'India's economy is growing faster compared to the developed economies of the world.'

'More importantly, it is growing faster compared to most of the developing economies.'

'The monsoon is not the only thing that drives the rural economy and certainly not the national economy.'

'It is too simplistic to reduce everything to the monsoon.'

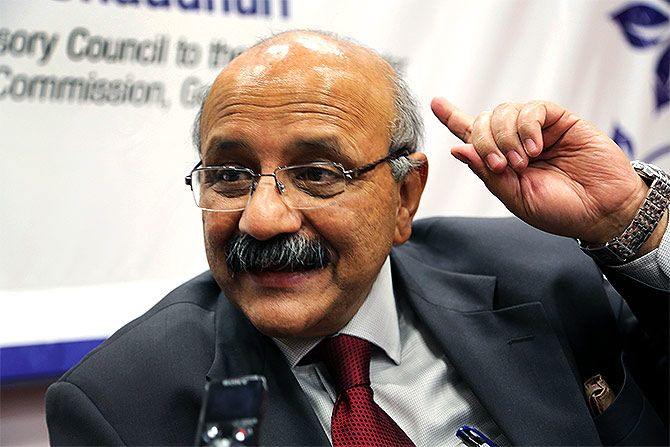

When Rediff.com interviewed Saumitra Chaudhuri, a former member of the Economic Advisory Council to the prime minister and a former Planning Commission member, in March, he had made the following comment on the Gross Domestic Product growth rate, "There is a problem with the numbers. We have numbers from a new data series and we also have numbers from the old data series. The kind of energy, growth and positivity we associate with 7.0-7.5 per cent growth in the past is certainly not there today. Maybe you are talking about two different kinds (of growth)."

As the world looks wonderously at the 7.6 per cent growth rate that India claims, Dr Chaudhuri speaks again to Shobha Warrier/Rediff.com about why there is something wrong with the figure and with the current economic scenario.

In March when I interviewed you, you said there was a problem with the growth figures. At that time, China was talking about India manipulating growth numbers. Now many other countries and rating agencies are also suspicious about the number.

One always relates economic growth with many other obvious economic activities. There is a correlation between economic activities and the growth rate though it is not a one-to-one correlation.

You talk about a growth rate of 7.6 per cent for the financial year 2016. We have seen 7.5 to 7.6 per cent growth in the past also, but the conditions today do not seem to be the same as what we saw in those years.

In fact, the conditions do not seem to be anything like that. Yes, a few items like cars are doing well -- the domestic sale of cars is up strongly, showing close to 8 per cent growth -- but the sale of motorcycles is down to marginally negative growth. Therefore, what you see is a mixed bag.

Generally speaking, when you have a national economic growth that is in the region of 7.6 per cent, one would have expected stronger parameters in many things -- but that is not the case today. That is why there is a doubt about the figures.

At the end of the day, it's not just an arbitrary measure; it's a measure that aggregates the level of economic activity in diverse fields.

People do not feel any exuberance, industry is sluggish and you see only a high number. What do you think is the different data series the government must have used?

The Central Statistical Organisation has created a new data series using 2011-2012 as the new base year -- a change from the earlier series which used 2004-2005 as the base year.

Shifting of the base year might have made a small difference; that difference should have been only about ½ per cent… like 7 per cent growth becoming 6.5 per cent or 7.5 per cent. But what we are seeing right now is larger than just ½ per cent.

Many foreign analysts feel the same though they don't say so explicitly. When in doubt, people become conservative.

I know that, when they developed strong doubts about China's growth rate, many foreign analysts told me China was growing at 1 per cent and not 6.5 per cent. When in grave doubt, one can sometimes become unrealistic. When you don't know something, you assume the worst. That's part of the problem.

The additional data the CSO has come out with to explain the figures has not been convincing. That's why many say one must use the same methodology for the previous years too, maybe from 2004-2005 onwards. But, so far, the CSO has not done that. Perhaps they may not have the data sources used in the current series for previous years.

If you look at the figures from 2004-2005 to 2011-2012, the growth rate was 8.0 to 8.9 per cent; we know what kind of economic activity happened then.

There was buoyancy in the market...

There was buoyancy everywhere. Now, you see no such buoyancy and that causes the discomfort.

Do you think somebody is fudging the data?

I don't think anybody is consciously doing that. There is a problem in constructing the data series and the sources they have used have not always been the wisest. They are stuck with the number now.

The Economic Survey predicted 8 per cent growth for the next year, but not many are buying it.

Many analysts and commentators have taken a different view. They ask, 'What is the deflator being used?' Even the finance ministry's mid-year report asked the same question. But that is not the whole issue.

When you talk about constant prices, you are basically looking at a quantity index in contrast with the current price data, which is the product of the quantity index and the price index.

At constant prices, you keep the price component out and you are only looking at the quantity part of it. When the quantity index does not correlate with other quantity indices and broad physical parameters, we have a problem.

I remember the legendary Professor B S Minhas, who was an architect of our statistical system and institutions, telling me privately, 'Chaudhuri, why are you wasting your time calculating implicit GDP deflators? In India, we calculate the constant prices series first and then compute the current prices data series.'

