| « Back to article | Print this article |

The inflation scare is the strongest among manufacturers of consumer goods such as automobiles, consumer durables, and FMCG.

After the hit of the pandemic, India Inc is now worried about the adverse impact of inflation and higher commodity prices on their revenues and margins.

The inflation scare is the strongest among manufacturers of consumer goods such as automobiles, consumer durables, and fast-moving capital goods (FMCG).

Companies across sectors fear they will not be able to pass on the hike in input costs to their consumers due to weak demand, which, in turn, would lead to a hit on margins and profitability in the forthcoming quarters.

“We are keeping a close watch. One needs to walk a tightrope,” said Shashank Srivastava, executive director (sales and marketing), Maruti Suzuki India, alluding to the company’s strategy to maintain its sales momentum amid a nascent recovery in demand.

The carmaker’s operating margin in Q1FY22 was the lowest in a decade due to higher input costs and low sales volumes.

In terms of volumes, Maruti Suzuki’s sales in the first four months of FY22 have gone up substantially quarter on quarter and year on year but they are down 19 per cent as compared to FY19, he said.

Consumer durables companies are in a similar boat.

“There is pressure on margins because commodities are at an all-time high and hence we are balancing between our selling prices in the market as well as market shares and the margins,” said Anil Rai Gupta, chairman and managing director, Havells India, in the analysts concall.

The company’s operating margins were down 140 basis points quarter-on-quarter in Q1FY22 due to higher input costs.

One basis point is one-hundredth of 1 per cent.

FMCG makers are in a relatively good position due to their superior pricing power though they have also seen an erosion in margins in Q1FY22.

“Our EBITDA (earnings before interest, tax, depreciation, and amortisation) margins have declined by 110 bps on a year-on-year basis primarily because of high input costs and an increased A&P (advertising and promotional) spend.

"The sequential drop in margins was driven by high input costs from crude and palm oil, partly offset by pricing actions,” said Hindustan Unilever executive director and chief financial officer Ritesh Tiwari in the post-results concall with analysts.

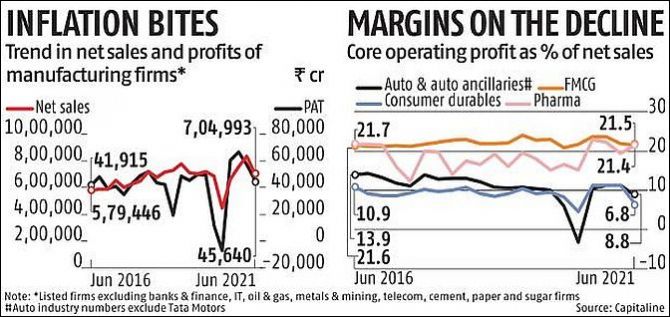

The adverse impact of inflation and higher commodity prices is visible in the overall corporate results for Q1FY22.

The combined net profits of 1,305 manufacturing and domestic market-oriented service sector companies were down 21 per cent quarter-on-quarter to their lowest levels in eight quarters with the exception of lockdown quarters of Q4FY20 and Q1FY21.

In comparison, the companies’ net sales were down 15.6 per cent quarter-on-quarter.

The companies reported combined net profits of Rs 45,640 crore in Q1FY22, down from Rs 57,654 crore in Q4FY21.

Net sales in the period declined from Rs 8.35 trillion to Rs 7.05 trillion.

The analysis excludes banks, insurance, non-banking financial companies, IT companies, and producers of oil and gas and commodities such as metals, minerals, cement, sugar, and paper (see the charts).

These companies’ core operating margins (excluding other income) were down nearly 200 basis points from the record highs in Q3FY21 but were up 70 basis points on a quarter-on-quarter basis.

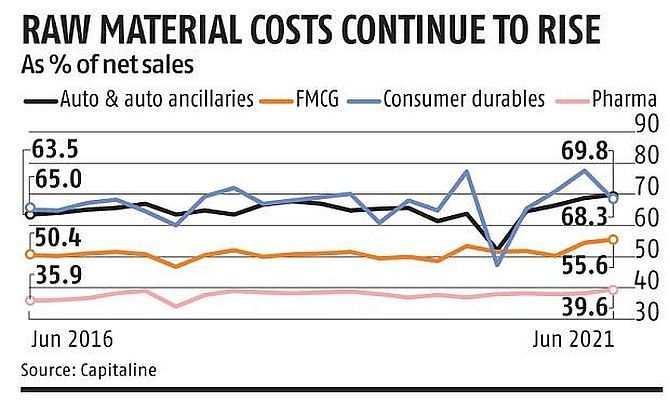

The impact of inflation and commodity prices was most visible in the companies’ raw material and power and fuel costs.

The companies’ raw material to net sales ratio at 50.1 per cent in Q1FY22 was the highest in at least 21 quarters and was up nearly 1,100 basis points year-on-year and 70 basis points quarter-on-quarter. In comparison, power and fuel costs to net sales rose to a four-quarter high of 6.3 per cent.

A sectoral break-up of the numbers suggests that the hit on margins has been the most severe for metal-intensive industries such as automobiles and ancillaries, capital goods, and consumer durables.

In contrast FMCG, pharmaceuticals, and chemical manufacturers have seen the least impact on their margins.

For example, in the automobile industry including ancillaries, the raw material to net sales ratio rose to the highest level in at least five years while the industry’s core operating margins and operating profits in Q1FY22 were the lowest since at least Q1FY17.

The story was the same for consumer durables makers such as Havells India, Bajaj Electricals, V-Guard, and TTK Prestige.

In contrast the margins in the FMCG and pharma sectors remain close to the average in the last five years despite a rise in the raw material to net sales ratio.

The predicament of two-wheeler makers is worse. Unlike cars, demand for motorcycles and scooters has been patchy and a broadbased recovery remains elusive.

“In nine months, steel prices are up more than 50 per cent. In my 23 years I have never seen prices of commodities other than oil go up by more than 50 per cent in nine months,” Bajaj Auto chief financial officer Soumen Ray said at the earnings call, adding that he could not give a guidance on Q3 as the company has “zero visibility”.

Infrastructure firms like Larsen & Toubro are, however, banking on the price escalation clause to protect their margins.

“Most contracts have inbuilt price escalation clauses, which provide protection against price rise to a large extent.

Contractors usually have a very limited appetite to take commodity price risks while bidding for projects,” said R Shankar Raman, whole-time director and chief financial officer at L&T.

Analysts don’t expect any adverse impact on India Inc’s overall profits from higher inflation and commodity prices.

“FY22 is expected to be bad for manufacturing companies but a decline in their margins would be more than compensated by higher earnings by companies in metals, cement and oil and gas,” said Shailendra Kumar, chief investment officer, Narnolia Securities.

According to him, besides automobiles, India has few large manufacturing industries and the industrial space is dominated by commodity producers that benefit from higher commodity prices.