| « Back to article | Print this article |

India's budget disappointed foreign investors on Thursday by failing to deliver a much anticipated cut in withholding taxes for debt investments and creating confusion with a proposal that appeared to target tax treaties. Several measures for foreign investors were unveiled for the 2013-14 fiscal year starting in April, including simplifying a cumbersome registration process and allowing investments in corporate bonds and government securities to be used as collateral to meet margin requirements.

Several measures for foreign investors were unveiled for the 2013-14 fiscal year starting in April, including simplifying a cumbersome registration process and allowing investments in corporate bonds and government securities to be used as collateral to meet margin requirements.

However, the measures on their own were seen as unlikely to significantly boost foreign inflows at a time when India needs capital flows to plug a current account deficit that hit a record high in the quarter ended in September.

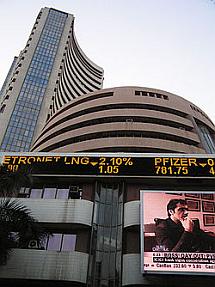

Indian shares were hit in part by concerns about the impact of the budget on foreign investors, with the benchmark BSE index ending down 1.5 percent.

"Easing the registration process for foreign investors is a facilitator, but the game changer would have been a withholding tax cut across the board, which would have helped the current account deficit and the development of the onshore debt market," said Jayesh Mehta, Managing Director and Country Treasurer at Bank of America.

The main announcement for foreign investors was the simplification of the complicated "Know Your Customer" rules.

Finance Minister P. Chidambaram, who met foreign investors last month as part of a roadshow, said the country would consolidate the current system of mandating different registration rules for different types of investors.

However, the government did not announce a cut in the withholding tax imposed on income from government and corporate debt investments and deducted at source that can now reach up to 20 percent.

The government also created confusion with a proposal stating a tax residency certificate "shall be necessary but not a sufficient condition" to take advantage of double taxation avoidance agreements, according to the Finance Bill that was part of the 2013-14 budget.

Tax authorities had previously considered this tax residency