That was in response to a presentation where I had displayed computed implicit GDP deflators. Maybe that was the wiser course!

Another criticism is that India uses the wholesale price index, which has been declining due to lower commodity prices.

Oil prices are one component in the wholesale price. You always calculate the wholesale price index minus the oil price.

As a matter of fact, the wholesale prices of diesel and gasoline have not decreased to the extent of crude oil prices partly because of higher taxes and cesses and partly because the rupee has weakened.

The wholesale price inflation is at a low level, but it has not fallen as much as crude oil prices have internationally.

Is there anything wrong in using the wholesale price index?

There is nothing wrong in using wholesale price index because it is far more robust. It is a far more tried and tested system. It is much more standardised.

Most importantly, the weights used in the wholesale price index are the weights used in the national accounts statistics index. So, it reflects the economy as a whole.

I am much more comfortable with the wholesale price index than with the consumer price index. The CPI of garments shows a positive of 3 to 5 per cent inflation in the last two years, but the WPI is negative.

If you ask any garment manufacturing company, he will tell you garment prices are falling. Almost all of them are selling at hefty discounts -- just look at the signage in the shops.

But people say retail prices are going up...

People say all sorts of things. They only remember when the prices go up; they don't remember when the prices come down.

Yes, the prices of certain food items like dal have gone up. It doesn't mean the prices of all items have gone up.

On the other hand, the prices of many manufacturing items like textiles, garments, leather goods and steel items have come down.

That is why I say the WPI is strong and robust but the CPI is not quite so. In the end, inflationary trends seem to be satisfactorily explained through the WPI.

Finally, check the latest GDP numbers and you will find that the current price growth is much lower than the constant price growth rate not only for manufacturing sector, but also for trade, hotels, restaurants, transportation and communication and for real estate, financial and professional services.

For the former, the current price growth is 6.6 per cent and the constant price growth 9.0 per cent; for the latter, it is 7.4 per cent and 10.3 per cent respectively. That means that according to the CSO's GDP estimate, inflation was significantly negative in both these service sectors.

Then what, it may be asked, is the CPI measuring when it reports 5 per cent and 6 per cent inflation?

Incidentally, these two sectors account for as much as 36 per cent of the GDP and the effect of the implicit negative inflation evident in the current and constant price data in the GDP has a powerful effect on boosting the overall rate of GDP growth.

But if the GDP estimates are right, the CPI cannot be. If the CPI is correct, I am afraid it puts the GDP under a cloud. Of course, both could be wrong; however, both can't be right.

Some rating agencies say that, when GDP growth rates are taken, they do not take the kirana stores which account for 5 per cent of India's GDP...

They are wrong. The kirana stores are very much there. Even your plumber and scooter repairman are included.

Despite the fact that the exports down, manufacturing is down, bank credit to industries is down, don't you think the Indian economy is growing?

It is growing faster compared to the rest of the world. It is growing compared to the developed economies of the world. More importantly, it is growing faster compared to most of the developing economies.

Even if the growth rate figure was 6.6 per cent, it would have been more than everybody else.

At the end of the day, whatever reservation or problem you have with the 7.6 per cent figure, India's growth rate is higher than most countries, all large economies, excepting for maybe a couple of small countries.

So there is no need to quarrel about the accuracy of the number?

There is a need to quarrel about the number. Suppose you are driving a car and you do not know at what speed you are driving, it is going to create problems for you.

If the car doesn't show whether the speed is 100 kms or 50 kms per hour, you have to take it to the workshop. You will not be able to operate a machine if you do not know at what speed it is going, or what temperature the engine has reached.

Similarly, how will you run an economy if you do not know the correct growth figure? You cannot have andaz (approximate) figures.

When you want to manage an economy, you have to react to signals. How will you react to signals when you have question marks in front of all signals?

There is a problem in some changes the CSO has made to the methodology of the GDP estimation. Only they can fix the problem.

Numbers apart, for the economy to grow, what does the government have to do?

For that, many things must come together.

The government has to improve domestic consumption demand, step up consumer and business confidence and increase employment and livelihood.

We have a classic case of weak domestic demand. Unless domestic demand improves, investment will not pick up.

There are a multitude of issues causing a weak demand, starting from sluggish agriculture due to drought to the risk aversion amongst both banks and borrowers.

With the prediction of an above normal monsoon, do you expect domestic demand to go up and more economic activities?

It will certainly help.

There will be some improvement, especially in rain-dependent areas. It will only solve a part of the problem, not in entirety.

The monsoon is not the only thing that drives the rural economy and certainly not the national economy. It is too simplistic to reduce everything to the monsoon. There are many other things that are critically relevant too.

But the Indian economy is doing better than most other economies of the world and it is not facing any problem as such. After all, the energy of the youth is driving the economy.

When the world economy is not doing that well now, can India do well?

A high tide lifts all the boats. When the global economy does well, we also will do well without doing much.

But the real test is when the rest of the world does not do well. In 2008, we did not sink. In 2009, we managed to do well when the world suffered. So, there is hope that, in this period also, we will continue to do well.