| « Back to article | Print this article |

'Demonetisation, is in principal, a mistake, because it involves a theft -- a taking of private property by the State.'

'It is one of those bad Indian ideas that has been tried twice in the past, with two failures for the record books.'

'This cloud over the economy will probably remain as long as Modi is in power.'

Johns Hopkins University Professor of applied economics Steve Hanke does not mince his words. Or dilute views even while offering advice.

He might be talking about a national currency. Or one of the world's economies. A reputed financial institution. Or a global leader. His brusque verdict will often tear them to shreds.

Samples: 'The Achilles' heels of (developing) countries are their crummy little central banks. They basically make everyone poor.'

Or: 'Even though I refuse to get up close and personal with economists, they know that I hold all, but a few, in contempt and that I believe that economics has been in decline for decades.'

Or: 'Unofficially, the world is dollarised. You go to Mexico or Russia and you find that everybody's using greenbacks. They don't need some damned economist or pedagogue explaining the problem with central banks. (All statements from an interview to Johns Hopkins Magazine.)

His no-holds-barred judgements and successes working on high-profile assignments, naturally attract strong reverse criticism from his detractors and doubters who may not see eye to eye with him.

Professor Hanke has been dismissed as an 'obscure economist,' 'economic snake-oil salesman' and 'the Rasputin of the rupiah', among other assessments.

As director of the Troubled Currencies Project, a collaboration project between Johns Hopkins University and the Washington, DC think-tank, the Cato Institute, Professor Hanke is just the person to ask about demonetisation and where the rupee is headed.

He has already tweeted about it at @steve_hanke. While very promptly answering queries from Rediff.com's Vaihayasi Pande Daniel, he is vigorous in his views.

Yes, he doesn't mince words.

It is these kinds of opinions and no-nonsense financial expertise that has taken Hanke, "and Mrs Hanke" (who he says he consults religiously), sprinting impatiently around the globe on several lively international adventures: Advising presidents, prime ministers, ministers of emerging economies.

Setting up new currency regimes for nations with troubled or new currencies. Studying hyperinflation; another area of mastery where he says he has worked on 26 of the 56 cases of this grave economic affliction.

He has colourful vignettes to recount from each trip; the most fantastic being how his economy strategy advice to the president of the seceding Montenegro led then Yugoslav president Slobodan Milošević to put out a warning on him for being 'a French secret agent who controlled a hit-team code-named Pauk (spider)' and a potential assassin.

Your tweets were very interesting. What led you to tweet about India's demonetisation?

There are many reasons why I tweeted on demonetisation.

If I listed all of them, which I will refrain from doing, I would begin over 50 years ago, when I was a graduate student and developed many close friendships with students from the subcontinent.

Today, they are scattered around India -- from the deep South to Dalhousie (Himachal Pradesh) in the north.

When one has friends in a locale, one is obliged to pay attention, out of courtesy, if nothing else. (Hanke has made a personal visit to India, but not on work.)

But, in the case of India, there are other reasons. It's a big, important country, and of particular interest to an economist, who has been engaged in trading commodities, currencies, and securities for over 60 years.

Incidentally, some of that trading activity is noteworthy and of interest, at least for traders.

For example, when I was the president of Toronto Trust Argentina, in Buenos Aires, that mutual fund was the best performing fund in the world.

India is also of interest to me, an economist who has been engaged in designing and implementing currency reforms for over 30 years.

So, that's the general background that explains why I always have an eye on what is going on in India.

For example, I note the gold premium in India each and every day.

As we come down closer to the ground and my tweets on PM Modi's demonetisation, several things are worth mentioning.

The first goes back to a letter my old friend, the late great Daniel Patrick Moynihan, wrote to US President (Richard) Nixon March 21, 1973, a month after Moynihan had assumed his post as the US ambassador to India: 'The Indians have such good brains: if only they didn't have such bad ideas.'

So, in the sphere of economic policy in India, one has to be on guard.

I became particularly alert after Raghuram Rajan resigned as the governor of the Reserve Bank of India.

