Chinese automakers Great Wall Motors, FAW Haima Automobile, and Changan Automobile, after dithering about entering India for some years, have been encouraged by the robust sales performance of the late entrants Kia Motors and MG Motors even in a slowing market.

The worst slump in car sales in two decades has not discouraged global carmakers from entering the Indian market.

Two years after SAIC-owned MG Motors and Hyundai's affiliate Kia Motors established a presence here and tasted reasonable success, a clutch of automakers from China such as Great Wall Motors, FAW Haima Automobile, and Changan Automobile are set to firm up their India strategy.

All three have confirmed their participation in the biennial Auto Expo in the first week of February.

Besides these companies, a few other automakers from China, including Geely and Chery Automobile, are also working out a market entry strategy but their plans, say those who are familiar with them, are less advanced.

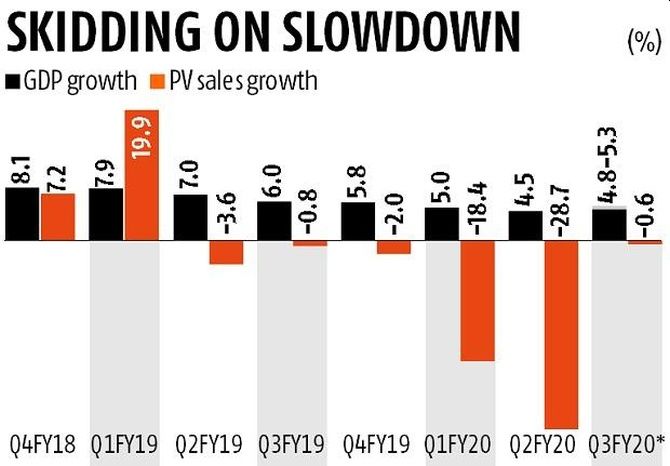

The new brands are driving in at a time when the market has been hit by a slowdown in consumption and anaemic economic growth.

Passenger vehicle sales have been declining for six quarters in a row. Annual sales fell to the lowest in 20 years in 2019.

They are also coming when India's 78-year-old automobile industry is on the cusp of transformation amid regulatory changes in emissions, safety and fuel efficiency, and a higher internet penetration, which is fuelling connected and shared mobility trends.

"These new trends will work to their advantage," said Puneet Gupta, associate vice-president at IHS Markit, a sales forecasting and market research firm.

"Unlike existing firms, new players do not come with any baggage and therefore will be more agile and in sync with the latest changes such as the government's thrust on electric vehicles."

If anything, Chinese automakers, after dithering about entering India for some years, have been encouraged by the robust sales performance of the late entrants Kia Motors and MG Motors even in a slowing market.

Take Kia, for instance. The Korean carmaker got into the market with the Seltos in August 2019 and captured a 6.23 per cent share in the SUV market in four months.

Similarly, MG Motors, which sells the Hector brand in the premium SUV segment, entered the market in June 2019 and cornered 2.20 per cent in the six months up to December, according to the Society of Indian Automobile Manufacturers.

The gains for the new players have come at the cost of the incumbents, namely Maruti Suzuki India, Tata Motors, Mahindra and Mahindra (M&M), among others.

M&M, which till recently used to be the leader in the SUV segment, has seen its market share plunge to a record low of 20.14 per cent in the first nine months of the ongoing financial year.

The new players have also nibbled into the share of Maruti, Tata Motors, and Honda Cars.

Gupta expects a further shake-up in the market share as more brands enter and the latest entrants populate their line-up with new offers.

While Kia will showcase four new models, MG is expected to have 14 models on display at the upcoming auto show.

This phenomenon of new entrants gaining market share is a departure from the past.

Cornering a 5 per cent share in any segment of the passenger vehicle market still remains an aspiration for a clutch of European carmakers who came to India in the mid-2000s.

What are the latest players doing that's enabled them to capture a significant share in the very first year of operations?

"A combination of right products and pricing. They have all chosen to enter the market with an SUV which has been relatively resilient to the slowdown compared to cars," replied Kaushik Madhavan, vice-president (mobility) at Frost & Sullivan.

While passenger car sales in the December quarter of fiscal 2019-20 declined 9 per cent year-on-year, UVs advanced at a brisk 23 per cent in the same period.

According to Madhavan, the sharp focus by MG and Kia on technology and connectivity has also proved popular with millennials.

In addition, as Gupta notes, a high internet penetration has ensured that, unlike in the past, new players no longer have to sweat over "playing catch up with the market leaders" who boast a large distribution footprint.