It’s a tough summer for India’s financial services sector. Lower profits, muted loan demand and a rise in bad assets have raised fears of a Lehmanesque crisis in the banking sector. And, the fact that interest rates are firm, inflation high, liquidity conditions tight and the currency exchange rate volatile isn’t helping. “While the context is different, the nature of risks is similar,” says Dhananjay Sinha, co-head (institutional research), economist and strategist at Emkay Global Financial Services, while comparing the stress in the Indian financial services sector to the collapse of US investment bank Lehman Brothers Holdings in 2008.

“While the context is different, the nature of risks is similar,” says Dhananjay Sinha, co-head (institutional research), economist and strategist at Emkay Global Financial Services, while comparing the stress in the Indian financial services sector to the collapse of US investment bank Lehman Brothers Holdings in 2008.

Though Indian banks don’t have large exposure to subprime mortgages, analysts are worried at the rise in their restructured loan portfolios and deterioration in credit quality. Sinha warns there are significant risks of capital erosion, especially for government-owned banks, if non-performing assets continue to rise further.

He estimates domestic banks would need at least Rs 1,75,000 crore (Rs 1,750 billion) to prevent capital erosion due to loan impairment. This is in addition to the estimated Rs 5,00,000 crore (Rs 5,000 billion) required to meet the new Basel-III capital norms.

“If you have to save banks from failing, you need more capital. The government has to act swiftly in recapitalising public sector banks. Otherwise, there is a significant risk of some of the banks’ net worth being impaired,” Sinha says.

For analysts and bankers, rising bad loans are the primary concern. Rating agency Icra estimates the banking sector’s overall gross non-performing assets rose to 3.8 per cent at the end of June 2013 from 3.1 per cent a year earlier.

The ratio of net non-performing assets to net worth fell to 20 per cent at the end of the quarter ended June from 14.5 per cent a year ago. For state-run banks, the decline in credit quality was steeper — the bad loan ratio was 4.2 per cent, while the ratio of non-performing assets to net worth was 28 per cent at the end of June this year.

“Asset quality challenges will remain a central issue for the Indian banking sector. Our meetings with managements gave us little confidence that we are past the worst of the cycle...Problems continue across a broad range of industries...On a sector basis, loans in the iron & steel, aviation, jewellry, real estate and telecom sectors have experienced higher levels of stress in this cycle,” Vishal Mahtani, research analyst with Bank of America Merrill Lynch, wrote in a note to clients in July.

With several companies requesting lenders to restructure existing bank debts, the problem compounded further. The number of cases approved by the corporate debt restructuring cell rose from 184 at the end of March 2009 to 415 at the end of June this year.

The value of loans proposed to be restructured was estimated at Rs 2,250,279 crore (Rs 22,502.79 billion) at the end of the June 2013 quarter, against Rs 86,536 crore (Rs 865.36 billion) at the end of March 2009.

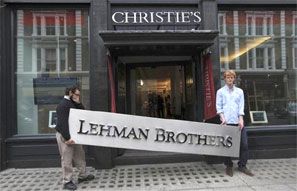

Image: Christie's employees pose for a photograph with a Lehman Brothers sign. ' Photograph: Andrew Winning/Reuters