| « Back to article | Print this article |

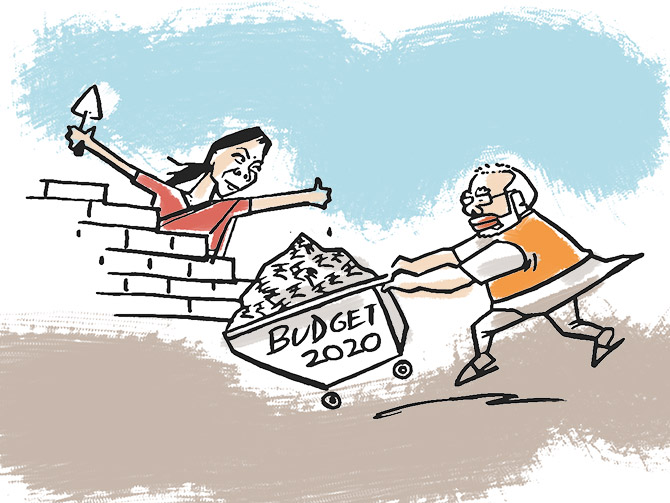

'The next general election is four years away. That's enough time to recover -- provided the government stops spending and taxing so much,' says T C A Srinivasa-Raghavan.

Much has been said about India's twin balance-sheet problem and the Great Indian Slowdown.

It's like a person getting a stroke and a heart attack at the same time.

Usually the cause is the same: Obesity caused by a fat-filled diet.

This is exactly the economy's problem today, which has two major problems at this juncture.

Together they have caused the enormous slowdown in growth.

The first, from which every single problem follows -- like a bad diet -- is that the government is spending too much on politically beneficial programmes, thus leaving less for others, and taking too much from citizens to finance this spending.

This was the UPA's halwai approach, formulated by a bunch of NGO bleeding hearts.

They called themselves the National Advisory Council and were headed by Sonia Gandhi.

The second problem is a result of this.

It's no one's case that the government should not collect tax.

But the manner in which this is being done under NDA II is scaring people and depressing the business mood.

This Budget must, therefore, be judged by whether it reduces government expenditure and thus helps lift spirits by taxing less.

It's been done once before in 1991 and 1997.

Exit gorilla, followed by sighs of relief.

In 1991, the next general election was far away in 1996.

Then as now the government was very nearly broke.

Then as now the business sentiment was deeply depressed.

The formula that worked then was simple: The government stepped back and let the private sector take up the slack.

It also made a lot of positive noises that helped cheer everyone up.

It used the CII and Ficci to dance, with colourful handfans, on the sidelines.

Have no doubts about it.

Government spending on welfare and 'development' is the original sin.

Anyone who endorses it is, quite simply, a fool because it doesn't work.

Quite simply, the State must not concern itself with individual welfare, only the provision of pure public and quasi-public goods like health and education.

Spending on other things is a recipe for fiscal disaster.

This is because when the government spends a lot on the welfare of individuals, it also means it taxes a lot and borrows a lot.

High taxation, which only the very perverse and/or very stupid people support, leaves less in the hands of citizens to spend.

This depresses consumption, which depresses sales and profits, which depresses investment, which depresses increases in incomes and new jobs.

You don't need a Nobel in economics or even a degree from JNU to see this.

Yet this is exactly where the economy is today.

Hence the test: Reduce expenditure.

Tax less. And watch the economy revive. That's all there is to it.

So I, at least, will judge the Budget by its efforts to keep expenditure under control.

And I think it will, because the finance minister and her expenditure secretary both enjoy the confidence of the prime minister.

Of course, all three will pretend that they have actually increased expenditure because that's politically required.

But in reality I expect them to keep it at this year's levels.

In any case, they don't have the revenues to increase expenditure by much.

That leaves borrowing to finance higher spending but from whom? So necessity may well be the mother of abstention.

But Budgets are not only about expenditure. They are also about revenue, and not necessarily tax revenue.

So this is the second way to judge the Budget: What the increase in non-tax revenue is and what the sources are.

Basically, in the current context it means asset sales. This is tricky because some stupid people will talk about selling the family silver. Others will talk about the price.

But the time has long gone for getting back what has been spent. What is needed is a garage sale.

So this is the other criterion: What is the change in the policy towards asset sales?

Having itself caused deflation by demonetisation and an appallingly bad implementation of GST, now the government can't say it's waiting for prices to get back up.

That's not going to happen for a few years. In any case what's fair value for public sector sheds full of useless men and machines?

The next general election is four years away. That's enough time to recover -- provided the government stops spending and taxing so much.

The rest is a matter of detail.