| « Back to article | Print this article |

Ronald Perelman spent five years rebuilding his $6 billion fortune amid travails at Revlon and Marvel. Suddenly he's back.

Ronald Perelman spent five years rebuilding his $6 billion fortune amid travails at Revlon and Marvel. Suddenly he's back.

For much of the 1980s Ronald Perelman was one of America's most feared corporate raiders. Then came the dark years of the late 1990s -- his abusive relationship with the faded-luster franchise of Revlon; the bankruptcy of Marvel Entertainment, which wiped out a stake once worth $2.1 billion; a divorce (his third); and an ill-fated deal with Sunbeam that turned a $680 million investment into nothing.

Perelman, 62, says the string of setbacks, especially Marvel, marked the lowest point of his long career, which spans 27 years and 38 big deals. He still winces from the fallout over the divorce in 1997 from his third wife, Patricia Duff, who demanded $7 million in annual child support for their then-3-year-old daughter (and ended up getting less than $150,000 a year).

Perelman got pilloried for testifying that a child could be fed on $3 a day. "People said I was a terrible human being and that I was starving my daughter," he says. Howard Gittis, his longtime consigliere, recalls: "Emotionally, to come to the office every day was difficult."

Along the way the size of Perelman's self-made fortune, a point of pride for this giddily competitive, 5-foot-7 corporate barbarian, declined frightfully. It peaked at $6.5 billion in 1997 and fell by two-thirds in four years to a low of $2.3 billion in 2001, Forbes estimates. In the same time period the S&P 500 rose 17 per cent. Perelman's comment on those figures: "I never agreed with any of your numbers anyway."

The Many wives of Ronald Perelman:

|

Name |

Married |

Divorced |

Children |

|

Faith Golding |

1965 |

1984 |

4 |

|

Claudia Cohen |

1985 |

1994 |

1 |

|

Patricia Duff |

1994 |

1997 |

1 |

|

Ellen Barkin |

2000 |

still married |

0 |

Fourth time's the charm

Suddenly he's back. Perelman's fortune, largely amassed through the acquisitive MacAndrews & Forbes (no relation to Forbes magazine), is $6 billion, we figure, ranking him number 34 on the list of richest Americans.

He purged the last of his demons earlier this year, in Manhattan on a warm day in May. He sat in his townhouse office on East 62nd Street and watched a live courtroom feed on TV as a jury ruled in his favor in his lawsuit accusing Morgan Stanley of fraud in the Sunbeam deal.

America's rich list

Sort List by Rank | Sort List by Name | Sort List by Net Worth | Sort List by Age

In 1998 Perelman had sold his 82 per cent stake in faltering Coleman (camping goods) to Sunbeam for $140 million in cash and $680 million in Sunbeam stock. By 2001 the shares were worthless, and Sunbeam had folded under an accounting scandal that took place under the reign of chief Albert (Chainsaw Al) Dunlap.

The circuit court jury in Florida ordered Morgan Stanley to pay Perelman's MacAndrews &Forbes $1.6 billion, including $850 million in punitive damages. The two sides likely are in settlement talks, and Perelman could clear $1 billion or more after taxes.

Top profile links

William H Gates III | Warren E. Buffett | Paul G. Allen

That would arm him with a total $2 billion in cash to parlay into new bets, which he vows to do even at this late stage of his career. With debt he could turn it into, say, $10 billion or more in deals, probably starting in banking.

"I'm not in the twilight of my career," he insists, four years shy of qualifying for Social Security payments. "We're going to wait for the right deals. We're looking aggressively, but I have no pressures from anyone but myself. I get bored easily."

The big question is whether Perelman matters anymore. He is a solo practitioner in a buyout game of newly bulked-up giants. Big private equity funds, not lone raiders, do takeovers these days -- funds run by such tycoons as Stephen Schwarzman of Blackstone Group and David Bonderman of Texas Pacific Group. Perelman argues their sheer size forces them to invest in deals he wouldn't touch.

In pictures

The very richest | Notable newbies | Near misses | Billionaire dropouts | In memoriam | Booze Hounds

One of the biggest funds now is $8.5 billion, and a $10 billion pot is all but inevitable, Perelman says. He aims to dodge these titans and find "quirky deals" to buy companies or assets at a low price and run them without looking to get out.

Attention-deficit-disorder investing, you might call it. Typically he picks out an ugly duckling other investors don't like, disposes of the dreck and, at times, hollows out a corporate shell to use tax-loss benefits to buy something better. Then he adds a few properties that offer glitz but bear little relation to everything else. He believes in diversity, not synergy.

This is how he came to make a few billion in profit buying bankrupt banks, overhauling them and selling them to the giants, while also betting on distractions, from cosmetics to comic books to camping gear.

Since 2002 he has bought pieces of a scratch-ticket lottery outfit, a security service and a maker of military Humvees.

Yet for all that fragmented focus Perelman is singularly obsessed with Revlon, a problem bride he bought in 1985 in a hostile takeover for $1.8 billion, financed by junk bonds from the renowned Michael Milken of now-defunct Drexel Burnham Lambert.

"It's by far the hardest transaction I've ever been involved with, but I still think it has enormous underlying value," says Perelman. "I'm the most encouraged I've been in 20 years. It's an irreplaceable asset." Revlon stock was as high as $55 in 1998; these days it hovers at $4, all but daring Perelman to buy it back.

He is a celebrity in his own right, a guy who's both tough and gentle and who hangs out now and then with rock stars Jon Bon Jovi, Rod Stewart and Billy Joel. Yet he is an observant Jew who doesn't work from sundown Friday to Sunday morning and who, as the Talmud demands, on Saturdays always prays in a group of ten Jewish men, no matter where he is in the world.

