, which have gained in popularity as an alternative to bank deposits.

Despite flat stock market returns over the past year, sentiment around MFs shows no signs of weakening, according to Roongta.

"It is getting stronger," he said.

Feature Presentation: Aslam Hunani/Rediff