Global spirits giant Diageo has said it may not be able to fully recover a loan of $135 million given to Vijay Mallya-affiliated Watson Ltd by Standard Chartered Bank where it had acted as a guarantor in case it is asked to pay up.

Global spirits giant Diageo has said it may not be able to fully recover a loan of $135 million given to Vijay Mallya-affiliated Watson Ltd by Standard Chartered Bank where it had acted as a guarantor in case it is asked to pay up.

The world's largest spirits maker, Diageo, which acquired control of United Spirits (USL) in 2012, had issued a guarantee to Standard Chartered Bank for a $135 million (around Rs 900 crore) loan to Watson to release certain USL shares that were to be acquired as part of the deal.

The company said the risk had arisen due to default by Watson in May and Debt Recovery Tribunal (DRT) in Bengaluru preventing sale or any other transfer of such UBL shares in June as part of the enforcement process pending further orders following petition by a consortium of banks led by State Bank of India.

"Standard Chartered is required to take certain pre-agreed steps to recover from Watson prior to calling on the Diageo Holdings Netherlands BV (DHN) guarantee...

In the event that DHN makes any payment under the guarantee, DHN would intend to pursue claims under these indemnities to seek to recover any outstanding amount," Diageo said in its annual report of 2015.

The company said the underlying security held by Standard Chartered includes shares in United Breweries Ltd (UBL) and Watson's interest in a venture that owns the Force India Formula One (F1) team. "Under the terms of the guarantee, there are arrangements to pass on to DHN the benefit of the security package if it makes a payment under the guarantee of all amounts owed to Standard Chartered," it added. However, in June 2015, a consortium of banks led by State Bank of India obtained an order from DRT preventing the sale or any other transfer of such UBL shares as part of the enforcement process pending further orders.

Flagging concerns that the company may not fully recover the amount, Diageo said: "In light of the litigation risk associated with the UBL shares and the potential loss of realisable value of the F1 security during enforcement, Diageo believes that the outstanding amount may not be fully recoverable.

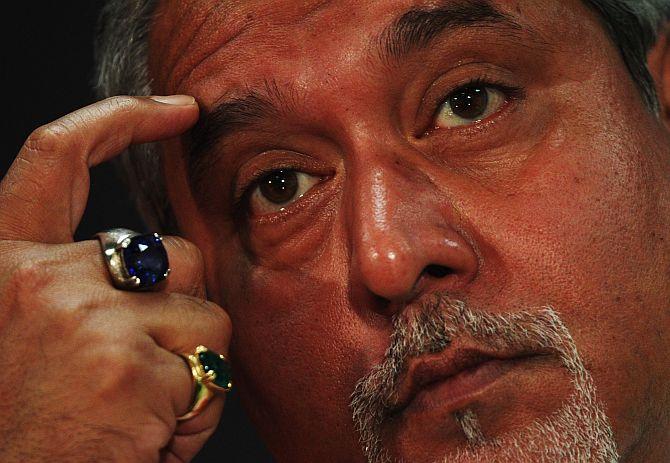

Mallya has been battling a number of cases, including against banks over a 'willful defaulter' tag related to loan defaults by the now-defunct Kingfisher Airlines.