| « Back to article | Print this article |

The number of companies reporting a decline in earnings has been shrinking over five to six quarters. For the quarter ended March as well, the expectations are high and the Street is hoping the number will shrink.

The number of companies reporting a decline in earnings has been shrinking over five to six quarters. For the quarter ended March as well, the expectations are high and the Street is hoping the number will shrink.

A rising number is also reporting a turn in their performance. In the March quarter, the Street will be looking to companies that investors believe will return to profits.

"Though the pace of improvement is slow but things are improving as the number of companies reporting a decline in earnings has over a few quarters come down.

Some stressed sectors and companies have been able to manage their finances as a result of cost rationalisation and other initiatives," said Phani Sekhar, a fund manager at Angel Broking.

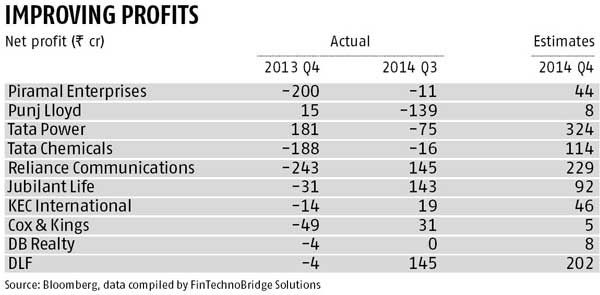

According to Bloomberg data, the consensus estimates for the quarter ended March showed there were quite a few expected to return to profits after a loss a quarter or year ago.

Many belong to capex-led sectors like power, capital goods, real estate and construction. Tata Power is expected to do well. Punj Lloyd, Piramal Enterprises, Tata Chemicals and Tata Power had losses in the December quarter.

Tata Power is expected to return to profits as analysts are factoring in a higher dividend from its global coal subsidiary and marginally higher realisations in the coal business, along with the benefit of stability in the exchange rates.

Also, recovery of dues and benefit from compensatory rate for its Mundra ultra mega power project is expected to drive the company into profit in the quarter.

Also, recovery of dues and benefit from compensatory rate for its Mundra ultra mega power project is expected to drive the company into profit in the quarter.

In the capital goods space, Punj Lloyd and KEC International could be in limelight for the expected turnround as analysts are factoring in improvement in execution, gains from cost control and lower proportion of low-margin orders. KEC, which reported a loss of Rs 14 crore (Rs 140 million) in last year’s quarter, is expected to make a profit of Rs 46 crore (Rs 460 million) in the March quarter.

This will be largely driven by higher execution leading to strong growth in revenues. This will help the company achieve 200-300-basis-point improvement in operating profit margins. To an extent, the margin gains will also be aided by the depletion in low margins orders.

In the real estate space, because of the positive impact of Aman Resorts sale transaction and its exit from the insurance business, DLF is estimated to report a net profit of Rs 202 crore (Rs 2 billion) against the loss of Rs 5 crore (Rs 50 million) a year ago. The insurance business of the company is estimated to be making an annual loss of Rs 120-130 crore ( Rs 1.2-1.3 billion), hurting consolidated profits.

In the telecom segment, Reliance Communications (RCom) could see profits against the adjusted loss of Rs 243.4 crore (Rs 2.43 billion)last year. RCom, DLF and KEC are among the few companies that will see an increase in profits compared to the December quarter. Backed by two-three per cent expected growth in revenues, with expansion in operating profit margins and control on interest costs, RCom is expected to report a net profit of Rs 228 crore (Rs 2.28 billion) for the March quarter.

Jubilant Life Sciences, backed by strong growth in the life science ingredient segment, is expected to see a good rise in revenues. This will help the company to improve margins, leading to gains at the net profit level. The Street is expecting the company to make Rs 92 crore (Rs 920 million) of profits against a loss of Rs 31 crore (Rs 310 million) a year ago.