With Rajan's resignation, I knew there was trouble in paradise.

And sure enough, there was.

Indeed, demonetisation is theft.

And a currency theft, regardless of its form, is always worth commenting on.

Why do you feel demonetisation is a mistake? Why is it perhaps a very poorly thought out move?

Demonetisation, is in principal, a mistake, because it involves a theft -- a taking of private property by the State.

As a practical matter, it is one of those bad Indian ideas that has been tried twice in the past, in India, with two failures for the record books.

It should be noted that the record books are filled with failed demonetisation (theft) programmes.

For example, the bright boys in North Korea engaged in a demonetisation of the won in 2009, and like night follows day, it was a disaster and further fueled an expansion of North Korea's underground economy.

Why do you feel India is facing a contraction? What does this contraction indicate?

If India doesn't engage in some adjustment, will more contractions put India on the brink of a recession?

National income, in nominal terms, is determined by the quantity of money broadly determined.

So, if the Indian government steals money from the pockets of some Indians, it will reduce the money supply, and in consequence, nominal national income will take a hit.

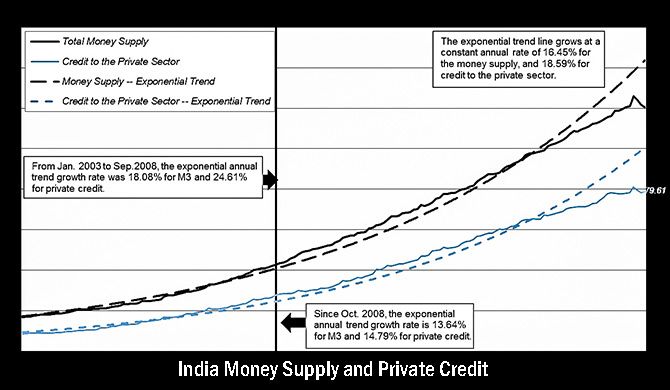

And, as the attached chart shows, money measured by M3 and private credit has taken a hit.

Unless the Reserve Bank can offset the hit caused by the demonetisation theft by filling others' pockets with money, nominal national income will slump.

You tweeted: 'Demonetization will cause #India to slip from the leaders board for economic growth in #2017' Why so?

Was India potentially one of the fastest growing economies before this because of her potential demographic dividend?

How long will it take to get near there again?

And what moves might help her get there?

Unless the Reserve Bank's monetary policies and the policies associated with commercial bank regulation and supervision can be altered, to get broad money and credit to the private sector back on track, slower nominal growth is baked in the cake.

Add to that the fact that demonetisation has resulted in a negative confidence shock.

This cloud over the economy will probably remain as long as PM Modi is in power.

The negative shock to business sentiment is always important, particularly for members of the Cambridge School of Economics, which was founded by Alfred Marshall.

All members concluded that fluctuations in business confidence are the essence of the business cycle.

John Maynard Keynes put great stress on changes in confidence and how they affected consumption and investment patterns.

Frederick Lavington, a Fellow of Emmanuel College and the most orthodox of the Cambridge economists, went even further in his 1922 book, The Trade Cycle.

Lavington concluded that, without a 'tendency for confidence to pass into errors of optimism or pessimism,' there would not be a business cycle.

The monetary and confidence factors might just make for a deadly Indian cocktail.

I have read in several places that demonetisation, as a move in general, for any economy is over-rated. It is said to be unfeasible and always unsuccessful.

As the director of the Troubled Currencies Project, has that always been your view too?

Demonetisation (read: theft) is always "bad."

After all, thieves (unless they are politicians or government officials) usually end up behind bars.

It is also said that Trump's Muslim ban and further immigration policy changes might mean grief for India as it will affect the tech company growth and profits?

President Trump's so-called Muslim ban is a misnomer. It is a country-specific temporary ban. India isn't on the list.

Modi has now re-parcelled demonetisation to make it about driving the Indian economy towards being cashless. Quite a few financial experts have told me that's a very welcome and bold move.

