'The probability of this being a suckers' rally, where all kinds of beaten down stocks have begun to rally sharply, should be a time to be cautious and circumspect.'

'It doesn't mean that this rally will not continue; it can continue.'

'It is like if there are dark clouds outside you take out your umbrella and go.'

'It may not rain, but take your umbrella.'

'Don't be foolish and get drenched.'

"You should definitely take some money off the table. At least lock up and take home 20-25 per cent of your gains," ace investor Shankar Sharma tells Prasanna D Zore/Rediff.com in a typically enlightening interview.

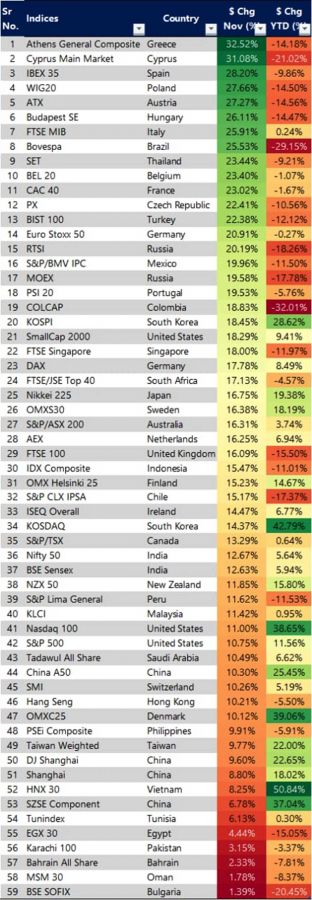

In the table that you tweeted India's Nifty 50 is at the 36th place with November gains of 12.67 per cent and year-to-date (YTD) gains of 5.64 per cent.

How do you look at India's returns matrix compared to other emerging market peers?

If you look at China, Taiwan, or (South) Korea, which are broadly India's peers, India has done far, far worse than these markets; it has done a little better than Brazil and Russia. So, with the emerging markets (EMs) India is in a middling kind of situation.

Overall, if you look at global markets, India is nowhere on the map this year. And this +5 per cent happened only because of Nifty's 12 per cent rally in in the last 40-45 days (of October and November).

If you go to October India was at minus 4 per cent. That is nothing to write home about; India has been a very average market for many years now, not just 2020.

Some stocks might have done well here and there but that's true of every other market. You will always find handful of stocks in every country going up substantially.

In fact, even in 2019 India was among the worst (performing market) in the world. It just returned 8 per cent in 2019. In comparison, Brazil was up about 30 per cent and Russia was up about 48 per cent (in 2019).

Do you see this poor run continuing in Indian markets compared to its global peers?

I think overall the EMs are going to do better in the coming year. To that extent India, being part of the EM pack, will also benefit because. Within this pack India is right there in the middle, it is neither the best nor the worst.

India should give similar returns as the emerging market index. Let's say if EMs deliver 15 per cent in 2021, then India will also deliver the same returns, plus or minus two per cent.

If you look at the Nifty 50 performance since March 2020 lows, it has skyrocketed almost 70 per cent from there. What explains this V-shaped jump?

The problem with Indians is that they only look at India. You have to look at other global markets and then conclude if Nifty has had an extraordinary run or otherwise.

Every market is up 50-70 per cent (since hitting lows in March 2020). What is so special about India then?

What fueled this rally? People were worried about the pandemic; the economy was in the doldrums.

I am repeating myself. Please remove the India lens. India is one market out of 50 markets (where you could make more money), which have done as well, and better, this year. That's not being contrarian. That's just the data talking.

What if you are an Indian solely invested in Indian companies?

If you are only invested in India, then you have a serious asset allocation and diversification problem. India is not the centre of the universe. It's around 2-3% of global market cap.

India and Indian markets will largely mirror a global trend. Except that in the last two years India has done far worse than its global peers.

Since March 2020, it has been following the global trend of a huge rally from April 1 (2020) onwards. There is no extraordinary reason one can attribute to why India jumped 70 per cent since March lows.

The correct comparison is the calendar YTD returns (from January 1, 2020) because from a certain point (say lows of March 2020) you can pick any other point (say November end) and say that this (Indian) market has done better. But that is meaningless.

The correct thing in every market return calculation is to look at the calendar-year return. That is the standard. So, what India has done in this calendar year is nothing worth writing about.

Are the global market rallies fueled just by a glut of liquidity floating around? Or, is there more to this global rally than meets the eye?

I don't think people understand that the global liquidity and all such things are just bakwas (nonsense). These talks are utter rubbish, utter nonsense. I'm surprised how little thinking goes into one's head while making such sweeping statements.

Markets have rallied only for one reason.

The reason is that the pandemic created massive opportunities for certain businesses. It created huge opportunities for pharmaceutical companies, the technology industry, for IT offshoring, remotely operating industries. All the sectors that have done well this year in India, let's say, are the beneficiaries of the pandemic.

(Companies in the) Pharma (sector) have rallied; chemicals have rallied; IT has rallied. Broadly, these three sectors have done the best.

Banks have not done well; they are more or less flat for the year. One can argue that they have rallied from the bottom (of March 2020). In fact they have given negative returns (On January 1, 2020, the Nifty Bank index closed at 32,100 and compared to its December 3 close of 29450 has given negative return) if you look at YTD performance.

