'The finance ministry's decision to accept the deficit target of 4.5 per cent in 2025-2026 appears to have emanated from its endorsement of the Finance Commission's view that the Indian economy will continue to remain impacted by the pandemic, adversely undermining its growth potential,' notes A K Bhattacharya.

While presenting her Budget for 2021-2022, Finance Minister Nirmala Sitharaman had announced the government's intention to amend the Fiscal Responsibility and Budget Management (FRBM) Act.

Importantly, she had also hinted at the likely glide path that the amended law would outline for fiscal consolidation.

The amendment would be aimed at 'achieving the central government fiscal deficit along the broad path that I have already indicated', she had said.

What was the nature of that broad path?

According to the finance minister, the Union government's fiscal deficit should see a gradual reduction from 9.5 per cent of gross domestic product or GDP in 2020-2021 to 6.8 per cent in 2021-2022 and further down to 4.5 per cent by 2025-2026.

The substantial improvement in fiscal consolidation was premised on an increase in the buoyancy of tax revenue through better compliance and higher receipts from monetisation of assets, including privatisation of public sector undertakings and land.

But it is not clear from the Budget speech or the Budget documents why the government chose the figure of 4.5 per cent of GDP as the fiscal deficit target for 2025-2026.

The Medium-term Fiscal Policy-cum-Fiscal Policy Strategy Statement, released along with the Budget documents, says the following: 'The government will amend the FRBM Act. Hence, no fiscal projections for the years 2022-23 and 2023-24 have been presented along with the statement.'

In past years, this statement would indicate the deficit projections for at least two years. But not this time, because of the proposal of amending the FRBM Act.

So, the question is: From where did the finance ministry get the idea of indicating a target of 4.5 per cent of fiscal deficit by 2025-2026? The report of the 15th Finance Commission provides a partial answer.

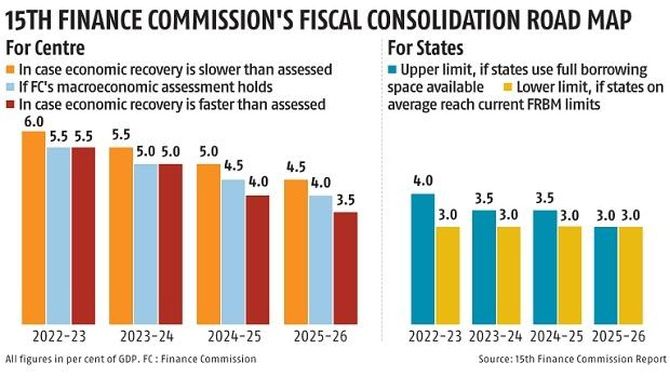

According to the report, a fiscal deficit target of 4.5 per cent of GDP is achievable in 2025-2026 only in a scenario where economic recovery is slower than assessed by the Commission.

In a scenario, where the Commission's macroeconomic assessment holds, a fiscal deficit target of 4.5 per cent can be achieved by 2024-2025. And this target can be achieved even earlier in a different scenario, in which economic recovery is faster than assessed by it.

It would appear that the finance ministry has based the deficit target of 4.5 per cent by 2025-2026 on a worst-case scenario for the Indian economy.

Quite ironically, therefore, the finance ministry's deficit assumptions betray a lack of confidence in the Indian economy's ability to achieve its potential growth rate.

Indeed, many independent experts also believe that while the Indian economy would stage a smart recovery with a double-digit growth rate in 2021-2022, the prospects of sustaining growth in the years from 2022-2023 onwards would be a big challenge.

In its report, the 15th Finance Commission recognises the uncertainty in the economic outlook and revenue path of the Union government for a period of five years after 2021-2022.

'The range of deficits... reflects the uncertainty about the impact of the pandemic on the economy, its implications for the revenues of the Union and the resource requirements for fighting the pandemic and for stimulating the economy,' the Commission has observed (please see charts).

Given this background, the finance ministry's decision to accept the deficit target of 4.5 per cent in 2025-2026 appears to have emanated from its endorsement of the Finance Commission's view that the Indian economy will continue to remain impacted by the pandemic, adversely undermining its growth potential.

Equally significant is the way the Union finance ministry has made a distinction between its assessment of its own finances and that of the finances of the states.

While it has desired the Centre's fiscal deficit to be restricted to 4.5 per cent of GDP by 2025-2026, the goal for the states' deficit is a more difficult number of 3 per cent of GDP and that too has to be reached two years earlier by 2023-w024.

'States will be expected to reach a fiscal deficit of 3 per cent of GSDP by 2023-2024, as recommended by the 15th Finance Commission,' Sitharaman stated in her Budget speech.

Note that the justification for setting the fiscal deficit target for the states is that such a recommendation was made by the Finance Commission.

The Commission's report notes: 'The impact of the contraction in 2020-2021 will continue to be present in the borrowing limits of the States for the years 2023-2024 and 2024-2025 also. However, this impact is likely to be counterbalanced by the sharp recovery in growth projected for 2021-2022.

'Hence, we recommend that the normal net borrowing limit to the State Governments for the three-year period of 2023-24 to 2025-26 may be fixed at 3 per cent of GSDP.'

This also shows that the finance ministry has been largely influenced by the recommendations of the Finance Commission, particularly with regard to those for the fiscal consolidation path for the states.

A different approach has been adopted for the Centre, wherein the finance ministry has preferred a conservative stance with regard to the need for reducing its fiscal deficit.

Once the new road map is finalised for implementation under the amended FRBM Act, it would be instructive to see how much of that conservatism informs the new targets set under the law.

Hopefully, more clarity would also emerge on why the finance ministry chose a certain glide path on fiscal consolidation. But the concerns over differently treating the states' fiscal consolidation imperatives are serious and will have to be addressed.

The demands for a more equitable architecture of fiscal consolidation for the states cannot be ignored for long.

Either way, watch out for the Bill on amending the FRBM Acts that should be before Parliament before the end of its Budget session on April 8.

Feature Presentation: Rajesh Alva/Rediff.com