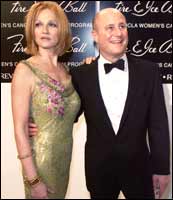

For five years now Perelman has been married to his fourth wife -- the blonde Ellen Barkin, the actress; friends say she has calmed him down. He had four children with his first wife, a fifth with his second wife (former gossip columnist Claudia Cohen) and a sixth (the daughter with the $3 meal tickets) with his third spouse. Perelman proclaims a profound love for his children, yet he refused to attend the wedding of his eldest son, Josh, because the bride didn't sign a prenup; asked about this, his handlers note that "no one attended the wedding because of that."

Ronald Owen Perelman was born on New Year's Day in 1943 in Philadelphia, the grandson of Lithuanian immigrants. His father was Raymond Perelman, an intense buyout artist who owned a metals company called Belmont Industries. In 1965 Ronald graduated from the University of Pennsylvania and married Faith Golding, whose grandfather had built the Essex House hotel and amassed a $100 million fortune. He then picked up his M.B.A. from Wharton and went to work for Dad.

Perelman worked for his father until 1978, when the two had a falling out and he quit and moved to New York to start doing buyouts himself.

Ronald, then 35, had argued he was ready to be president of Belmont; Raymond said he wasn't. "I've always been very impatient," Ronald says. The rift lasted for six years. His father, now 88, is still president of Belmont.

In 1980 he bought Philadelphia candymaker MacAndrews & Forbes for $45 million. He sold off chocolate-making but kept the licorice extracts business (which he controls today as publicly held M&FWorldwide). In 1984 he took the company private for $95 million; today MacAndrews & Forbes is worth perhaps $6 billion, and he owns all of it.

MacAndrews & Forbes embarked on a buyout binge, getting film developer Technicolor, Consolidated Cigar, the Pantry Pride supermarket chain and a few other properties for $360 million in borrowed money, including $140 million in Milken bonds.

The gem was Pantry Pride: He took a 38 per cent stake for $60 million. On the books: a $300 million tax-loss carry forward that could shelter profits elsewhere.

In November 1985, backed by $750 million more in junk debt, he used Pantry Pride to buy Revlon for $1.8 billion, plus $700 million in assumed debt.

Soon after, he offered $4.1 billion for Gillette but was turned down. He walked away with $34 million that the press played up as "greenmail," solidifying his predator status.

A year later he went after a 14 per cent stake in Salomon Brothers but was rebuffed. In 1988 he sold off Consolidated Cigar for $135 million, then bought it back five years later, paying $185 million, only to sell it again in 2000 for $730 million.

In banking Perelman hit the most profitable streak of his career. The savings-and-loan crisis and government bailout were in full swing, and in 1988 Perelman linked up with Texas banker Gerald Ford to buy five bankrupt S&Ls with 300 branches for $315 million. The government kicked in $5 billion, including $900 million in tax breaks Perelman could use at his other companies.

When the deal was done, Perelman owned 90 per cent of the S&L group, dubbed First Gibraltar, and Ford had 10 per cent. In 1993 they sold it to Bank of America for $1 billion, keeping four branch offices to hold on to some of the tax breaks and funnel them into new ventures.

In 1995 Perelman and Ford bought First Nationwide bank from Ford Motor for $730 million, selling off branches in three states for 7 per cent of deposits and reinvesting the proceeds in California bank branches priced at only 2 per cent of assets.

"It was a great arbitrage," says Gittis, Perelman's chief lieutenant. Soon they had merged with Cal Fed to form Golden State Bancorp, the second-biggest thrift in the US, with $3.6 billion in assets.

In 2002 they sold it to Citigroup for $6 billion in cash and stock. Perelman took out $300 million in cash and held on to 36 million shares, worth $1.6 billion today.

But Perelman had a much tougher time in other businesses. In 1989 he acquired Coleman, which led to the Sunbeam flop. That same year he took a wild Spidey ride with Marvel, acquiring it for $83 million and taking it public two years later.

By 1993 the shares had soared from $2 to $36, adjusted for three stock splits, and Perelman's 60 per cent stake was up to $2.1 billion. Emboldened, Perelman raised $500 million in Marvel bonds against his own shares to fund other properties.

Then the bottom dropped out. By late 1996 rival raider Carl Icahn had bought up control of Marvel bonds. Marvel filed for bankruptcy court protection, Icahn installed himself as chairman, and Perelman was forced out, his equity wiped out by the bonds he had issued.

It is far more difficult to track how much Perelman is up -- or down -- on his Revlon investment. He waited 11 years to take it public, peddling a 17 per cent stake in 1996 that valued Revlon at $1.05 billion.

A decade later its market cap is at only $1.3 billion. The stock has languished in the single digits for five and a half years.

Along the way Perelman brought in $3 billion selling off some Revlon assets. But he also spent $500 million to add a few brands, and reportedly tried (but failed) to sell the company in 1999 (he denies this).

He had his stake diluted from 83 per cent to 60 per cent when the company issued more shares to pay off $800 million in bond debt. Moreover, Revlon ran up $440 million in losses in 1991, and since 1996 has had net after-tax losses of $1.3 billion.

Worse, its revenue fell by 40 per cent in six years, to $1.3 billion, on asset sales and tough competition. After 24 straight losing quarters the company turned its first profitable quarter late last year -- and has returned to losses.

Yet Perelman remains obstinately bullish on Revlon's future. "It's still a brand that cannot be replicated," he insists. "The question is, how can we get the business to be the size of the brand?" Maybe so, but his other pursuits -- not his prized beauty franchise -- are what made him rich.