| « Back to article | Print this article |

The passage of the Bankruptcy Code could set the stage for other important legislation that may see India undergo more economic change than all governments combined since the reforms implemented by P V Narasimha Rao in 1991-93, says Ben Merton.

It's been a long time since I bumped into my old friend, Simon Long, at Colombo airport in 2004.

It's been a long time since I bumped into my old friend, Simon Long, at Colombo airport in 2004.

At the time, he was the India bureau head for The Economist magazine.

Both of us had figured out that the best-timed flight connections to London from India were via Sri Lanka, not to mention the Rs 200 foot massages in the mildewed reclining armchairs under the escalators.

At the time, he was working on what was to be the last of The Economist's India vs China surveys.

I had moved to India almost a year before and was filled with youthful optimism. Why were they stopping it?

"Because China has won [duh]," came the answer. "At least for the time being. Maybe we'll relook at it in 10 years or so."

Twelve years later, while the state of India's connectivity from modernised airports has visibly improved, the India vs China gap has widened by a greater margin.

China has its own section in The Economist; India is still a footnote.

During the intervening period, I witnessed the dramatic Indian growth spurt of 2003-2009 which, while surpassed by China, was impressive indeed.

Real estate values, in particular, rose by an order of magnitude, taking a whole generation of relatively poor urban Indian landowners, and imposing upon them a new global standard of wealth.

Along with the real estate boom, other areas grew: information technology exports, pharmaceuticals, textiles and renewables, to name but a few.

With this growth came lending at an unprecedented scale for a country of India's size, but the economic reforms required to sustain the momentum just stopped while successive Congress governments atrophied.

In 2009, I wrote an article about India's bankruptcy problems.

For over six years nothing has changed, except I myself acquired a distressed manufacturing company, got married and had a child. And lots more grey hair.

In the intervening period, the atrophy turned to outright poison.

Like many other domestic businessmen, I had to face the humiliation of trying to encourage investment in a country during the dark days of Pranab Mukherjee's retrospective taxation initiatives.

Change was still not a certainty at that time, and every businessman I knew was affected by a sense of perpetual doom.

While there were high hopes in the business community in the lead-up and immediate aftermath of the Bharatiya Janata Party's general election victory, many of us had become increasingly sceptical about the possibility of any meaningful reforms, largely due to painful exchanges of political spite and one-upmanship as the various Bills made their way through Parliament.

And then suddenly last week, our Sleeping Pachyderm opened its eyes, stumbled to its feet and bellowed a fanfare of change: The Bankruptcy Act passed in both Houses, replacing earlier laws governing insolvency from 1909 and 1920.

This will likely have been missed by most people in India (and around the world); an ignored news alert at best.

But you just can't ignore the magnitude of this change.

Since I wrote my original article on India's bankruptcy laws in 2009, non-performing assets on India's balance sheet have doubled to 11 per cent, and the dollar value is now estimated to be around $170 billion.

This is hugely significant for any economy, even one estimated to be worth $2 trillion overall.

Clearing this mess up could put two per cent back on to Indian gross domestic product (GDP) growth alone in the next three to five years.

On the ground, this translates into two major advances: First, the Bankruptcy Code provides a method for banks and other creditors to force the restructuring and/or liquidation of companies that don't pay.

Second, it addresses the fact that there is currently no clean legal mechanism for a business to close down, meaning that business owners often face no choice but to continue operating broken companies and incurring more losses.

And this is just one of the reforms lined up to get on India's statute books before the next general election.

Next up is the Goods and Services Tax, which will (hopefully) reduce my monthly torture of paying excise duty, cess on excise, education cess, value-added tax, service tax, Octroi and entry taxes into one nationwide indirect tax.

The impact of this itself is estimated to add another two per cent to India's GDP.

If the government manages to pull off only these two reforms, it will have achieved more economic change in a few short years than all governments put together since P V Narasimha Rao's reforms of 1991-93.

But we also have reforms to land purchasing to make it easier to buy land for infrastructure and industrial projects, labour reforms to overhaul the stifling Labour Act of 1947, subsidy reforms to wean the country off its 21 per cent spending on fuel, fertiliser and food, along with divestments in bloated, dysfunctional state-run assets.

Is this a new beginning for India's beleaguered economic growth story?

There is still a long way to go; India is filled to the brim with great laws and execution train wrecks, not to mention that the impact of these changes will still take several years to work their way through to tangible GDP growth.

But while I will still have to plan the route carefully to my factory to ensure we take partners and investors over the least potholes, at least I won't feel like I am selling them a hopeless economic lemon.

Don't look now, Simon, but the India vs China story may yet need to be rehabilitated in the coming decade.

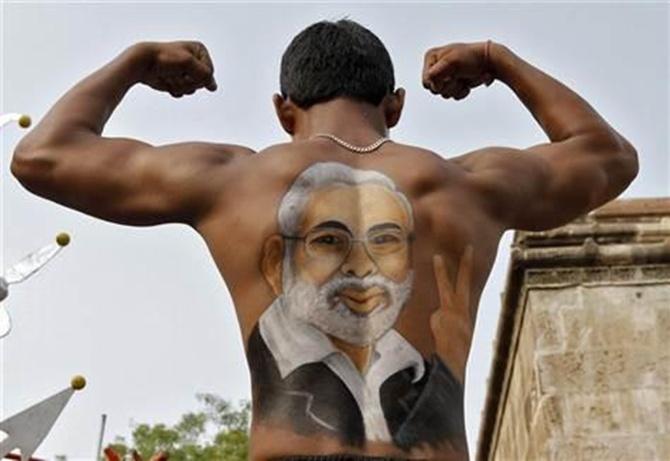

Photograph: Reuters

The author is the managing director of Algypug Enclosures, and a principal of Pugilistic Capital.