B

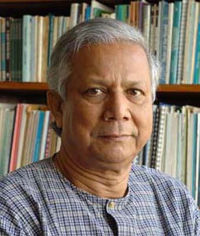

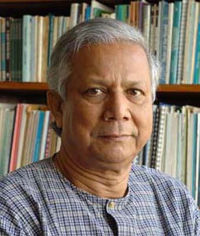

Bangladesh's High Court on Tuesday upheld the sacking of Nobel Peace laureate Muhammad Yunus as head of the pioneering Grameen Bank he founded nearly three decades ago, holding he has been continuing in his job with "no legal basis".

"The MD of the Grameen Bank is an official who cannot hold the office for an unlimited period. He has been continuing in his job with no legal basis," the High Court said in its judgement that came as a major setback to 70-year-old Yunus who is locked in a biter clash with authorities.

The two-bench headed by Justice Momtaz Uddin Ahmed in its order said the petitions by Yunus, an outspoken government critic, challenging the legality of last week's Central Bank order removing him as Managing Director of the pioneering microfinance bank "are rejected".

It delivered a lengthy judgement after three days of hearing on his appeal.

"Also, the managing director is an officer of the bank, and the mandatory retirement age for bank officers is 60, so he has also exceeded his retirement age long ago," he said, adding it was "crystal clear" that the order to remove Yunus from his post as managing director was legal.

One of Yunus' lawyers Sara Hossain said the veteran banker will appeal to the apex Appellate Division of the Supreme Court through a provisional leave petition.

Hossain was quoted as saying that they will be taking an appeal forward and it could be as early as Wednesday.

The bench, which included Gobinda Chandra Thakur, said that despite being a mandatory provision, the permission of the Bangladesh Bank was not obtained when the Grameen Bank Board appointed Yunus as the executive chief of the bank, which Yunus founded in 1983.

At the crowded courtroom, Yunus was represented by only Hossain, who said "what we had apprehended appeared true".

Attorney General Mahbubey Alam and the Central Bank lawyers, however, were present as the judgement was passed.

Yunus had defied government order removing him from his position at the Grameen Bank, returning to work and filing the petition in the High Court against his dismissal.

The government said he was working in violation of the country's retirement laws.

He has alleged that the government was trying to take control of the pioneering micro lending agency, which provides small loans to the poor.

Yunus has long had strained relations with Prime Minister Sheikh Hasina and has charged that the government is seeking political advantage by controlling Grameen Bank, which was fuelling a boom in such lending across the developing world.

Hasina has accused Grameen Bank and other microfinance institutions of charging high interest rates and "sucking blood from the poor borrowers".

She was reportedly angered by Yunus' 2007 attempt to form his own political party, backed by the country's powerful army.

Yunus won the Nobel Prize in 2006.

Grameen Bank, which is 25 per cent state-owned and employs 24,000 people, provides collateral-free loans to eight million borrowers, the vast majority from rural areas.

© Copyright 2024 PTI. All rights reserved. Republication or redistribution of PTI content, including by framing or similar means, is expressly prohibited without the prior written consent.

Bangladesh's High Court on Tuesday upheld the sacking of Nobel Peace laureate Muhammad Yunus as head of the pioneering Grameen Bank he founded nearly three decades ago, holding he has been continuing in his job with "no legal basis".

Bangladesh's High Court on Tuesday upheld the sacking of Nobel Peace laureate Muhammad Yunus as head of the pioneering Grameen Bank he founded nearly three decades ago, holding he has been continuing in his job with "no legal basis".