Photographs: Reuters Khemchand H Sakaldeepi and Nupur Pavan Bang

The economy is made up of simple parts called ‘transactions’ that come together and is repeated over and over again. In the first of a four-part article Khemchand H Sakaldeepi and Nupur Pavan Bang weave all the different parts of the economic machinery together to help the readers take a view on the current scenario in India.

The subject of economics has always been very fascinating and yet confusing. Many curious and critical minds find it difficult to actually understand the state of our economy. We all understand the meaning of GDP, IIP, inflation, interest rates and intervention of central bank, that is, the RBI, to control money flow, the volatility of Indian rupee etc. But it is very difficult to join all the dots.

The media and academia are ripe with reports, articles and peer reviewed papers. All of these are many times contradictory and have their own school of thought, and for a common man it is difficult to comprehend.

In this article we will attempt to put the conceptual pieces together. This article is divided into four parts. The first part introduces transactions, credit, interest rates and inflation. The second part will deal with the importance of credit and introduces de-leveraging. The third part will talk about the impact of deleveraging and introduces fiscal deficit. The concluding part, weaves all the different parts of the economic machinery together to help the readers take a view on the current economic scenario in India.

Click on NEXT for more...

Debunking the Indian economy machine

Image: Agriculture grew at 3.6 per cent in Q3. UPA will have to go to the polls with a sub-5 per cent growth rate.Photographs: Reuters

How the economic machine works

Let us begin by summarising the framework created by Ray Dalio of Bridewater Associates. He presents a very robust framework to understand 'How the economic machine works'. If one understands this well, the rest will be just nuts and bolts to play with.

Let us begin by imagining that the economy works like a simple machine. This is something that many people do not understand, or if some do understand it, then they are at disagreement over how it actually works. This is the exact reason why policy-makers and economists just cannot come to a conclusion when taking critical decisions. Therefore Dalio presents a simple template that can help us in more ways than we can imagine.

The economy is made up of simple parts called ‘transactions’ that come together and is repeated over and over again. These transactions, above all, are driven by human nature. Some assume that they are rational and others say they are irrational. These transactions create three main forces that drive the economy:

- Productivity growth

- The short term debt cycle

- The long term debt cycle

Click on NEXT for more...

Debunking the Indian economy machine

Image: Gross fixed capital formation shrank in Q3 to 27 percent of the GDP.Photographs: Adnan Abidi/Reuters

The transaction here refers to quid pro quo where the Numéraire (unit) is usually the currency (due to historical reasons) issued by a statutory body of the government of various countries (There are other interesting forms of money but we shall not deal with them in this article).

In any transaction we have a buyer paying for goods and services using money (store of wealth) and/or credit (store of expected future wealth) to the seller. This summation drives the economy. If we can understand transactions then we can also understand the economy.

The biggest participant in these transactions is the government. It consists of the central and state governments and the central bank, the RBI in our case. The government collects money in the form of taxes (direct and indirect) and the RBI controls the flow of money in the country.

The RBI has two basic tools to influence the flow of money and credit in the economy -- interest rates and printing new money. We must now pay attention to credit.

Click on NEXT for more...

Debunking the Indian economy machine

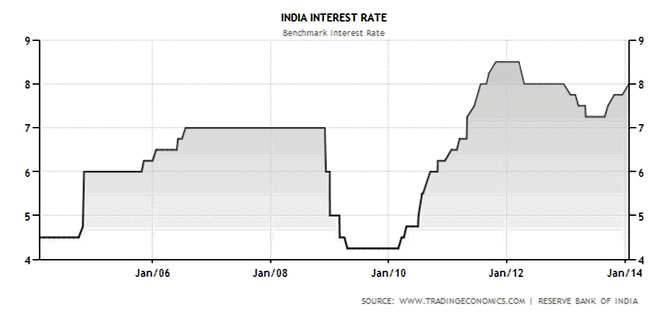

Image: RBI governor Raghuram Rajan on his way to announce the monetary policy. Interest rate has gradually been increasing since 2010 to curb inflation.Photographs: Danish Siddiqui/Reuters

Credit

This is the most important and least understood concept. It is important because it is a really big and volatile part of the economy. Credit can be created out of thin air. All we need is a buyer (borrower) and a seller (lender).

The buyer in principle borrows to pay for his present needs and the lender just acts as a facilitator for the prospect of increasing the value of their excess money. Here come the interest rates.

When the interest rates are low then people are more likely to borrow than when the interest rates are high. The RBI controls the interest rates that it charges the banks for giving them money (repo rate).

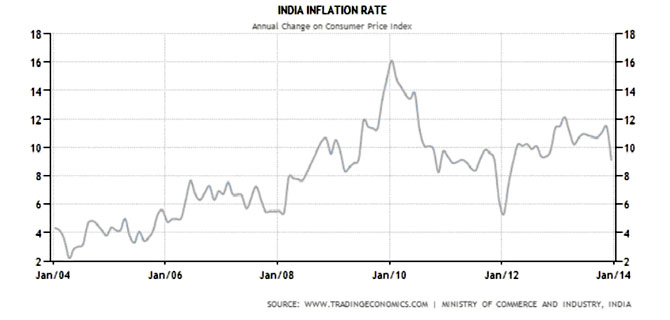

The historical interest rates and inflation rate in India are shown in the chart below. One can note that the rate has gradually been increasing since 2010 to curb inflation in India.

Click on NEXT for more...

Debunking the Indian economy machine

Image: How badly off is India's economy? If it weren't for the farms, things would be a lot worse.Photographs: Amit Dave/Reuters

When credit is created it becomes debt. This is an asset for the lender but a liability for the borrower. When the debt is settled then the asset and liability both disappear.

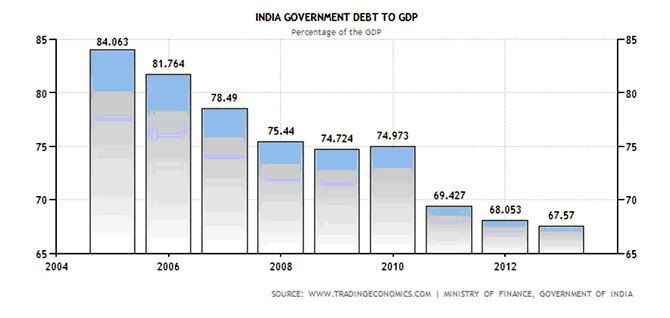

The Debt to GDP or the level of credit with respect to the assets and goods that produced is given below. Fortunately we are well off here as compared to other countries like Japan (214.3%), Singapore (114%) and USA (72.5%).

Yet, they are supposedly (based on some mathematical default models) more likely to pay off their debt in the long run than India. India at 67.57% lags behind China (31.7%), Brazil (54.9%) and Russia (12.2%).

Khemchand H Sakaldeepi is a researcher in the Centre for Investment at Indian School of Business, Hyderabad, and Nupur Pavan Bang is head analytics, Insurance Information Bureau of India, Hyderabad.

article