| « Back to article | Print this article |

GVK Power & Infrastructure has gained investors’ interest recently following news of the company’s plans to monetise assets in the coal and airport verticals.

GVK Power & Infrastructure has gained investors’ interest recently following news of the company’s plans to monetise assets in the coal and airport verticals.

The recent completion of the new Terminal 2 at the Chhatrapati Shivaji International Airport has further fuelled hopes the debt burden will ease.

Though a lot of this is driven by hopes, analysts are cautious as there are many issues whose resolution may not happen soon.

"Despite improvements in operating performance of airport and road assets, cash flow concerns are expected to worsen due to the incremental funding needs for cost overruns. Debt burden and the need to retire acquisition debt are other issues," said Shankar K of Edelweiss Securities.

Analysts are not falling for the cheap valuations as they believe some issues are far riskier from the investors’ perspective.

"We highlight that higher debt, Hancock (coal business based in Australia) and overhang in the power vertical would continue to weigh despite attractive valuations," said Deepak Purswani of ICICI Securities.

After Terminal 2, the market has started to look for the monetisation of the adjourning land bank, crucial for retiring some debt, the biggest concern for investors for some time.

The company had got interest from 23 parties for monetisation of the 1.8 million square feet of Mumbai International Airport Limited.

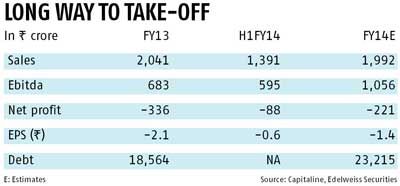

Analysts are expecting this to fetch Rs 1,200-1,500 crore (Rs 12-15 billion), not sufficient given the debt of Rs 18,500 crore (Rs 185 billion).

The company had said it planned to monetise assets in the coal, power and airport businesses. However, looking at the issues in the power and coal businesses, the Street is banking on the monetisation of airport-related assets.

Also, this vertical is making profits and will enable good valuations.

The book value of the stake in the business is estimated to be Rs 3,000 crore (Rs 30 billion), including Rs 2,200 crore (Rs 22 billion) for the Mumbai airport.

"Even in the airport business, it would not fetch much money and if the company sells a large stake, it will have nothing in its portfolio to talk about," said an analyst.

In the September quarter, the company had incurred an interest cost of Rs 213 crore (Rs 2.13 billion) on an operating profit of Rs 299 crore (Rs 2.99 billion), indicating very less leeway in terms of disposable profits for repaying debt.

The Street was worried about how the company was going to repay its debt and service interest cost in the light of losses in the power business and constrained cash flows.

The power segment employs Rs 10,755 crore (Rs 107.55 billion) of capital and generates a quarterly sale of Rs 96 crore (Rs 960 million).

The power segment employs Rs 10,755 crore (Rs 107.55 billion) of capital and generates a quarterly sale of Rs 96 crore (Rs 960 million).

Its 900 Mw of gas-based capacity is operating at 20-30 per cent and is not even able to recover the costs and service the debt.

The market has written off the equity invested in these projects, suffering due to the lack of gas and losses.

In fact, analysts worry if the problem of availability is not resolved, the debt taken for the power projects could have their bearing on the overall business.

However, with buzz of a possible rise in India’s gas availability, there is some hope.