There was no postal intimation to unitholders who didn’t have a registered email address, according to a letter that Midas Touch Investors Association sent to Sebi.

A leading investor association has raised questions about the legality of the voting process for the winding up of six funds that Franklin Templeton Asset Management (India) manages.

There was no postal intimation to unitholders who didn’t have a registered email address, according to a letter that Midas Touch Investors Association sent to the Securities and Exchange Board of India (Sebi).

It also argued that unitholders should have a vote in proportion to their holdings.

“The principle of one vote per shareholder violates the right of the unitholder, and hence is Illegal,” said the letter from founder Virendra Jain to the regulator.

Legal opinion pointed to the need for equal treatment in terms of intimation.

“We note basis the notice for e-voting as published on its website, that the unitholders eligible to vote were to receive their login credentials for the e-voting process by email.

"Typically, in a scenario where the voting is be conducted through electronic means and the login credentials are being provided by email, the trustee should ensure that every unitholder receives the intimation of such meeting and login credentials for the e-voting process irrespective of whether their email IDs were registered with the scheme or not,” according to Divaspati Singh, Partner, Khaitan & Co.

A spokesperson for Franklin said that it had conducted the process with due permissions.

“We wish to clarify that we have conducted the e-voting and unitholder meets after obtaining permission from the Hon’ble Supreme Court and under the scrutiny of an independent observer appointed by Sebi.

"As per the directions of the Hon’ble Supreme Court, the results of the e-voting and the report of the observer are expected to be submitted in a sealed envelope to the court.

"We request our investors and partners to wait for further directions from the Hon’ble Supreme Court in this regard.”

Franklin Templeton wound up six schemes in April 2020 amid liquidity issues because of the pandemic.

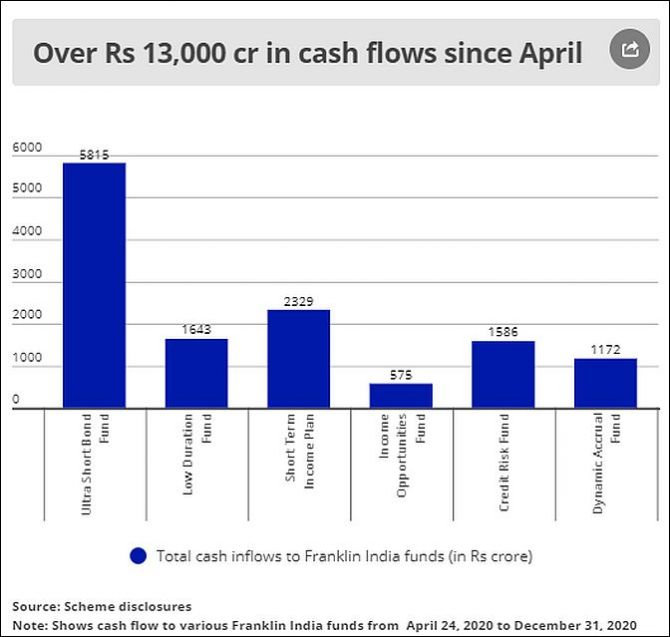

Investors had around Rs 28,000 crore stuck in the schemes at the time.

The six schemes were Franklin India Low Duration Fund, Franklin India Ultra Short Bond Fund, Franklin India Short Term Income Plan, Franklin India Credit Risk Fund, Franklin India Dynamic Accrual Fund, and Franklin India Income Opportunities Fund.

Investors moved court on the matter after which voting happened in December.

Results are yet to be declared.

Meanwhile, the fund has said that the schemes have got cash inflows of over Rs.13,000 crore from which can come as the result of investments maturing and coupon payments among others (see chart).