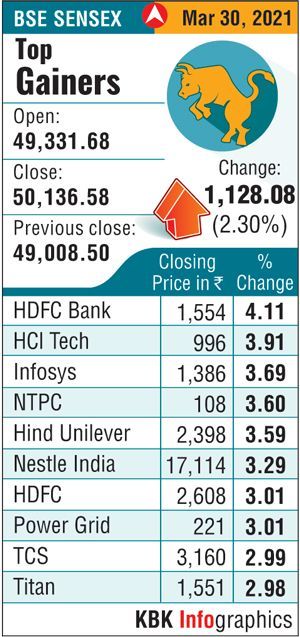

HCL Tech was the top gainer in the Sensex pack, rising over 4 per cent, followed by HDFC Bank, Infosys, NTPC, Nestle India, TCS and HUL.

NSE Nifty surged 337.80 points to 14,845.10.

Benchmark Sensex rallied by 1,128 points -- its biggest single-day gain in nearly two months -- to close at a two-week high on Tuesday as financials, IT and energy stocks advanced amid positive global cues.

Extending its gains to the second consecutive session, the 30-share BSE index ended 1,128.08 points or 2.30 per cent higher at 50,136.58 - a level not seen since March 16.

The broader NSE Nifty also logged its biggest single-day spike since February 2 to settle at a nearly two-week high of 14,845.10, showing gains of 337.80 points or 2.33 per cent.

As many as 46 of its constituents closed in the green.

"Domestic equities rebounded sharply today mainly led by strong buying in IT, metals, pharma and FMCG stocks. Barring realty, most of the key sectoral indices ended in the green today," Binod Modi, head - strategy at Reliance Securities, said.

Favourable cues from global markets also supported domestic rally despite the prevailing concern of sharp rise in COVID-19 cases in various parts of the country, he added.

HDFC Bank was the lead gainer among Sensex stocks, rising by 4.11 per cent. HCL Tech rose by 3.91 per cent, Infosys by 3.69 per cent and NTPC by 3.6 per cent.

Gains in Nestle India, HDFC, PowerGrid, TCS, HUL, Reliance and ICICI Bank also supported the rally.

On the other hand, M&M, Bharti Airtel and Axis Bank were the laggards.

"Markets opened firm on strong global cues with Joe Biden slated to announce his $3 trillion Infra Package.

“Investors shrugged off the rising coronavirus cases in few states as the GOI prepares for a vaccine rollout on a larger scale.

“Steel & IT stocks led the bull charge while FMCG stocks joined the party in late afternoon trade as the Sensex scaled past 50k," S Ranganathan, head of research at LKP Securities, said.

All sectoral indices ended on a positive note with BSE IT, teck, metal, healthcare, FMCG, basic materials and finance indices rallying up to 3.51 per cent.

All sectoral indices ended on a positive note with BSE IT, teck, metal, healthcare, FMCG, basic materials and finance indices rallying up to 3.51 per cent.

Broader midcap and smallcap indices surged up to 1.30 per cent.

Abhishek Chinchalkar, CMT charterholder and head of education, FYERS said that Indian markets have extended their recovery for a second session, boosted by strength across the board.

Global cues have been supportive of the rally since Friday, with both US and European markets advancing to life-time highs, he added.

Elsewhere in Asia, bourses in Shanghai, Hong Kong, Tokyo and Seoul ended on a positive note.

The rupee slumped by 87 paise to close at nearly a one-month low of 73.38 against the US currency.

“Except for today's depreciation, the INR has remained quite steady even though the dollar index rose.

“Also when the US 10-year bond yields have spiked sharply India's 10-year bond yield has remained quite stable.

“These two factors could act in India's favour and help Indian equities outperform its peers in the emerging markets,” said Rusmik Oza, executive vice president, head of fundamental research at Kotak Securities.

The recent correction could be due to rising COVID-19 cases and the year-end phenomenon wherein retail and HNI investors would have avoided taking any fresh positions, he said, adding that the start of new settlement for FY22 and forthcoming Q4 earnings seasons could be the reasons for fresh investor interest in stocks.

“US markets, especially the Dow Jones and S&P 500 are showing firm uptrend due to the ongoing stimulus and faster vaccination drive which could also be one of the reasons for our markets to inch upwards,” Oza noted.