| « Back to article | Print this article |

Consider this: Nearly 40 per cent of the 1,140 firms that paid dividends to shareholders in FY13 did so despite running cash deficits on their balance sheets.

Consider this: Nearly 40 per cent of the 1,140 firms that paid dividends to shareholders in FY13 did so despite running cash deficits on their balance sheets.

In all, 434 dividend-paying companies had negative free cash flows last year.

The number would rise further if the dividend outgo is taken into account.

Free cash flow is derived by deducting cash outgo on account of capex and dividends from cash flow generated from business operations.

It denotes the cash surplus generated by a company after paying for growth projects.

A deficit would have to be plugged through fresh borrowings or equity infusion.

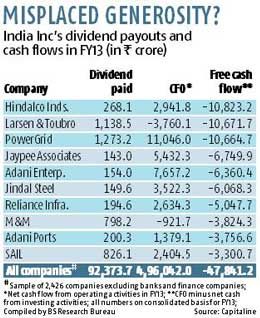

Some of the major companies in the list include Larsen & Toubro, Hindalco, PowerGrid, Jaypee Associates, Adani Enterprises, GMR Infra, Reliance Infra, Jindal Steel, Adani Ports, Steel Authority of India and Mahindra & Mahindra (see table). At least 15 per cent of the companies (182 companies) declared dividends despite reporting negative cash flows from operations last year.

“The biggest challenge for most of these companies is, if they stop paying dividends, that might give a wrong signal to the market and erode their market capitalisation and fund-raising ability,” says Mehraboon Irani, principal & head of private client group at Nirmal Bang Securities.

Analysts say the dual challenge of maintaining dividend payouts and capex forces many companies to increase borrowings and raise fresh equity capital.

“There are companies paying dividends out of borrowings.

They do this either because promoter stake is high or the management fears a backlash from investors if dividends are cut,” says P Phani Sekhar, fund manager at Angel Broking.

Faced with financial headwinds, companies reduce dividends to conserve cash.

In the current slowdown, however, a majority of companies continues to pay dividends despite a fall in profitability and cash flows.

The number of dividend-paying companies last financial year fell just eight per cent from FY07’s 1,242 to 1,140.

The analysis is based on a sample of around 2,400 companies the comparable numbers for which for the period are available.

Alok Industries, for instance, had cash and bank balance of Rs 165.98 crore (Rs 1.65 billion) at the beginning of FY13.

During the year, it used Rs 450 crore (Rs 4.5 billion) for operations and another Rs 1,280.50 crore (Rs 12.8 billion) for capex.

During the year, it used Rs 450 crore (Rs 4.5 billion) for operations and another Rs 1,280.50 crore (Rs 12.8 billion) for capex.

Its cash flow from operations was negative but it paid Rs 24.5 crore (Rs 245 million) in dividends.

Sometimes, it is also a result of mismatch in a company’s net profit and its underlying cash flow from operations.

If a company declares net profit, its shareholders expect a dividend, which may not be viable if more cash is used up in operations.

In FY13, L&T reported net profit of Rs 5,219 crore (Rs 52.19 billion) on a consolidated basis, but its cash flows from operations were negative to the tune of Rs 3,760 crore (Rs 37.6 billion), largely due to unrealised receivables.

Despite this, it made a fresh capex of around Rs 7,000 crore (Rs 70 billion) and rewarded shareholders with a dividend payout of Rs 1,012.80 crore (Rs 10.12 billion).

India Inc’s scorecard gets worse if data for the past five years are taken.

Nearly half of the companies that paid dividends at least once in the past five years (691 out of 1,464) had negative free cash flows.

PowerGrid Corp, for instance, has cumulatively distributed Rs 4,196.7 crore (Rs 41.96 billion) as dividends in the past five years.

During this period, its capex and investment exceeded its cash flow by Rs 33,268 crore (Rs 332.68 billion), funded through a mix of borrowings and fresh equity.

Things were similar at Tata Motors, which rewarded shareholders with Rs 4,371 crore (Rs 43.71 billion) in dividends over last five years, though its cash outgo on capex and investments exceeded operating cash flows.

The divergence is even bigger in case of IndianOil, India’s largest fuel marketer.

Since FY09, it has distributed Rs 9,334-crore (Rs 93.34 billion) dividends, despite reporting cash losses in operations.

“There are certain businesses, such as infrastructure, power and metals, that require huge capex and these tend to report cash flow mismatch for short periods; that is understandable.

"But, if the cash flow mismatch becomes recurring, one needs to be cautious,” said Mahesh Patil, Co-CIO, Birla Sunlife MF.