| « Back to article | Print this article |

With the government asking the companies to operate with only 50 per cent staff strength, and exports dipping to almost zero, the truck and bus drivers idling at the petrol pump say they hardly have any work now.

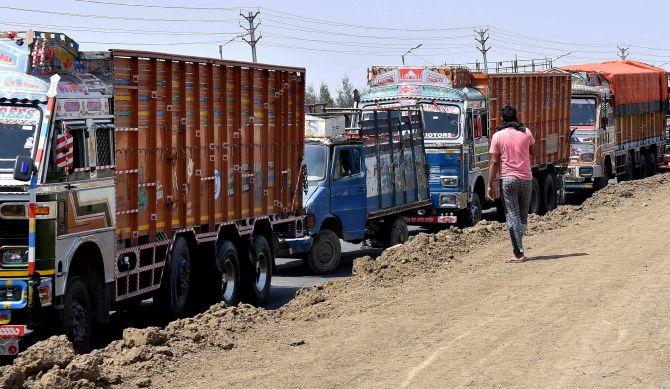

At a petrol pump on the deserted Bavla-Changodar highway near Ahmedabad in Gujarat, several trucks and buses are neatly parked in a row.

Some of the drivers are taking a nap, while some others play Ludo on their mobile phones, even as they maintain physical distance from each other.

The highway cuts across one of the busiest pharmaceutical hubs in the country.

But that was before the nationwide lockdown to battle the coronavirus pandemic came into force.

Today, the hub, which consists of big, mid-sized and small pharma companies, wears a desolate look.

With the government asking the companies to operate with only 50 per cent staff strength, and exports dipping to almost zero, the truck and bus drivers idling at the petrol pump say they hardly have any work now.

“The number of trucks plying here have fallen by more than 70 per cent.

"This is because exports are almost at a standstill and the pharma companies are now catering only to the domestic market.

"Raw material from other states are also not coming as often as they used to,” says Kalubhai Damor, a driver for one of the big companies in the pharma Special Economic Zone (SEZ) in Changodar.

Kamlesh Prajapati, who operates a commercial tempo for pick-up and delivery of goods for companies like Zydus Cadila and Intas, says his weekly trips have fallen from three to one.

Transportation has been hit also because the number of drivers has dwindled.

Prakash Singal, who usually delivers metal parts for auto companies, is now serving pharma companies since his colleague got stuck in the village when the lockdown began.

Pharma companies say that they are doing the best they can under the circumstances.

“All our plants are functional to ensure that the essential requirements are met.

"We are taking all precautions as per the government and Indian Pharmaceutical Association guidelines.

"The plants are operating with minimal manpower to prevent overcrowding.

"Wherever possible, we are ensuring the delivery of medicines to the stockists.

"One of the initial challenges we faced was the availability of drivers and loaders, but things have improved gradually,” says KVR Sarma, vice-president and head-supply chain, at Cadila Pharmaceuticals Ltd (Zydus Cadila).

Though the pharma industry is coping with the lockdown by focusing on the domestic market, the sourcing of raw materials has become an issue.

As Vijay Shah, member of the Committee of Administration (CoA) at Pharmaceutical Export Promotion Council (Pharmexcil), points out, “Flights and ports are closed and workers are not available.

"Transportation is not fully operational and hence, sourcing of raw materials, such as active pharmaceutical ingredients (API), has become very difficult.”

Shah, who also runs a small drug firm called Stallion Laboratories Pvt. Ltd, goes on to add that though there are warehouses in Bhiwandi and other areas of Mumbai which stock API, it is not able to move beyond state borders.

While mid-sized companies like Lincoln Pharmaceuticals Ltd. have a decent inventory of API that could last the duration of the lockdown, smaller ones like Stallion are concerned about depleting resources.

“The government has been making efforts, but because of the lack of workers and hiccups in supply logistics, our API stock of 45 days could get exhausted soon,” says Shah.

Viranchi Shah, chairman, Gujarat, Indian Drugs Manufacturers' Association (IDMA), says that pharma companies are trying to adapt to the new reality of almost zero exports.

"Challenges such as non-availability of ample workers as well as international logistics remain.

"Gujarat is one of the leading pharma export hubs globally.

"But since airports and ports are shut and freighter cargo movement is almost at a standstill, production capabilities have been shifted from exports to the domestic market,” says Shah of IDMA.

For instance, Lincoln Pharma, which manufactures oral solid doses (OSDs) and parenterals (drugs administered via infusion or injection) largely for markets in the African countries, has quickly adapted itself to serve the domestic market.

The company is running on a 70 per cent capacity utilisation since the beginning of the lockdown at its plant at Khatraj, which is otherwise capable of making 150 million OSDs, seven million injectables and 1-1.2 million liquid oral doses per month.

“The drugs we manufacture, including paracetamol and azithromycin, are needed in the domestic market.

"Hence, production has not been impacted even as we take the necessary precautions of engaging only 50 per cent staff and ensuring thorough screening and sanitisation of personnel, vehicles and premises.

"We also have an API inventory of over one month, which is sufficient for now,” says Sanjay J Bhatt, general manager, operations and plant head, at Lincoln Pharma.

The pharma industry has been trying to resolve the issues that the companies are facing.

In a letter to the minister of commerce and industries, industry body Pharmexcil has written that several of its members are reporting cancellation of orders.

“India is being replaced by other countries like Brazil, China, Turkey and some other countries in East Asia.

"Member companies are facing considerable problems in bringing their import shipments from airports and ports to their warehouses.

"The imports are essential raw materials for manufacturing essential products/medical devices to fight Covid-19,” the letter states.

Pharmexcil has also requested that the lockdown be lifted in the case of factories engaged in exports, since foreign buyers have started cancelling orders and switching to competing countries.

Moreover, in its letter to the Governor of the Reserve Bank of India, Pharmexcil has stated that its roughly 3500 member companies, that generate a turnover of $50 billion, are seeking an extension of six months for making payments to the banks against the letters of credit for exports.

“This is very urgently needed on account of the huge disruption which has been created all over the world on account of Covid-19,” states Pharmexcil’s letter to the central bank.

Photograph: PTI Photo