| « Back to article | Print this article |

Markets were in green on Tuesday, following the Union Budget on Friday and positive cues from US markets.

Markets were in green on Tuesday, following the Union Budget on Friday and positive cues from US markets.

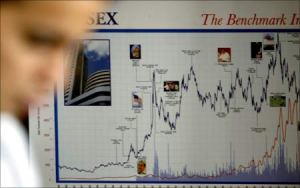

The Nifty crossed the 5,000 mark after January 25 and touched a high of 5,5,029. The index finally ended at 5,017 - up 95 points.

The Sensex ended at 16,773 - up 343 points after touching a high of 16,808.

Most of the sectoral indices were in the green. The auto sector jumped 4.7% to 7,510, along with metal (4%), bankex (2.5%) and FMCG (2.2%).

However, the realty sector showed signs of weakness in morning trades. Oil & gas index ended with marginal gains after Prime Minister Manmohan Singh said there might not be any roll back on fuel prices.

The BSE market breadth was positive through the day. Out of 2,901stocks traded, 2,059 advanced while 768 declined.

The biggest beneficiaries were the infrastructure, steel and cement. These sectors surged in trades today.

Nagarjuna Construction gained 1.5% to Rs 156. IRB Infrastructure added 2.2% to Rs 258. Sensex stock, Larsen & Toubro was up 1% at Rs 1,582. MSK Projects (India) jumped 4.5% while Subhash Projects and Gammon Infrastructure advanced over 1% each.

Among steel stocks - Tata Steel surged 6% to Rs 609. SAIL was up 3% at Rs 225. Sesa Goa added 4.4% to Rs 418. Sensex stocks - Sterlite and Hindalco were up 3-4% each. Nalco gained marginally.

Cement stocks also added. ACC rallied 4.3% to Rs 963. Jaiprakash Associates added 3.4% to Rs 137. Ambuja Cements, India Cement and Ultratech Cement also ended in green.

Oil Marketing Companies fell after the restoration of basic custom duty of 5% on crude petroleum and 7.5% for petrol and diesel.

HPCL and BPCL dropped 2.5% each to Rs 339 and Rs 541, respectively. IOC was down 1.8% at Rs 312.

The day belonged to Tata Motors which soared 12% to Rs 797. Among Sensex heavyweights, ICICI Bank surged 2.9% to Rs 898. Reliance was up marginally at Rs 983. Infosys added 1.4% to Rs 2,640.