'One of the biggest employment generators, the MSMEs, have not got much from the government.'

The ruling party says Budget 2023 will trigger growth, address unemployment and zoom India to Amrut Kaal.

But many economists do not agree with the rosy picture painted by the finance minister.

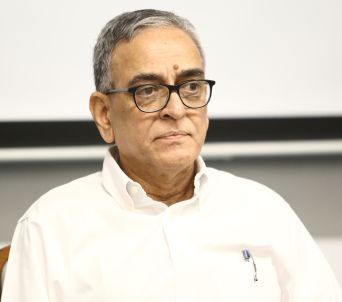

One such economist is Professor R Nagaraj, professor at the Indira Gandhi Institute of Development Research, Mumbai.

"MNREGA was a very effective means of creating productive employment and productive assets in the rural areas. But the government has made a 35% cut in government funding," Professor Nagaraj tells Rediff.com's Shobha Warrier in the concluding segment of a two-part interview:

Do you feel FDI leaving the country will happen again because of the general global gloomy scenario?

I think so.

I would say from 2010, India got derailed because the GDP growth rate came down, savings came down and investment rate also came down.

The government is refusing to acknowledge these macro aggregates.

The government is quite happy that we have been able to overcome the covid crisis.

I credit the government for the economy recovering quickly.

Yes, 2022-2023 is also a recovery period, especially for domestic services.

But what about the decline in the growth rate over the decade which we have not addressed so far? This is the point I want to highlight.

Supporters of the Budget say that capex will restart investment and the growth cycle which has been stagnant for quite some time.

Do you think private players will be confident and the investment cycle will restart?

I wish it comes through. But I am not very hopeful. That is because there is enormous uncertainty in the private sector.

The global situation is still very uncertain. Of course, it is not as bad as it was six months ago.

Everybody is waiting and watching. Nobody is making investments.

This is where public investment has to play the role of giving confidence to the private sector.

If there is massive public investment, the private sector will gain some confidence. Otherwise, they will wait and watch.

Do you feel the Rs 7.5 lakh crore capex which the finance minister is talking about is not adequate enough to instil confidence in the private sector?

I wish we knew how much the real capital formation is. What we see are just numbers. Unless they announce concrete plans, I am not very sure.

For example, in the case of the Railways, they say they have increased investment seven times from 2013-2014.

But it is just an absolute number. We do not know how much increase is there in the percentage of GDP.

The question is, where do you invest in the Railways? Are you going to invest in beautifying railway stations? That is not going to add to productivity.

Unless you invest in rolling stock, in modernising your railway track, your efficiency in the Railways will not go up.

The man who created the Vande Bharat Express, Sudhanshu Mani gave a very good interview to you in which he clearly said, Vande Bharat trains would not run at its optimal speed if your rail track was poor.

It means unless you make the right kind of investment in rolling stock, there will not be any additional growth.

You mean, unless the government says specifically where it is going to invest and not just give a vague number like Rs 7.5 lakh crores, the announcement will not instil confidence in the private players?

Yes. I did not see many details in the Budget. If they had announced a dozen or half a dozen big projects, with a committed time frame and clear budgetary allocation, it would give confidence.

But one headline number without any details, will not bring in any confidence.

One criticism against the Budget was that it did not touch upon unemployment at all. But they say, because of capex, they expect the investment cycle to start and with that, employment generation too...

The fact is, the Budget has not touched upon unemployment at all. And unemployment is acute in rural areas.

And the government investment in rural areas has declined.

MNREGA was a very effective means of creating productive employment and productive assets in the rural areas.

But the government has made a 35% cut in government funding.

The government says its borrowing from the market has not increased.

It means the total expenditure of the government has not increased.

What they have done is, shifted money from one scheme to another.

They cut money from MNREGA and put money in capex, and says it will do wonders.

I am not so sure. I wish I am wrong, and the government's claim is true.

Will this take care of the decade-long poor investment rate which I talked about in the beginning? I have my doubts.

One of the biggest employment generators, the MSMEs, have not got much from the government, too.

Why the UPA could manage 7%-8% growth was because they were clearer about investments.

There were problems with that growth, and I am not denying that. But growth was happening.

You mean, this government is more vague than specific?

Absolutely. They are more interested in getting brownie points when for a decade, growth rates have declined. Also, the growth rate is far lower than the official growth rate.

Feature Presentation: Aslam Hunani/Rediff.com