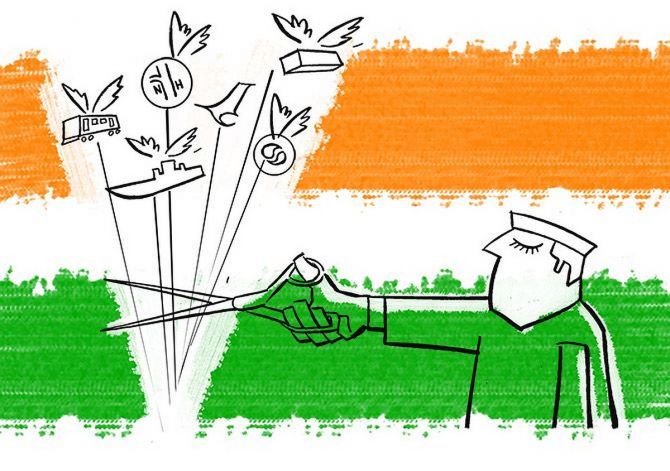

India will miss its revised divestment target for the second time in the past eight years by a wide margin, as the government may not be able to raise an expected over Rs 60,000 crore from the IPO of insurance behemoth LIC in 2021-22.

Since the Modi government came to power in 2014, it was only in the financial year 2019-20 that it failed to achieve the revised CPSE divestment target of Rs 65,000 crore. The mop-up during the year was only Rs 50,304 crore.

In the ongoing financial year 2021-22, the government was all set to go ahead with the share sale of Life Insurance Corporation (LIC) this month and draft papers for the same were also filed with markets regulator Sebi.

However, the Russia-Ukraine war has severely impacted the stock markets forcing the government to rethink about the timing of the IPO.

If the IPO fails to hit the market by March 31, the government will stare at a huge shortfall in the divestment mop-up.

So far, the government has collected Rs 12,400 crore and was banking on LIC IPO to achieve the revised target of Rs 78,000 crore.

But for the financial year 2019-20, the government has invariably exceeded the Revised Estimates of the divestment proceeds.

In 2015-16, the actual mop-up was Rs 42,132 crore as against RE of Rs 25,313 crore. Similarly, in the financial year 2017-18, the government had set a record of sorts by raising over Rs 1 lakh crore, which was nearly the same as was mentioned in the RE.

As regard the current financial year, the government has raised Rs 12,434 crore so far, including Rs 2,700 crore from Air India sale and Rs 3,994 crore from sale of SUUTI stake in Axis Bank.