| « Back to article | Print this article |

Who is to take their place?

Will a new generation of entrepreneurs start up with better business sense, or at least better luck?

But the so-called unicorns are mostly copy-cat entrepreneurs whose cash flow is funded by overseas (including Chinese) money, notes T N Ninan.

First, there was Prompt Corrective Action for banks.

Now we have it for businessmen.

Anil Ambani's group finds itself in virtual meltdown.

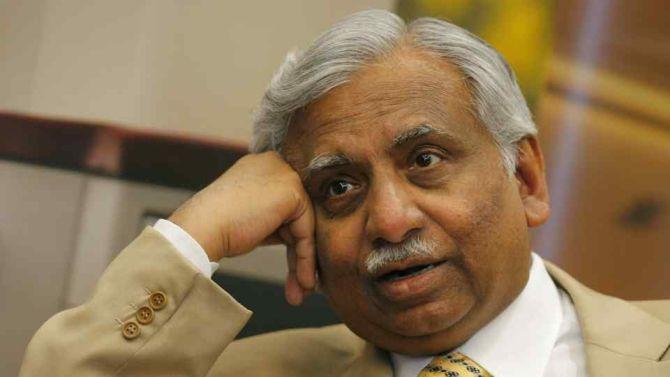

Naresh Goyal is about to lose control of Jet Airways.

Subhash Chandra of Zee is looking for a white knight.

The Ruias have lost one flagship enterprise, and seem set to lose the other.

In Kolkata, the B M Khaitan group is selling tea gardens and has put a company on the block.

In Delhi, the Singh brothers after destroying their Ranbaxy inheritance are destroying each other.

And in London, Vijay Mallya is trying desperately to keep a safe distance from the Arthur Road jail that has been spruced up in his honour.

Meanwhile, the great debt sell-off continues.

Whether it is the airport titans GMR and GVK or financial sector giants like IL&FS and DHFL, or real estate stalwarts like DLF, they are all coping with the problems of past excess.

Other over-ambitious creations of the go-go years, like the Bhushan companies and Lanco, have pretty much disappeared off the map.

Rumours whirl in business circles about still hidden toxicities in the financial sector.

This is a great unraveling.

The simple narrative had been public sector bad, and private sector good.

Public sector still looks bad; consider Air-India, the Rs 48,000 crore (Rs 480 million) to be pumped into government banks (on top of Rs 1.57 trillion already pumped in during just the last two years), and the bail-out that is round the corner for the government's terminally ill telecom twins, BSNL and MTNL.

But who will fly the flag now for India's vaunted private sector, who are the primary authors of the balance sheet problems that have plagued banks, squeezed credit and slowed down the economy?

Many of the businessmen biting the dust are first-generation entrepreneurs who could possibly earn some sympathy for having dreamed big.

Still, the Ruias learned no lessons from having gone bankrupt once earlier in the 1990s.

They and others gorged too much on debt, or under-estimated risk on commodity price swings and long-gestation projects.

Also, there are those who generated their initial capital by means that will not bear close scrutiny -- the old story of businessmen flourishing while their companies went under.

Now the fates of companies and promoters seem more closely intertwined, thanks to new rules.

As for the high-flying second- or third-generation inheritors who mismanaged what they started with, the reaction they provoke in at least some circles must be schadenfreude.

Who is to take their place? Will a new generation of entrepreneurs start up with better business sense, or at least better luck? But the so-called unicorns are mostly copy-cat entrepreneurs whose cash flow is funded by overseas (including Chinese) money.

Many of the billionaires thrown up by the tech services boom of an earlier era have turned to philanthropy.

Some recent stars like Radhakishan Damani of DMart continue to flourish, while Dilip Shanghvi of Sun Pharmaceuticals has faded along with the pharma story, and Sunil Mittal has been sucked into the telecom tariff whirlpool.

Indeed, a feature of the current scenario is that even rapidly growing sectors like telecom and aviation don't generate surpluses.

No wonder the stock market has been sluggish these past five years.

One must hope there are hidden gems as yet unlisted.

Among the safe bets so far have been consumer-facing businesses in which Emami, Marico and others have done surprisingly well against the giants in the field.

Emami strayed, though, and is now trying to reduce its debt load.

Some established groups continue to do well -- Bajaj, Mahindra, Piramal, Godrej and of course relentless Reliance.

But Tata looks increasingly like a one-and-a-half company group as old Bombay House stalwarts soak up capital.

Meanwhile, Suzuki has half the car market, the Chinese have the mobile phone business, and the Koreans key consumer durables segments.

Deep-pocket investors like Blackstone and KKR have moved in, seeing opportunity.

IBM is among the country's largest employers, Honda has overtaken Hero, Diageo has bought out Mallya, the two largest private banks are basically foreign-owned, and Etihad may run Jet.

Where would we be without the foreign players?!