Assuming the government sells the entire stake, it will be the country's largest capital market transaction ever, notes Una Galani.

Assuming the government sells the entire stake, it will be the country's largest capital market transaction ever, notes Una Galani.

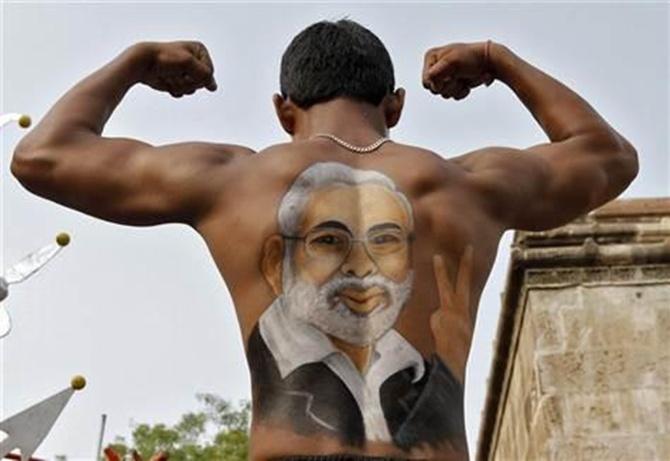

A lumbering, state-controlled monopoly is about to test the Indian stock market's 'Modi Mania'.

The government is selling a stake in Coal India worth around $3.7 billion to meet its fiscal deficit target.

A pledge to ramp up domestic coal production makes it easier to lure investors. Still, the placing will set the tone for a stock market that has rallied by one quarter following the election of Prime Minister Narendra Modi last year.

The sale of up to 10 percent of Coal India at a maximum 4.5 percent discount to the closing price on Jan. 29 is a big deal to swallow.

Assuming the government sells the entire stake, it will be the country's largest capital market transaction ever.

The proceeds will be equivalent to more than a third of the entire amount raised through initial public offerings, follow-on issues, and convertible bonds in India last year, according to Thomson One.

In spite of its inefficiencies, Coal India has some attractive qualities. Low-cost mines allow it to easily cover its capital expenditure and pay chunky dividends even though the company is obliged to sell the bulk of its production below global prices, which are currently near multi-year lows. That's likely to be the case even if the sector is opened up to more competition.

Modi's promise to provide round-the-clock energy to the entire population is also already having a positive effect.

Coal India's production grew 7.3 percent in the nine months to the December, compared with a 1.6 percent annual average growth rate for the past five years, according to Ambit.

A successful sale that attracts a broad range of domestic and international private-sector investors will give a confidence boost to the many deals in-waiting.

The government is expected to offer shares in Oil and Natural Gas Corporation and power producer NHPC worth a further $3 billion before the end of March.

Elsewhere, State Bank of India is seeking to raise around $2.4 billion and Tata Motors wants to raise $1.2 billion.

An uptick in initial public offerings is also expected. Coal India will test the market's willingness to absorb the unusually large pipeline.

The author is a Reuters Breakingviews columnist. The opinions expressed are her own.