But if you look at pharma stocks, many are up five times from their March 2020 lows. Banks have been terrible performers and they logged in huge gains only in October and November.

And it is not just Indian banks (that have out performed), I may also point out. Globally, in the last 45 days all banks have rallied. They have been rallying in China, Europe and the US.

Again there is nothing special about the performance of Indian banks.

In fact, even with this 45-day rally, banks have been terrible performers on a YTD basis.

The only sectors that have done well YTD globally are the sectors that I just mentioned like pharma, chemicals and IT services.

Companies like Infy benefitted because of work from home, their margins have gone up, costs have come down; pharma has been a direct beneficiary of the pandemic; chemicals has benefitted because of the shift away from China.

Reliance has been a big driver, but we all know why Reliance has rallied. So, all the sectors that have rallied in India, and globally, rallied because of very strong fundamental reasons.

This global liquidity glut (being the reason for the rally from March lows) is all nonsense. You can use this word (global liquidity glut) to explain anything.

If we have to attribute every rally to global liquidity then why do we need research analysts?

There is no such thing as global liquidity. As research analysts we have to find out if the markets rallied for any fundamental reasons and if those fundamental reasons are viable and sustainable.

The point I want to make is the rally we have seen (since March 2020) is quite a logical rally.

That is not to say that logical rallies can continue endlessly, but I have not found a more logical bull market in the last 20 years than this one.

This rally can be easily explained, company by company.

In this context, do you see some disconnect between the rally seen in Indian markets and the valuations at which we are trading currently?

Let's be clear about one thing: Valuations in India have always been expensive. So looking at valuations, India is a pointless game. You should never even attempt it. India has always, always been expensive.

India is so starved of good companies and good businesses that whatever little value exists is priced to perfection.

Nowhere in the world does a Lever company (Hindustan Unilever in India compared to other companies owned by the same parent in other countries) trades at these multiples.

Nowhere in the world does a Nestle-type company trade at these multiples.

But they are traded here in India at these (very expensive multiples) whether you like it or not. That's the way they have traded in India for nearly (last) 25-30 years.

India has always been a pricey market. That is one factor.

The second factor is interest rates have come down in India as they have come down globally. Lower interest rates means higher PE (price to earnings) multiples.

So, one can say valuations are expensive, but to be honest I never found India cheap. Never ever has India traded at low PE multiples.

You have been quite cryptic with your tweet about this being a suckers' rally in emerging markets? Would you like to elaborate? Is there more steam left in this suckers' rally?

This is in the context of only the rally we have seen in October-November 2020 where all kind of beaten down, low-grade companies too have been rallying. That they have been rallied because of vaccine hopes or reopening of lockdowns, whatever you may want to call it.

Typically, when such companies rally, one should become circumspect because at the end phase of any bull market, you will start seeing every kind of stock staging big rallies.

In the first phase, all the good companies start rallying. We have seen all the good companies have done very well. But they (the good companies) have not rallied in the last 30-45 days.

What has performed has beaten down banks, beaten down NBFCs, beaten down airlines, all kinds of infra companies.

Now, we have reached a point of caution. And these (rallies) can often turn out to be suckers's rally.

In the markets there is never hundred per cent certainty about anything. We only talk about probabilities.

And the probability of this being a suckers' rally, where all kinds of beaten down stocks have begun to rally sharply, should be a time to be cautious and circumspect.

It doesn't mean that this rally will not continue; it can continue.

It is like if there are dark clouds outside you take out your umbrella and go. It may not rain, but take your umbrella. Don't be foolish and get drenched.

If you were to accumulate global stocks, including some from India, in your portfolio for the next five-ten years, which sectors and companies would find prime of a place?

If you are building a global portfolio, (asset allocation for) India should typically be between two and four per cent (of your portfolio).

Out there globally, there are thousands of great companies, so why restrict yourself to just 25-30 handful companies from India?

We own a number of excellent companies in our India PMS (Portfolio Management Services, which is up nearly 30% calendar year to date), but we own twice the number globally in our Global Funds, simply because there is such a massive list of great big and small companies to choose from.

And it's because of this selection, that our Global Fund is up 34% calendar year to date, beating vaunted rivals such as Bridgewater and Renaissance.

The world (markets) is a very large playground and if you are investing globally, then India's allocation should not be more than two to four per cent.

Globally, you are spoilt for choice. India is not the be all and end all of everything (of investing or place to find great companies).

India is just two per cent of the world market cap (capitalisation). 98 per cent of the world market is still available for your play and only then (if you invest in good companies globally) you are going to make tons of money, with far lower SCCARS (Single Country Single Currency Single Asset Risks)

What would be those companies or sectors you would pick for your global portfolio?

There are electric vehicle companies in China, consumer companies in Japan, tech companies in Taiwan and South Korea, banks in Russia and Brazil, and consumer companies in the UK and Switzerland.

No great companies in India?

There are 25-30-40 good-very good companies in India, but that cannot be the be all and end all investing. Why restrict yourself by having just India in your asset pie chart?

What would be your advice to those investors who were lucky enough to have bought companies when they were crashing all around in February and March 2020 and are sitting on good profits today?

You should definitely take some money off the table. At least lock up and take home 20-25 per cent of your gains.