| « Back to article | Print this article |

The FM could scrap the secrecy around tax rates and exempt the tax dept from revenue collection targets, notes A K Bhattacharya.

It is not often recognised that compared to Congress-led governments, those run by the Bharatiya Janata Party (BJP) have always shown greater innovation and fresh thinking on the manner in which Budgets are prepared and presented to Parliament.

The Congress governments have been relatively more tradition-bound and have followed the conventions more sincerely than their BJP counterparts.

It took a BJP-led government to discard an old convention of presenting the Budget at 5 pm in Parliament.

On February 27, 1999, Yashwant Sinha, finance minister of the Atal Bihari Vajpayee government, stood up in the Lok Sabha and said: "For the first time after Independence with the enthusiastic support of all political parties in Parliament, it has been possible for me to discard the long-standing tradition of the British Raj of presenting the Budget at 5 pm."

That was the first Budget of independent India when the finance minister rose in the Lok Sabha at around noon, instead of 5 pm as was the practice till then.

It was obviously a legacy of the British raj and no finance minister in those 52 years had thought of discarding that practice and presenting the Budget at what obviously was a more reasonable time of the day.

It was again the BJP-led government of Vajpayee that speeded up the process of Budget scrutiny by departmentally related Standing Committees of Parliament. It had been acknowledged by all governments that the system of oversight and scrutiny of Budget documents needed to be revamped.

Proposals of a large number of central ministries would not get discussed by Parliament because of shortage of time. The BJP-led government took a big initiative in this area in 1999.

Thus, the number of departmental committees of Parliament for examining the Budget proposals of different ministries went up from 17 at the start of the 13th Lok Sabha in 1999 to 24 when its term came to an end.

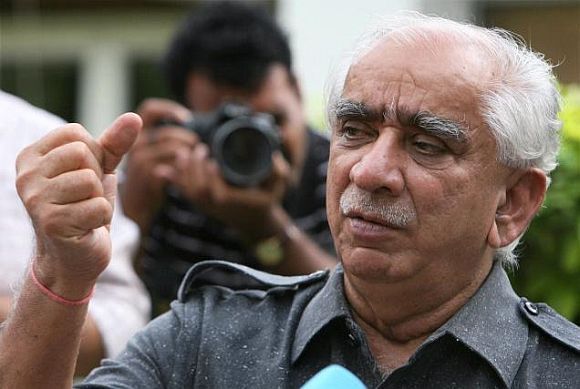

Jaswant Singh, who became finance minister in the last couple of years of the Vajpayee government, also left his own mark on the way Budget documents were presented. He abolished the system of presenting the Budget speech in two separate documents - one was called Part A of the speech and the other was called Part B of the speech.

Part A of the speech document contained broad policy formulations, Plan and non-Plan schemes and the government's overall expenditure programmes with their outlays.

And Part B of the speech document contained specific proposals for direct and indirect tax changes, ending with the government's fiscal deficit number. Singh merged the two documents into one, a modification all successive finance ministers have followed since then.

Finance Minister Arun Jaitley presented his first Budget for the Union government on July 10, 2014. There was, however, no innovation in the manner in which he presented the Budget.

He followed the same format his immediate predecessor had laid down. Will his second Budget, to be presented later this month, have some innovations?

That looks unlikely. But since he is going to present a few more Budgets in the remaining term of the government, he could consider introducing two specific changes that could be implemented in phases over the next three years.

One, the secrecy around what tax rates the Budget would propose should be scrapped.

For several years, both direct and indirect tax rates have by and large, reached a stable level and have moved within a narrow band.

Why can't the proposed tax rates be made public as part of a consultation paper for about a month and then the finance ministry finalises what the rates should be and presents them in the Budget?

Secrecy around tax proposals results in excessive lobbying and often rules out a more open debate on what the tax rates ought to be.

Two, tax departments should not be subjected to the revenue collection targets set in the Budget, as it gives rise to coercive behaviour from the taxman that often results in an adversarial relationship between the revenue department and the taxpayer. Budgeted goals for tax collection are likely to change in keeping with the pace of economic activity.

But if the tax department is forced to meet those targets, fixed well before the year begins, taxpayers are likely to be the victim of aggressive tax collection efforts.

It is, therefore, important to segregate the department that frames tax policy from those who collect the taxes and follow a more flexible and rolling tax collection target.

Both the changes will require major adjustments and internal consultations before they can be implemented.

But a start can be made with some internal consultation on such changes within the finance ministry.