The idea of India going cashless is a bit of a joke.

India has been one of the most cash-intensive economies in the world for many moons.

Whoever believes that India can become cashless in the foreseeable future must believe in the tooth fairy.

Others in the manufacturing sector, like you tweeted, have said it is disastrous and there are no sales. Although they feel the downturn might be temporary.

The slump could be temporary if the Reserve Bank can replace the cash that was stolen, and if magically people start trusting PM Modi and confidence returns.

What can demonetisation do to the rupee?

Demonetisation will do what it's already been doing: it will throw a wet blanket on the rupee, which is a second-rate currency in any case.

Ask any Indian whether they would prefer the rupee or the US dollar in their pockets.

They will not say "Rupee" unless a government official is within earshot.

What are the best moves to fight black money in any economy?

The reason for the massive underground economy and associated black money in India is because of government regulations, a weak rule of law, and uncertain property rights.

This state of affairs will be very hard to change.

The high Brahmins were very influenced by the upper-class British Left in the 1920s and 1930s.

In consequence, socialism and egalitarian principles are enshrined in the Indian Constitution.

That's why the Indian economy is overburdened with regulations and tied up in red tape.

It also explains the hordes of bureaucrats that would tend to drive many productive entrepreneurs either mad or underground.

Just consider the Reserve Bank.

Like all of India's bureaucracies, the Reserve Bank of India is stuffed with -- you guessed it -- worthless bureaucrats.

Indeed, the RBI staff numbers are stunning: A total of 16,671.

To get a handle on this, compare the RBI with the Bank of England staff numbers: 3,868.

The UK's economy is nearly 36% larger (at market prices) than India's, but the RBI carries 4.3 times more staff than does the BE.

Talk about gold-plating and bloat.

If it weren't for make-work created by a web of unneeded banking and financial regulations, and harebrained schemes, like demonetisation of the rupee, the RBI would be filled with redundant workers.

Alas, these make-work programmes keep the troops occupied.

What about the view that one of the biggest policy blunders of the Modi government has been, as an Indian investor told me, is its greed in sequestering the entire gains from the oil price decline and not passing anything to people at all?

This might qualify as a blunder, but if so, not the biggest one.

From the average Indian's point of view, when can we consumers start spending again, without feeling scared?

People are afraid to spend. People are afraid to change jobs in many sectors. People are afraid to travel. Buy cars or real estate.

What would be your advice?

The average Indian can relax if he (or she) has dollars or gold in their pockets.

And if they have bank accounts, the dollar should rule the roost, as it does in Turkey, where over 55 per cent of bank deposits are denominated in dollars.

The verdict is very mixed, both globally and locally, on how Modi will take our country ahead economically after demonetisation.

Apart from demonetisation, does he and his government show signs that he is a good economic custodian of the country and guiding India on the right economic path?

The Modi government has recently floated the idea of giving the majority of Indians $150 to $220 per year, free of charge.

This cash stipend idea is making the rounds in Socialist circles internationally.

It's an old canard straight from the Communist Manifesto.

If implemented, this will deliver a death blow to business confidence in India.

Demonetisation has affected the rural sector badly.

A top Indian investor told me that demonetisation has been responsible for pushing people at the margins into destitution.

And that even if they become less destitute after a year, they will not become productive enough to add to GDP growth.

Can the final outcome be as bad as this do you think?

Demonetisation has hit the rural poor much harder than rich urban residents.

In the future, the rural population will tilt away from the rupee whenever possible.

If Donald Trump is able to make the right start in strengthening the US economy, will it reflect in our economy?

How will it affect FII inflows into India?

Indian policy is the major determinant of direct foreign investment and portfolio inflows into India, not US policy.

One makes his (or her) own bed and has to sleep in it.

The Budget didn't offer any real solutions to perking up the economy after demonetisation. Would you have any thoughts?

Keep your eye on the money supply, not Budget details.

Money matters. It's the money supply that makes the world go around.