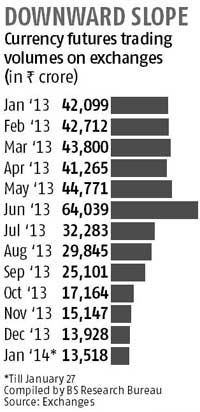

Exchange-traded currency futures volume down 80% since Jun

The Securities and Exchange Board of India (Sebi) is awaiting the Reserve Bank of India (RBI)’s nod to lift the curbs on exchange-based currency futures trading.

The Securities and Exchange Board of India (Sebi) is awaiting the Reserve Bank of India (RBI)’s nod to lift the curbs on exchange-based currency futures trading.

In July 2013, Sebi and RBI had imposed curbs such as doubling of margin requirement and a ceiling on position limits on exchange-traded currency derivatives.

That, coupled with other regulatory changes directed at stemming the slide in the rupee, led to a fall of about 80 per cent in currency derivatives market volumes since June.

“We are looking to roll back some of the limits we had imposed last year. Currency derivative volumes have declined,” said a Sebi official.

Typically, market players use currency derivatives, or the over-the-counter market, to hedge their forex exposure. Currently, four stock exchanges offer trading in currency derivatives between two currency pairs such as rupee-dollar or rupee-yen.

The combined monthly turnover of currency derivatives at these exchanges has fallen to about Rs 14,000 crore (Rs 140 billion) (December 2013 and January 2014) from its peak of Rs 64,039 crore (Rs 640.39 billion) in June 2013.

The exchange-traded currency derivatives market is jointly governed by Sebi and RBI; while the central bank is the regulatory authority for forex trading Sebi regulates stock exchanges and the exchange-traded currency futures market.

In July 2013, both the regulators had asked exchanges to double the margin requirement for rupee-dollar trades in currency derivatives.

They had also capped the position limit at a lower value between $10 million, or six per cent of the total open interest, for individuals and $50 million, or 15 per cent of the open interest, for trading members.

Sources have said Sebi wants the position limits raised to a “higher” value.

“If the position limits are increased, volumes on exchanges will start to move up again. It will help in better price discovery,” said Anil Kumar Bansali, vice-president (risk advisory), Mecklai Financial. “The benefit of trading on exchanges is you can hedge without an underlying, but for OTC, you need to have an underlying.”

However, Manis Thanawala, director, Greenback Forex, says, “The restrictions on OTC trades were volume boosters for currency futures in the first half of last year.

Earlier this month, RBI rolled back some of the curbs on OTC trades. Participants are now happy to trade on OTC, a far more vibrant and liquid market. Therefore, it will be difficult for exchanges to go back to peak volumes.”

Experts said RBI might relax curbs on currency derivatives after it was fully conceived the rupee was stable.. The rupee, which had dropped to a low of 68.83/dollar in August-end, has recovered sharply. Now, it is trading around 63 levels.

.jpg)