| « Back to article | Print this article |

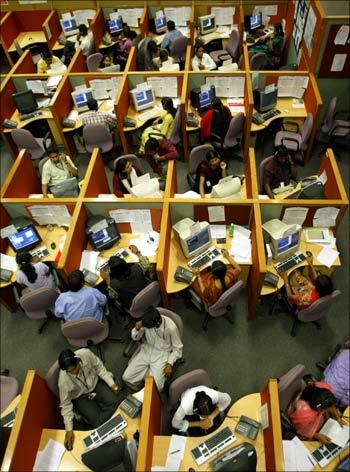

Kerala Finance Minister T M Thomas Issac on Friday announced that the government would take measures to create one lakh (100,000) job opportunities for the IT sector in the state.

Kerala Finance Minister T M Thomas Issac on Friday announced that the government would take measures to create one lakh (100,000) job opportunities for the IT sector in the state.

He also said that the Smart City project would be implemented in two stages at the Infopark and an amount of Rs 50 crore (Rs 500 million) has been sanctioned for the first year, the minister said.

The minister also said that the Kannur airport would be implemented in the manner of Cochin International Airport with public-private participation. The government will have 26% equity in the project.

Kerala budget taxes liquor, proposes sops for tourism

The Kerala government's budget for 2010-11 also proposed to extend the ambit of welfare schemes like employment guarantee and food subsidy, reduce taxes on tourism, beer and wine and impose fresh ones on direct to home services and jewellery shop owners.

While continuing with most of the schemes under the Rs 10,000-crore (Rs 100 billion) stimulus package unveiled last year during the slowdown, Isaac in his budget announced fresh sops for the crisis-hit tourism sector by slashing the luxury tax.

Luxury tax on tourism, a major revenue earner, was brought down to 7.5 per cent and 12.5 per cent in different categories from 10 per cent and 15 per cent.

Among other highlights of the budget are the extension of the Rs 2-per-kg-rice scheme to labourers of the unorganized sector from June and the employment guarantee scheme to the urban areas. The government has earmarked Rs 500 crore (Rs 5 billion) for the food subsidy plan that will benefit about 3.5 million families.

Possibly with an eye on the assembly polls next year, the budget also left VAT rates untouched but proposed a 10 per cent hike in tax on liquor other than beer and wine.

The budget, showing a cumulative deficit of Rs 577.09 crore (Rs 5.77 billion), also sharply brought down the stamp duty on registration of real estate property as a sop to recession-hit construction sector.

Stating that Kerala cannot get rid of the revenue deficit by 2014-15 as suggested by the 13th Finance Commission, Issac said it would be Rs 3,629.55 crore (Rs 36.295 billion) for the year, about 11.64 per cent of the state's revenue.

Tax on beer and wine was slashed by 10 per cent, but that on other liquors was increased by 10 per cent.

The budget also sought to rationalise stamp duty and increased lifetime tax to 8 per cent for new motor cars and omni buses for private use, where engine capacity is 1500 cc and above.

A lifetime tax of 6 per cent ad valorem on all types of construction equipment vehicles was also imposed.

As the steep rise in gold prices had not been adequately reflected in the compounded tax, the budget re-fixed tax rates increase payable by the Jewellery shop owners.

Direct to Home service was brought under the tax net, with a levy of one per cent tax on gross charges paid by customers.

To protect small-scale cable TV operators, it exempted those having less than 5,000 connections from luxury tax.

The minister also sanctioned Rs 412 crore (Rs 4.12 billion) for heavy industries, Rs 240 crore (Rs 2.40 billion) for small and traditional sectors, agriculture projects would get Rs 622 crore (Rs 6.22 billion), the grand Kerala Shopping Festival will get Rs 25 crore (Rs 250 million) and the coconut development project will receive Rs 30 crore (Rs 300 million).

Additional inputs: PTI