| « Back to article | Print this article |

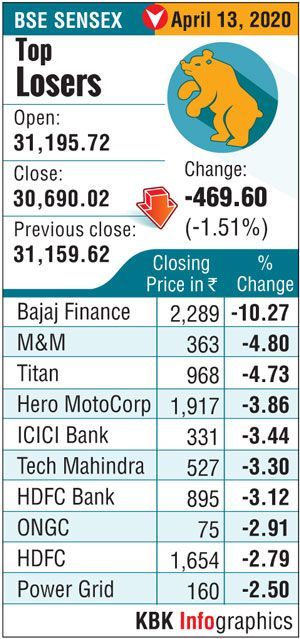

Bajaj Finance was the top laggard in the Sensex pack, slumping over 10 per cent, followed by M&M, Titan, Hero MotoCorp, ICICI Bank and Tech Mahindra.

On the other hand, L&T, Bharti Airtel, IndusInd Bank, UltraTech Cements and NTPC were among the gainers.

Equity benchmark Sensex on Monday tumbled about 470 points, dragged by losses mainly in index heavyweights HDFC twins, RIL and ICICI Bank as investors weighed the possibility of national lockdown extension amid mounting COVID-19 cases in the country.

After hitting a low of 30,474.15 during the day, the 30-share BSE barometer ended 469.60 points or 1.51 per cent lower at 30,690.02.

Similarly, the NSE Nifty dropped 118.05 points or 1.30 per cent to 8,993.85.

Bajaj Finance was the top laggard in the Sensex pack, slumping over 10 per cent, followed by M&M, Titan, Hero MotoCorp, ICICI Bank and Tech Mahindra.

Bajaj Finance was the top laggard in the Sensex pack, slumping over 10 per cent, followed by M&M, Titan, Hero MotoCorp, ICICI Bank and Tech Mahindra.

On the other hand, L&T, Bharti Airtel, IndusInd Bank, UltraTech Cements and NTPC were among the gainers.

Sensex heavyweights HDFC twins fell as much as 3.12 per cent, while Reliance Industries shed 2.46 per cent.

ICICI Bank dropped 3.44 per cent.

Indian bourses opened on a negative note tracking subdued global market peers in Asia, said Narendra Solanki, head- Equity Research (Fundamental), Anand Rathi.

"Sentiments remained downbeat due to rise in COVID-19 cases in the country and fears of extended lockdown weighed in which led sell-off and short-term profit booking in most financial services and bank stocks," he noted.

The markets remained volatile ahead of release of CPI data later in the day, he added.

Elsewhere in Asia, bourses in Shanghai, Tokyo and Seoul ended significantly lower.

Stock exchanges in Europe remained closed for 'Easter Monday'.

Meanwhile, the rupee provisionally settled for the day on a flat note at 76.27 against the US dollar.

Brent crude futures, the global oil benchmark, fell 2.06 per cent to $30.83 per barrel.

The commodity had rallied earlier in the day after Opec producers dominated by Saudi Arabia and allies, and Russia thrashed out a compromise deal on Sunday to cut production by nearly 10 million barrels per day from May.

Photograph: Danish Siddiqui/Reuters